CAN, that old drunkard of the stock market, has staggered back above $1 after months of teetering on the brink of delisting. With a 50,000-unit ASIC order and new partnerships with SLNH and Luxor, the market’s collective mood swings faster than a teakettle on a summer day. So, is this the moment to throw your hat in the ring-or just another round of roulette? 🎰

A few weeks ago, my inbox overflowed with messages about Canaan Inc. (NASDAQ: CAN). Folks claimed its share price was a “bargain” compared to its OG peers-those who’ve tripped over triple-digit gains like a parade of drunken sailors. While they hogged the headlines, Canaan quietly sipped from the dregs of obscurity… until last week, when it decided to waltz back into the spotlight. 🕺

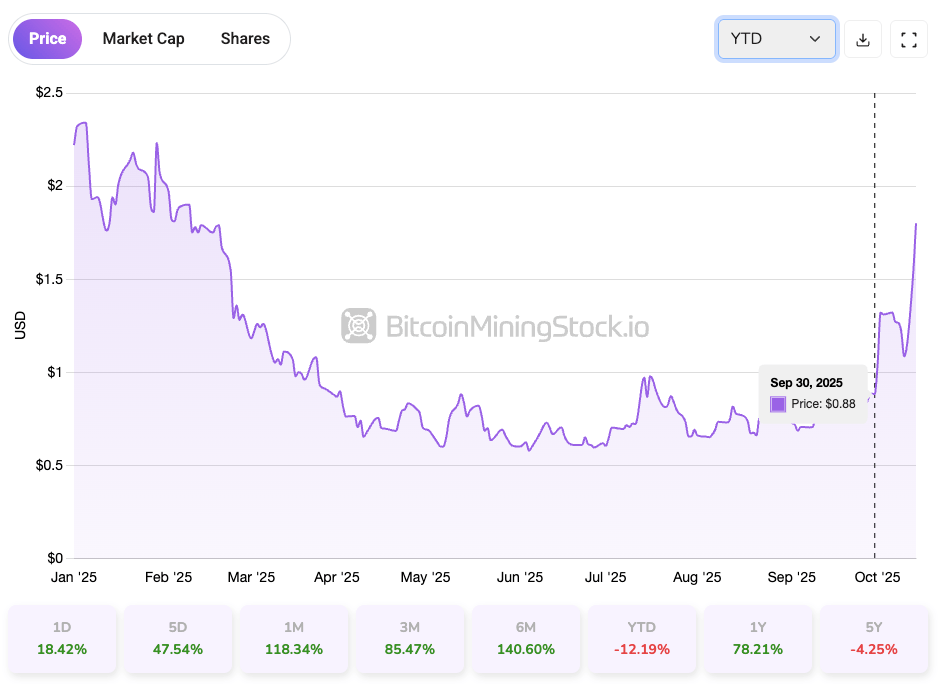

Known for its Avalon ASICs, Canaan spent 2025 dodging the HPC and AI hype train like a man avoiding a haunted house. Meanwhile, U.S.-China tariffs pushed its stock below $1 for months, raising the specter of Nasdaq’s ghostly delisting. But lo! Something shifted. Since September 30, the stock clawed its way back above $1 like a scorpion with a vendetta. Despite a -12.19% YTD performance, the momentum hums like a caffeinated jackhammer. The real question? Is this the right time to jump in-or just another fool’s errand? 🤡

Company Overview: More Than Just an ASIC Maker

Founded in 2013, Canaan Inc.-a Singapore-based tech firm with Chinese roots-is the crypto world’s answer to a chameleon. Once a pure-play hardware provider, it now plays dress-up as a diversified crypto mining player, thanks to its Avalon ASICs and a dash of self-mining wizardry. 🪄

