Ah, the fickle winds of fortune! TeraWulf, once a stalwart miner of the elusive Bitcoin, hath now cast aside its trusty rigs like a jilted lover, redirecting its energies toward the siren song of High-Performance Computing (HPC). 🌪️✨ Yes, dear reader, the same TeraWulf that once toiled in the digital mines now prances in the glittering ballrooms of Artificial Intelligence, joining a motley crew of blockchain firms in this grand masquerade. 🎭

- TeraWulf, the latest crypto miner to don the AI mantle, hath abandoned its pickaxe for a silicon scepter. 👑

- Riot, CleanSpark, and Galaxy Digital-a trio of erstwhile miners-have also traded their hash rates for neural networks. 🤝

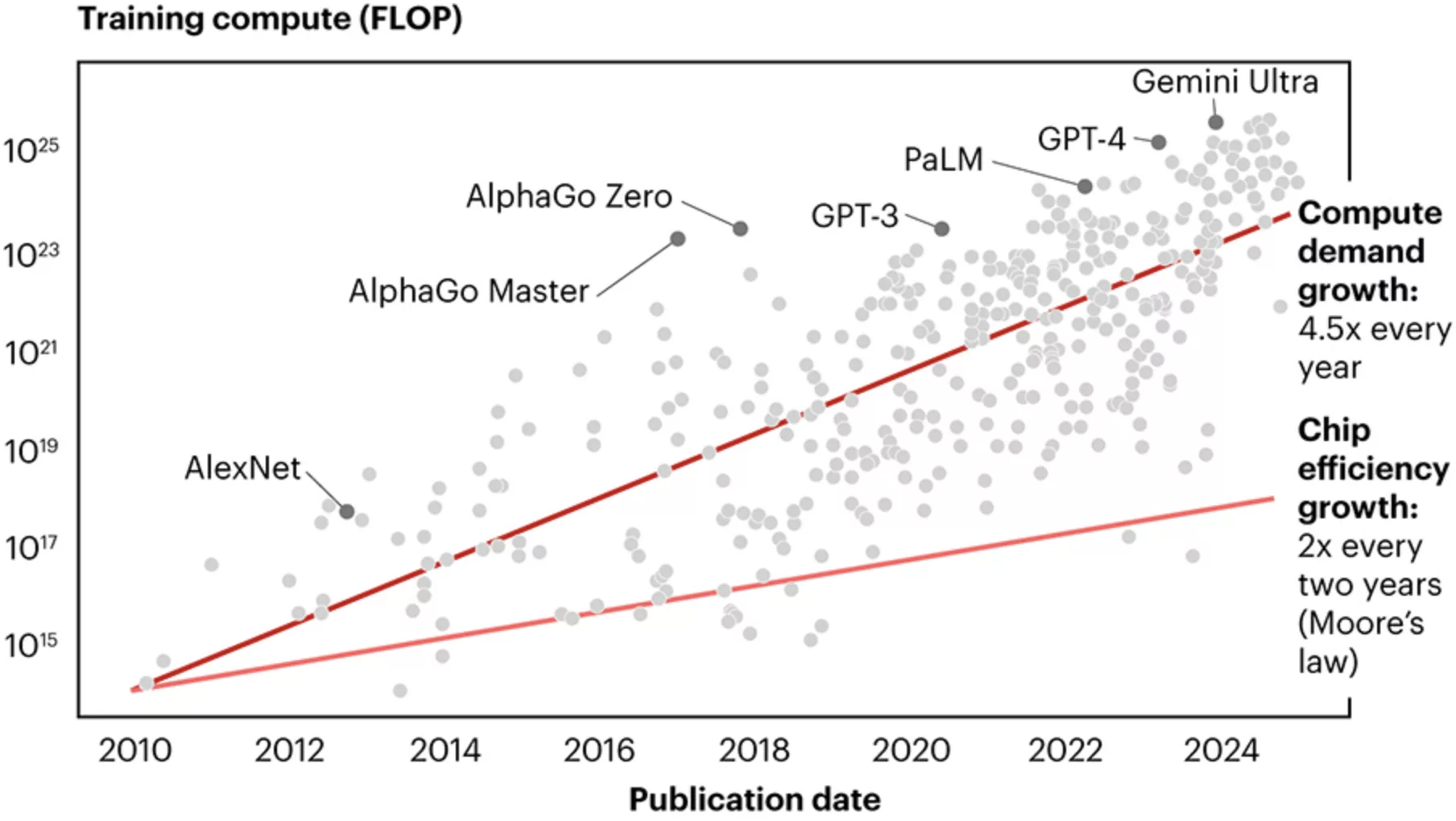

- AI, that insatiable beast, doth demand ever more compute power, leaving even the most efficient chips in the dust. 🐉

- Bitcoin mining, once a golden goose, now layeth eggs of lead, thanks to soaring costs and dwindling profits. 🥚💔

On the fateful Tuesday of November 11, TeraWulf’s financials revealed a plot twist worthy of a Gogol novella: a deliberate pivot from mining to the high-margin allure of AI infrastructure. 📉💸 The firm’s Q3 report, a veritable tragedy in numbers, showed a mere 377 BTC mined-a far cry from the 438 expected by those ever-hopeful analysts. Was this underperformance a blunder? Nay! ’Twas a calculated act of defiance, as uptime plummeted to 70% and the hashrate slithered to 8.5 EH. The rigs, once humming with purpose, were silenced, their energy redirected to the glittering altars of HPC. Mining revenue? A paltry $7.2 million, though the firm doth boast of its maiden quarter’s earnings. 🕯️

Bitcoin Mining: A Backseat Spectator in TeraWulf’s Grand Opera

Rosenblatt’s sage, Chris Brendler, doth proclaim: “TeraWulf hath not merely prioritized HPC but hath thrust it into the spotlight, leaving Bitcoin mining to languish in the shadows.” 🌚 In his November 11 tome, he notes that TeraWulf, during the third quarter, shifted its power capacity toward HPC “at the expense of mining,” as if the latter were a forgotten cousin at a family feast. 🍽️

TeraWulf is not alone in this grand exodus. Riot, CleanSpark, and Galaxy Digital have also traded their mining picks for AI wands, as if the blockchain were but a stepping stone to greater glories. 🧙♂️ AI, that voracious monster, demands not only high-end computing but also energy in quantities that boggle the mind. Its appetite for computational resources doubles yearly, leaving even the most efficient chips gasping for breath. 💨

Meanwhile, Bitcoin miners find themselves in a predicament most dire. Profits shrink like a timid snail, thanks to rising mining difficulty, a faltering Bitcoin price, and energy costs that soar like Icarus. In October, despite a record hashrate, daily revenue plummeted 7%, from $52,000 to $48,000 per exahash per second. Alas, the golden age of mining seems but a distant memory. 🌅

Yet, fear not, for TeraWulf doth not abandon Bitcoin entirely. Like a fickle lover, it keeps one foot in the mining door, even as it waltzes with AI. Needham’s wise men, Todaro and Ortiz, predict that Bitcoin mining shall persist through 2026, though HPC remains the firm’s darling. 📆 They, too, have trimmed their estimates, cutting the fourth-quarter 2025 Bitcoin price to $105,000 per coin. “We reaffirm our HPC estimates,” they declare, maintaining a buy rating and a $21 price target on the stock. 📈

At last glance, TeraWulf traded at a mere $12 per share, down over 16%. But oh, the drama! The intrigue! The sheer Gogol-esque absurdity of it all! 🎭🤡

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

2025-11-12 01:06