Markets

What to know:

- STRD’s credit spread versus the U.S. 10-year Treasury tightened so much, it could probably fit into a pair of skinny jeans! 🥳

- Strategy sold $82.2 million of STRD through its ATM program last week-biggest since launch! I guess they’re not just giving away free withdrawals! 💰

- Historical ATM data shows STRD has been the prom queen of preferred issuance lately-everyone wants a dance! 💃

So, Strategy’s (MSTR) junior preferred stock Stride (STRD) is tightening its credit spread like a belt after Thanksgiving dinner. Looks like everyone’s lining up for the highest-yielding treat on the block! 🍗💸

The yield spread between STRD and the U.S. 10-Year Treasury Note dropped to a new low of 8.12% (as of Dec. 12)-but hold onto your hats, because it widened back to almost 9% as Bitcoin nosedived below $86,000! 🎢

A credit spread is just fancy talk for the extra cash investors want for taking a riskier bet-like going to a carnival and betting on the clown to hit a bullseye! 🎯

This latest data point for STRD continues a trend that started mid-November. A shrinking spread usually means investors are feeling warm and fuzzy about their investment, kind of like finding an extra slice of pizza in the fridge! 🍕

Investors might be starting to think that Strategy’s financial position isn’t as shaky as Grandma’s old bridge table-demanding a smaller premium over good ol’ government bonds! 🏛️

And here’s a kicker: earlier this month, Strategy beefed up its credit profile with a $1.44 billion reserve-enough to cover 21 months of dividends while still hoarding Bitcoin like a dragon with its treasure! 🐉💎

Why STRD’s effective yield is drawing attention

The yield gap between STRD and its more senior preferred buddies is back in the spotlight. At this rate, STRD is offering a yield premium of about 320 basis points over another preferred series, STRF. Talk about sibling rivalry! 🤺

CoinDesk reported that Michael Saylor, Strategy’s head honcho, brushed aside concerns about not paying dividends on STRD like they were pesky flies at a picnic-because not paying just isn’t an option! 🧺🐜

He claimed the yield gap isn’t about fundamentals but more about who gets to sit at the big kids’ table. STRD was introduced six months ago to create a yield curve that spans from conservative investments to high-flying Bitcoin risks. 🎈

Record STRD issuance stands out in the historical context

Strategy announced it raised $82.2 million selling about 1 million shares of STRD last week. STRD was the star of the show, accounting for most preferred-stock issuance. STRF only contributed a measly $16.3 million, while STRK and STRC didn’t even show up to the party! 🥳

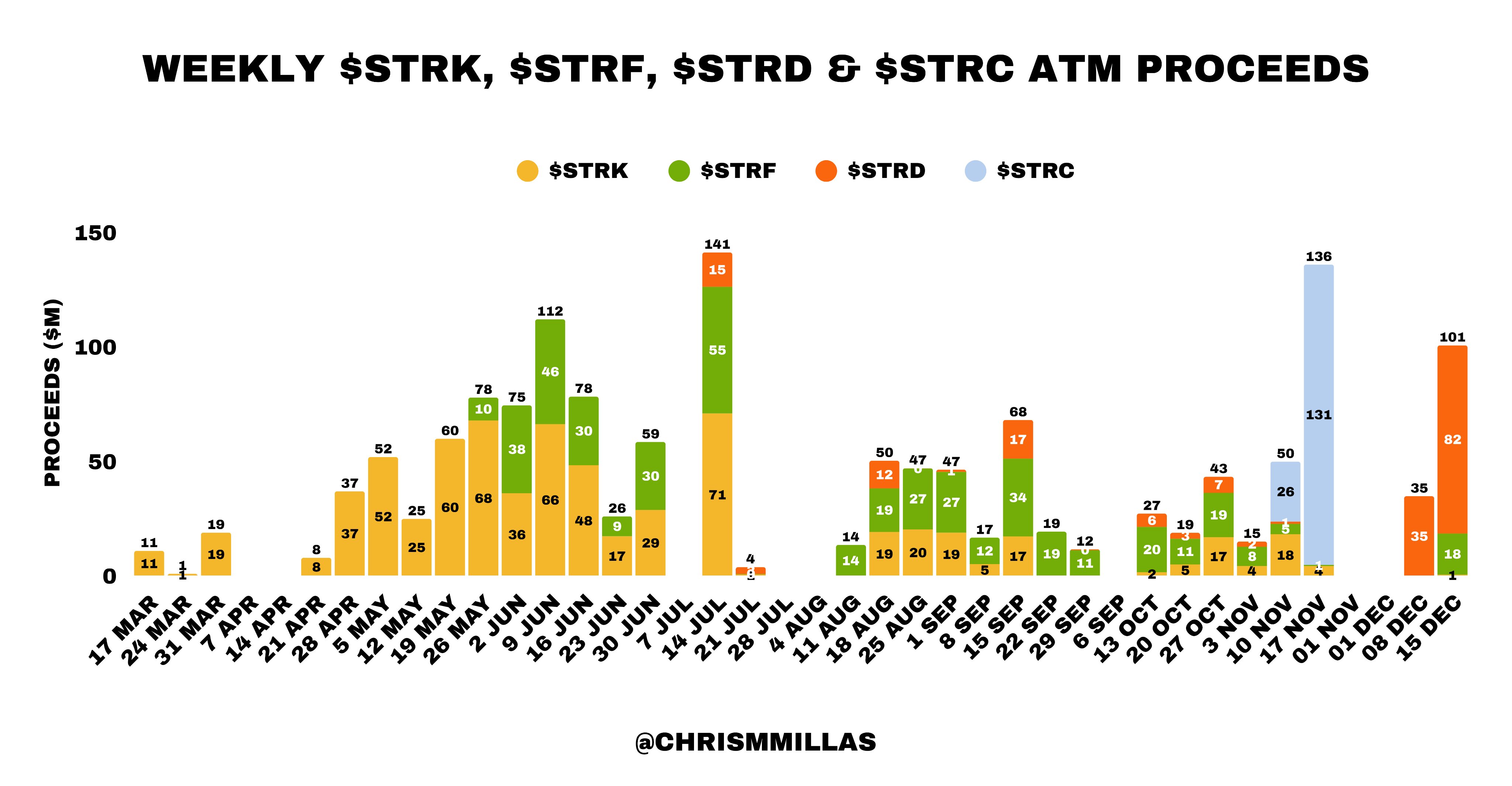

According to crypto analyst Chris Millas, this latest STRD issuance is the biggest single-week haul ever for Strategy’s preferred stock offerings. The chart below looks like STRD is leading the charge while the others are just trying to keep up! 📊

Read More

- Mewgenics Tink Guide (All Upgrades and Rewards)

- 8 One Piece Characters Who Deserved Better Endings

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- How to Discover the Identity of the Royal Robber in The Sims 4

- Sega Declares $200 Million Write-Off

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- How to Unlock the Mines in Cookie Run: Kingdom

- Full Mewgenics Soundtrack (Complete Songs List)

2025-12-15 21:30