Self-Mining

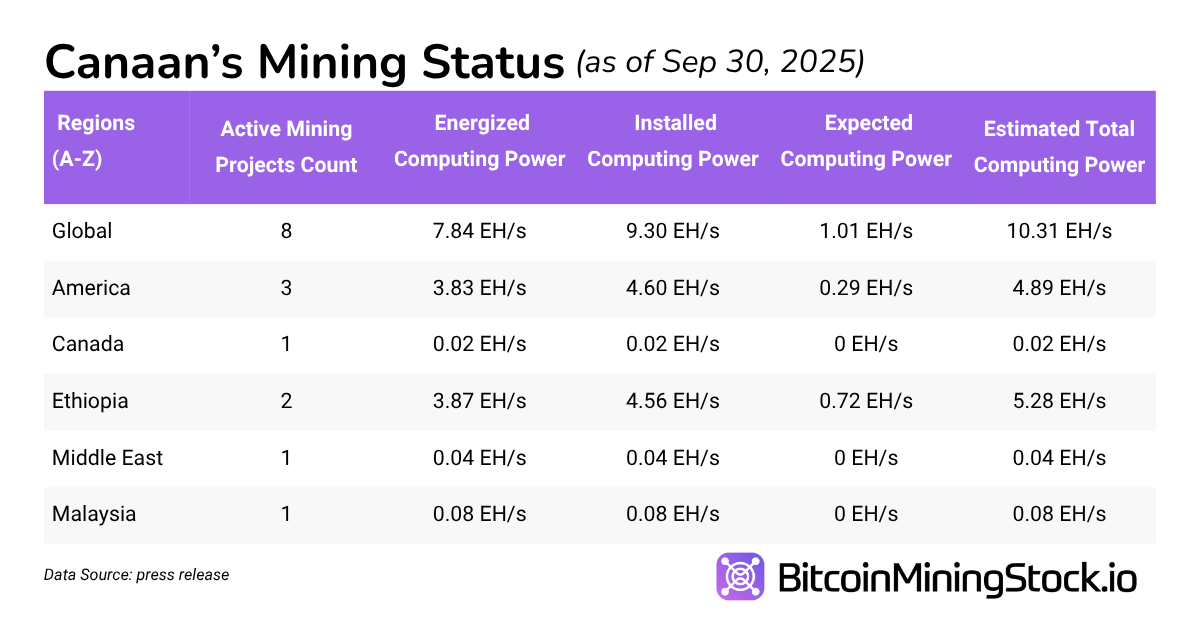

As of September 2025, Canaan operates 9.30 EH/s of hash rate in the U.S. and Ethiopia. With pending ASICs, it’ll hit 10.31 EH/s-a number that sounds like a lottery ticket to some. Since January, it’s mined ~87 bitcoins monthly, and its self-mining revenue has climbed like a drunkard on a ladder since Q2 2024. 🚀

Bitcoin Treasury

Canaan holds 1,582 BTC as of September 30, 2025-a treasure hoarded through self-mining, hardware sales, and spot purchases. The company uses these coins like a miser’s ledger: collateral for R&D, hardware production, and even stashing them in interest-bearing accounts to generate yield. According to CFO James Jin Cheng, the treasury is “in the early stages,” but it already ranks 35th globally in public company BTC holdings. At 20.29% of market cap, its exposure mirrors the likes of Riot Platforms and CleanSpark. A bold move-or a crypto gold rush fever dream? 🏴☠️

Retail Home Mining Equipment

Canaan recently unveiled Avalon Miner kits for homebrew miners-plug-and-play containers for the DIY crowd. While revenue remains marginal, the strategy aims to build brand visibility and reduce reliance on institutional whims. It’s like giving the little guy a slingshot while the big boys fire cannons. 🏹

