Oh, the audacity! Strategy has once again proven that when it comes to Bitcoin, they’re not merely playing the game—they’re rewriting the rulebook with a flourish of their financial wand. A mere $2.46 billion purchase? How *modest* of them. Why, this is their most extravagant spree since November last year, as if they’ve been patiently waiting for the right moment to outdo themselves. 🎩✨

Strategy Has Bought Another 21,021 Bitcoin

Chairman Michael Saylor, ever the showman, took to X to announce their latest acquisition: 21,021 BTC at an average price of $117,256 per token. One must commend their flair for financial jargon—turning an IPO into a “Variable Rate Series A Perpetual Stretch Preferred Stock (STRC)” is nothing short of poetic. 🎭📈

Funded by said IPO, which involved 28,011,111 shares (a number so large it could only have been chosen by a poet with a calculator), Strategy now holds the title of 2025’s largest US IPO. As they so eloquently put it: “Once listed on Nasdaq, STRC will be the first U.S. exchange-listed perpetual preferred security issued by a Bitcoin Treasury Company to pay monthly dividends.” Bravo! Who needs simplicity when you can have *style*? 🕺💼

“We believe,” they added, “this is the first U.S. exchange-listed perpetual preferred security to incorporate a board-determined monthly dividend rate policy.” One suspects the board now has more hair than the average investor. 🧠💸

With their BTC reserve now at 628,791 BTC and a total investment of $46.08 billion, Strategy’s wallet is thicker than a Victorian novel. At current rates, their holdings are valued at $74.04 billion—yes, that’s a profit of £27.96 billion. A tidy sum, one might say, for a company that clearly believes in the art of HODLing. 🧵💎

CryptoQuant’s Maartunn, ever the chartographer, shared a visual feast to put this into perspective. Let’s just say the numbers are as staggering as a penguin in a speedboat. 🐧⛵

As the graph reveals, Strategy’s latest buy is their most ambitious since November 24th—eight months of restraint, only to be shattered in a single transaction. Back then, they splurged $5.43 billion. Earlier that month? A “mere” $4.59 billion. One suspects they’re simply bored with smaller numbers. 🎲💰

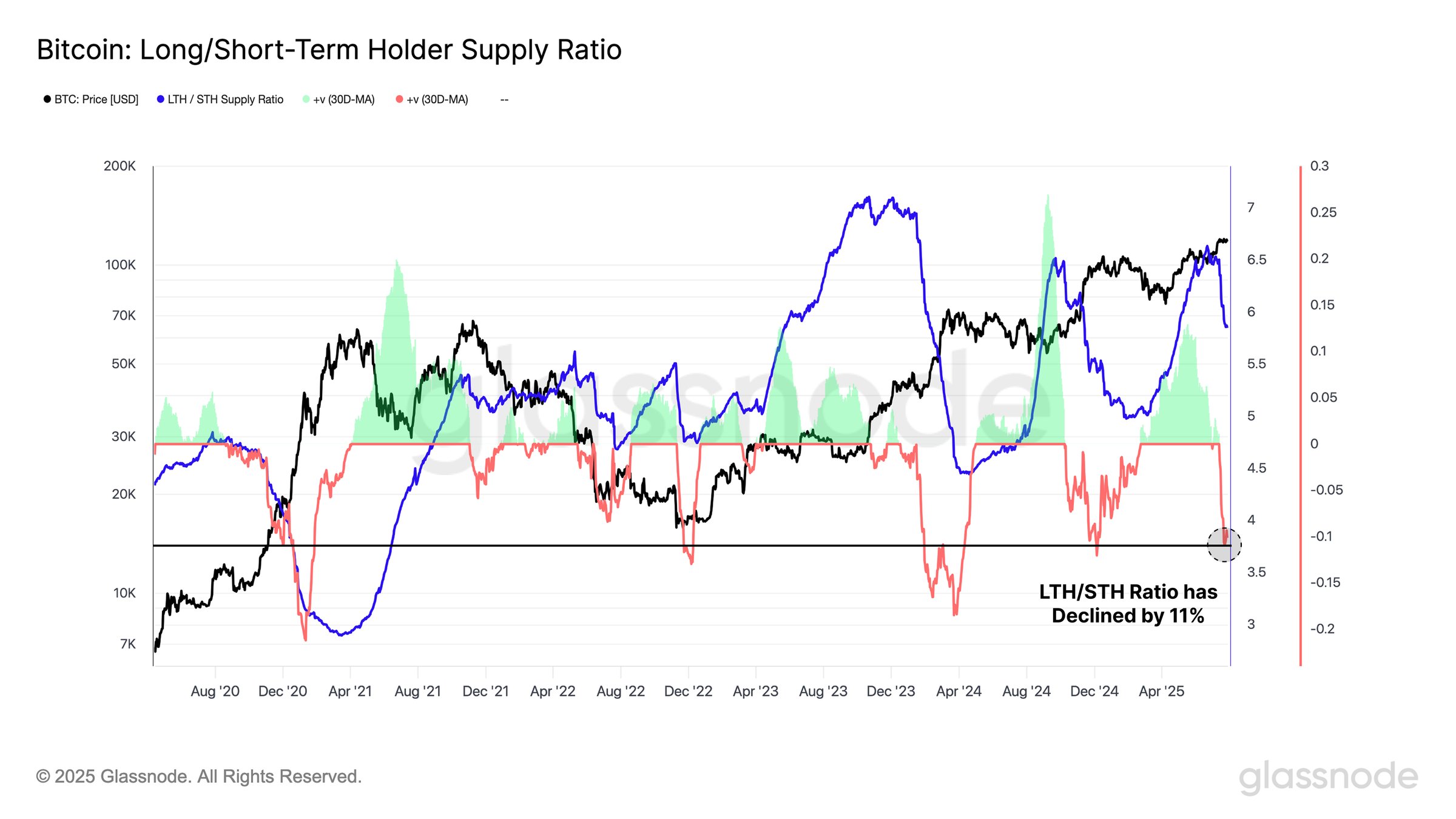

While Strategy’s coffers grow fatter, the rest of the market seems to be playing a game of musical chairs. Glassnode’s latest chart suggests that “diamond hands” are now passing the baton to short-term holders. Capital rotation, they call it. Or, as I prefer to call it, the art of throwing caution to the wind. 🎢📉

This 11% shift in supply, they claim, is a “structurally consistent shift in investor positioning.” Or, as I’d put it: everyone’s panicking but nobody’s admitting it. 😅📉

BTC Price

At the time of this charming missive, Bitcoin hovers around $117,800—a 1% dip in the last 24 hours. How thrilling! One can only imagine the gasps of horror from the tea-sipping investors. 🍵📉

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- INR RUB PREDICTION

2025-07-31 05:14