It appears that our dear Bitcoin traders are most audaciously predicting a most unexpected surge in volatility as we approach the months of June and July, thus defying the customary languor of summer, as noted by the esteemed analysts.

Indeed, those engaged in the crypto trade may wish to reconsider their summer sojourns, for the options markets are emitting signals that the forthcoming months shall be anything but tranquil. Contrary to the season’s well-established reputation for lethargy, wherein both crypto and equities tend to retreat into a state of repose, the current data suggests a rather more tempestuous period may be upon us, as articulated by the analysts from Kaiko.

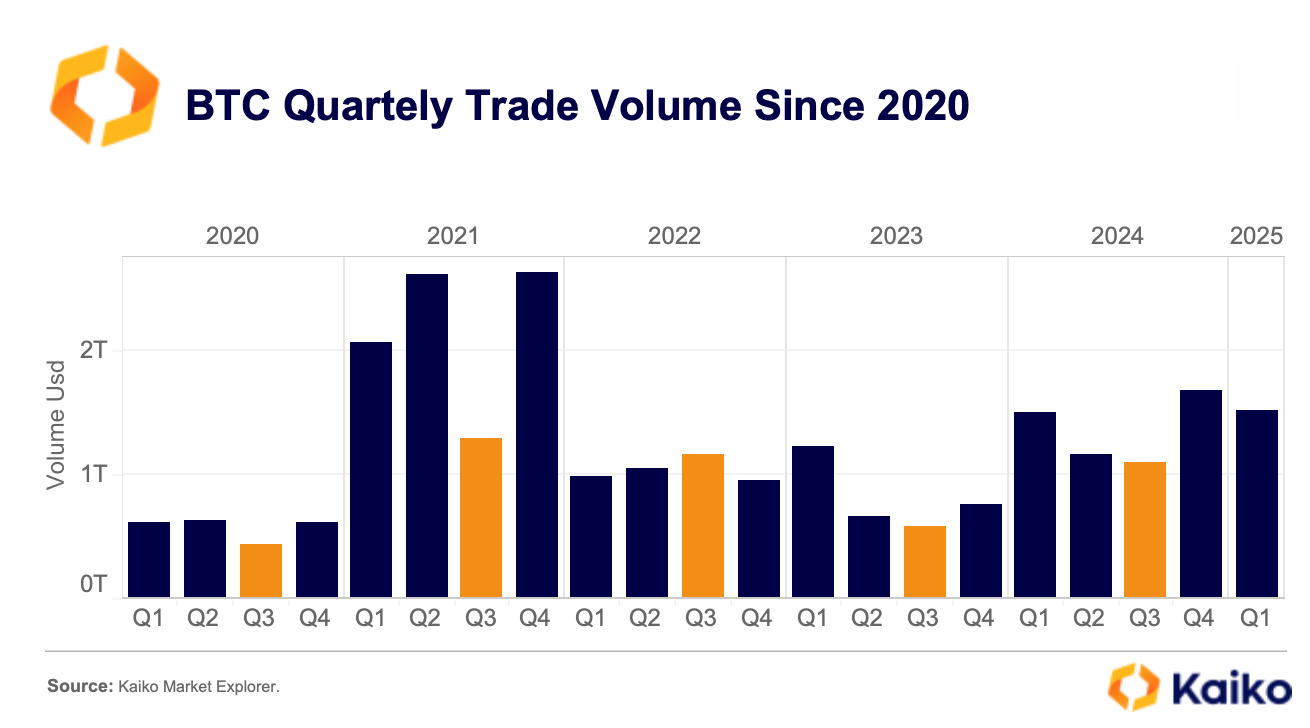

In a recent missive, these analysts have observed that since the year of our Lord 2020, Bitcoin (BTC) has consistently experienced its most meager trading volumes during the third quarter — the very peak of summer — save for the year 2022, when a veritable deluge of bankruptcies, including those of the Celsius Network and Three Arrows Capital, plunged the markets into a state of disarray.

The data most emphatically indicates that “options markets are already pricing in higher volatility,” a clear harbinger that something rather extraordinary may be on the horizon. Notably, the options set to expire on June 27 have witnessed a remarkable increase in volume, with optimistic wagers targeting the rather extravagant strike prices of $110,000 and $120,000. Such positions imply that some traders are rather hopeful that Bitcoin shall ascend to new heights, even amidst the lingering clouds of macroeconomic uncertainty.

Several catalysts are converging to stir the pot of market expectations. The impending meeting of the Federal Reserve may very well influence broader financial conditions, whilst the tariff deadline set by former President Trump on July 9 introduces an additional layer of geopolitical intrigue, as the analysts have so sagely noted. Concurrently, significant U.S. crypto legislation is anticipated before Congress retreats for its August recess, thereby adding yet more uncertainty to the months that lie ahead.

Traditionally, the summer months are synonymous with a cooling of activity. The volume of stock trading in August tends to diminish significantly. Crypto, in its usual fashion, often follows suit, with both on-chain and exchange volumes typically experiencing a decline in August. For instance, spot trading plummeted by nearly 20% in August 2023, and total exchange volume fell by over 11%, according to the market data.

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail The Fall of Avalon: How To Romance Alissa

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- AI16Z PREDICTION. AI16Z cryptocurrency

- Nine Sols: 6 Best Jin Farming Methods

- Delta Force: K437 Guide (Best Build & How to Unlock)

- USD ILS PREDICTION

- Rick and Morty S8 Ep1 Release Date SHOCK! You Won’t Believe When!

- One Piece Episode 1130: The Shocking Truth Behind Kuma’s Past Revealed!

2025-05-20 11:31