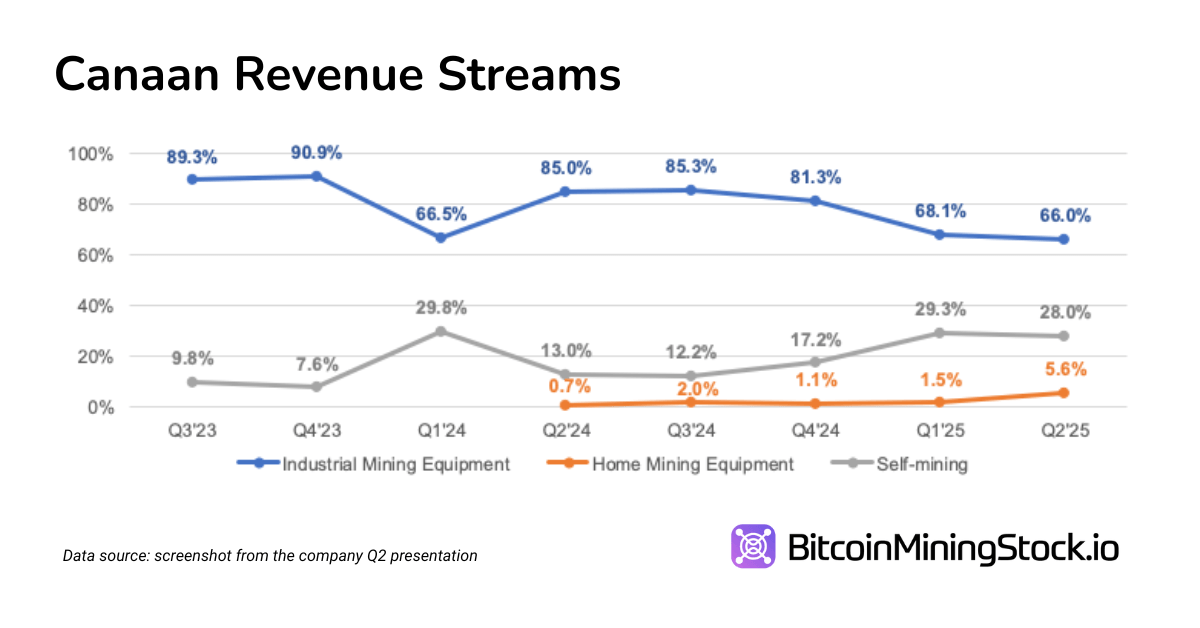

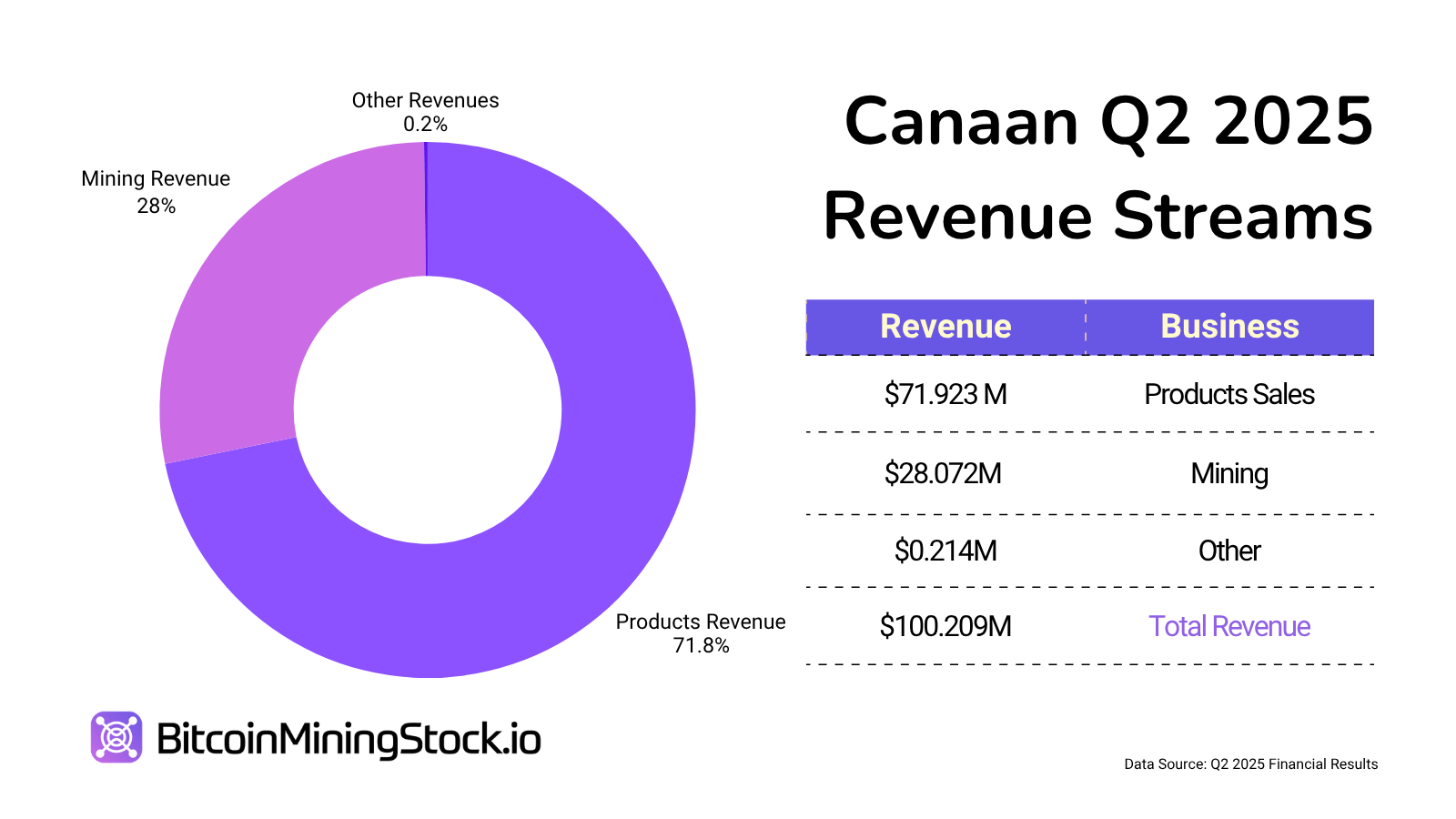

In Q2 2025, Canaan raked in $73.9M total revenue. Breakdown: 71.7% hardware, 28.1% mining, and <1% elsewhere. A modest feast, but not enough to feed the beast of investor expectations. 🍽️

