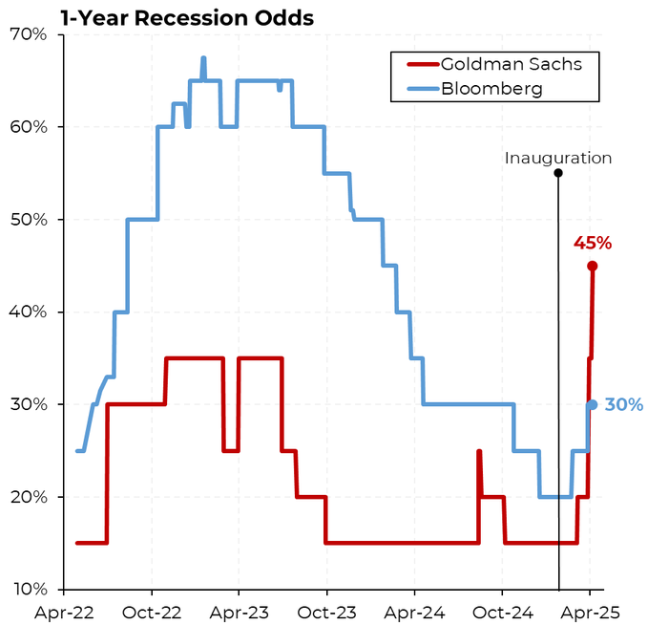

Goldman Sachs, in a dazzling display of cosmic foresight, has projected a 45% chance of a US recession. Naturally, few things say “confidence” like a near-half wager on doom, especially when accompanied by global tensions hotter than the surface of the sun and tariffs threatening to burst in like uninvited guests at a tea party.

This is, by the way, the highest doomsday percentage they’ve conjured since post-pandemic inflation and interest rates started doing the cha-cha.

Goldman Sachs Sees 45% Chances of US Recession

In its melodramatically titled “Countdown to Recession,” Goldman Sachs outlines how things might soon resemble a very bad interstellar hitchhiking trip. Tariffs on April 9 are expected to appear like cosmic gremlins, menacing global supply chains one teacup at a time.

Steven Rattner, who once valiantly juggled the Obama Auto Task Force, sounded the alarm on social media, emphasizing that even well-heeled financiers find this outlook about as comforting as a porcupine in a balloon factory.

“Goldman Sachs now predicts a 45% chance of a recession in the next year,” Rattner wrote, presumably with a stiff drink close at hand.

Rattner also pointed out that wobbly policy-making, capital spending jitters, and the general sense of “Oh dear, what now?” are helping to keep financial markets in a perpetual state of caffeinated excitement.

Meanwhile, Nick Timiraos from The Wall Street Journal chimed in with news that the bank has done some fancy math to whittle 2025 Q4 GDP growth down to a positively breathtaking 0.5%.

“We are lowering our 2025 Q4/Q4 GDP growth forecast to 0.5% and raising our 12-month recession probability from 35% to 45% following a sharp tightening in financial conditions, foreign consumer boycotts, and a continued spike in policy uncertainty that is likely to depress capital spending by more than we had previously assumed,” Timiraos reported, presumably while wearing a concerned expression.

Goldman Sachs simultaneously hopes the tariffs scheduled for April 9 might fizzle out into the ether, much like that leftover sushi you forgot in the fridge.

However, if those tariffs actually land, the bank will have no choice but to formally declare that the economy is about to put on its best “I told you so” face, likely fueling inflation with all the elegance of a rocket-propelled rhinoceros.

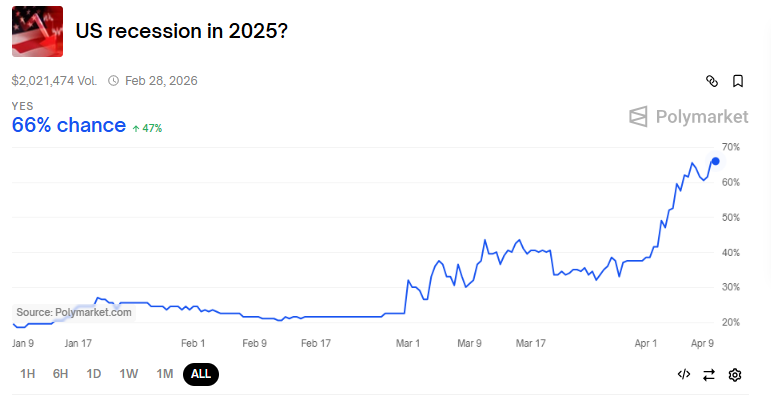

But wait—there’s more. Polymarket bettors, those fearless speculators of the cryptoverse, place nearly 70% odds on a recession after Liberation Day tariffs. Possibly they’re just having more fun than the rest of us.

Goldman Sachs Ups Bitcoin ETF Holdings

In a delightful twist, despite all the gloom and doom predictions, Goldman Sachs is wholeheartedly smitten with Bitcoin (BTC). Clearly, if you can’t beat the apocalypse, you might as well embrace a digital coin. As of February 12, the bank sits on a cozy $1.5 billion in Bitcoin, courtesy of its deep dive into BlackRock and Fidelity’s Bitcoin ETFs.

Apparently, the bank adores Bitcoin so much that it’s been topping up like a coffee addict on Monday morning. It bulked up on the iShares Bitcoin Trust (IBIT) by 88% and the Franklin Bitcoin Trust (FBTC) by a whopping 105%. This is possibly an advanced method of whistling in the dark while the economic thunderstorm brews overhead.

Given Bitcoin’s recent spurt of resilience—performing better than some folks’ sense of humor—the CEO of Goldman Sachs, David Solomon, has been praising blockchain technology for its potential to streamline traditional finance. He also graciously declared that Bitcoin was not a threat to the almighty US dollar, presumably as the dollar breathed a sigh of relief.

JPMorgan, not to be out-forewarned, predicted a recession too. Its economists spelled out the dire consequences of trade wars, basically urging the Fed to sharpen its scissors for rate cuts sooner rather than later.

Speaking of rate cuts, once the economy officially waves its white flag, the dreaded specter of stagflation could be next on the menu: a cheery combo of rising inflation and zero growth. This is around the time advanced financial lingo like “quantitative easing” (QE) gets bandied about.

If the Fed goes undercover with “stealth QE,” it might prime the rusted pumps of the economy, granting riskier assets like Bitcoin a fleeting moment in the sun. Alas, that could also stoke inflation’s fires. And so, the economic balancing act continues, prompting many a weary economist to sigh mightily and reach for the nearest emoji. 🤷♂️

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-04-09 14:24