Recent Catalysts: The Momentum Is Building

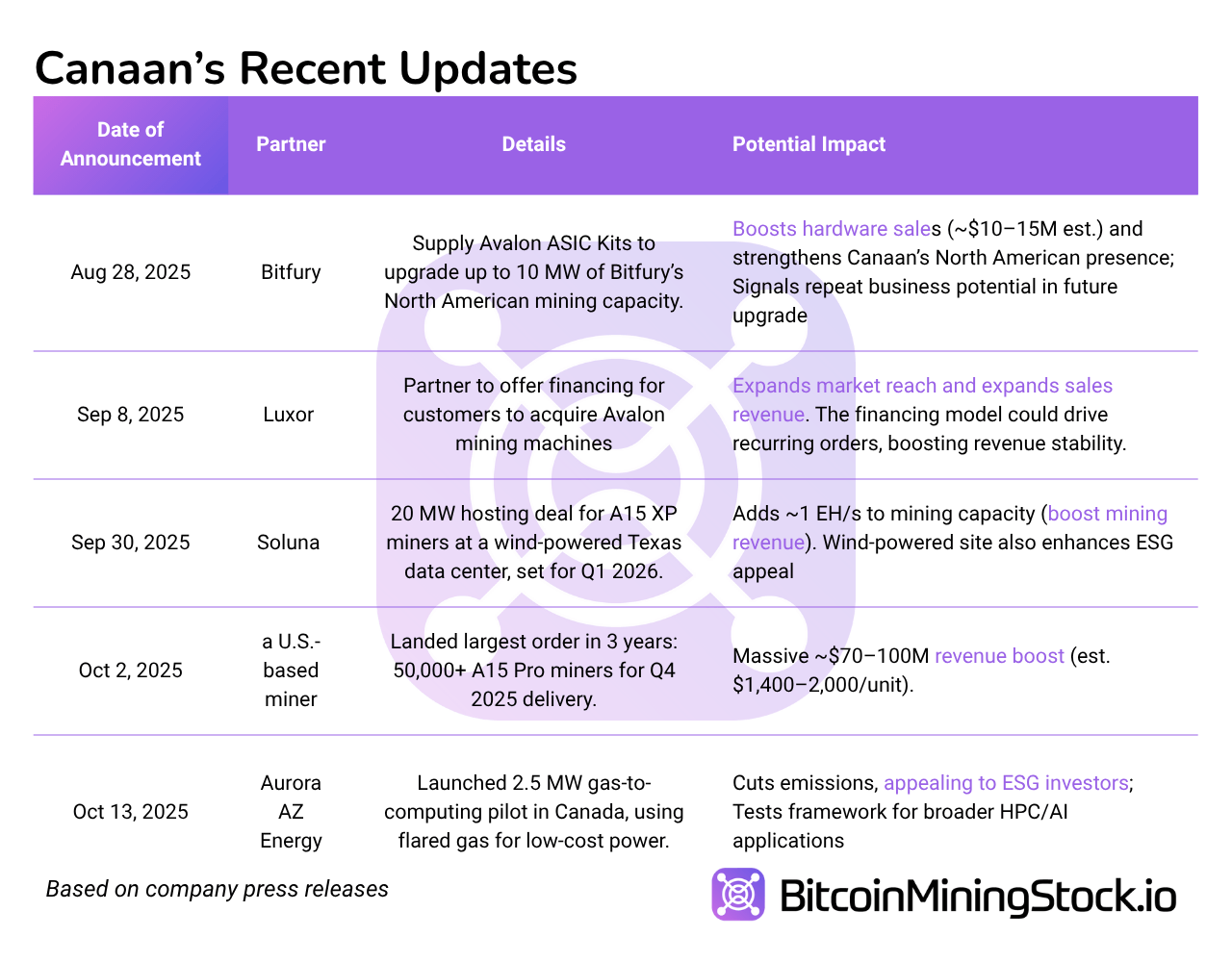

Investor sentiment has shifted like a pendulum in a windstorm, thanks to a string of business wins. Here’s a timeline of key updates:

Collectively, these moves suggest Canaan is doubling down on North America and renewable energy-a pivot that could charm ESG investors. Most importantly, these deals will show up in the numbers. The company guides for $125-145M in Q3 revenue, a 25%-45% QoQ leap. A grand gesture-or a desperate bid for relevance? 🎭

Is CAN Stock a Bargain at $1.80?

At $1.80, Canaan’s valuation resembles a magician’s rabbit-appearing and disappearing. As of Oct 15, 2025, its market cap is $881.96M. Adjusting for $179M in BTC, $11.63M in ETH, $65.9M cash, and $268.5M debt, the enterprise value (EV) sits at $894M. A cleaner view of the core operating value, excluding crypto’s wild swings. 🤯

*My calculation: EV = Market Cap + Debt – Cash – Crypto Value. Sources: latest quarterly report and spot prices.

Canaan’s Q3 guidance ($125-145M) implies an annualized revenue run rate of $500-580M. This translates to an EV/revenue multiple of 1.5x-1.8x-cheaper than U.S.-listed peers’ 2.5x-4x range. A steal? Perhaps. But remember: “cheap” and “smart” aren’t always kissing cousins. 💔

Profitability-wise, Q2 adjusted EBITDA was $25.3M, annualizing to $100M. An EV/EBITDA of ~8.9x is modest compared to top miners’ 10-20x. Room for growth? Possibly. If margins hold and sentiment improves. But don’t bet the farm. 🏡

On an asset basis, Canaan reported ~$484.5M in net assets (excluding crypto) and $592.1M including crypto. P/B ratios of 2.7x-4x aren’t “deep value,” but they’re not sky-high either. A cautious dance between optimism and skepticism. ⚖️

Ultimately, at $1.80, the stock isn’t a fire sale-but it’s not a luxury cruise either. The market nods to improved fundamentals and near-term revenue visibility, but hasn’t yet crowned Canaan king of the crypto castle. 🏰

Final Thoughts

Canaan is evolving from hardware vendor to crypto mining juggernaut, armed with 1,582 BTC, 2,830 ETH, and global partnerships. The 50,000-unit miner order? A potential revenue rocket. But challenges linger: Q2’s $11.1M net loss, high operating costs, and geopolitical risks (tariffs, anyone?) threaten to derail the train. 🚂

Geopolitical turbulence? U.S. tariffs on Chinese tech exports loom like a storm cloud. Canaan’s U.S./Malaysia manufacturing pivot is a noble attempt, but execution is a dice roll. 🎲

The next few quarters-Q3 results, Bitcoin’s price, and network difficulty-will decide Canaan’s fate. For crypto bulls, this stock offers potential. For skeptics? A reminder that every bull market needs a few tragic heroes. 🐉

tags or color styles. Also, I need to add humor and sarcasm with emojis, retain all images, and ensure the title is in the

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-10-16 09:01