What to Know (And Why You Shouldn’t Care) 🤯

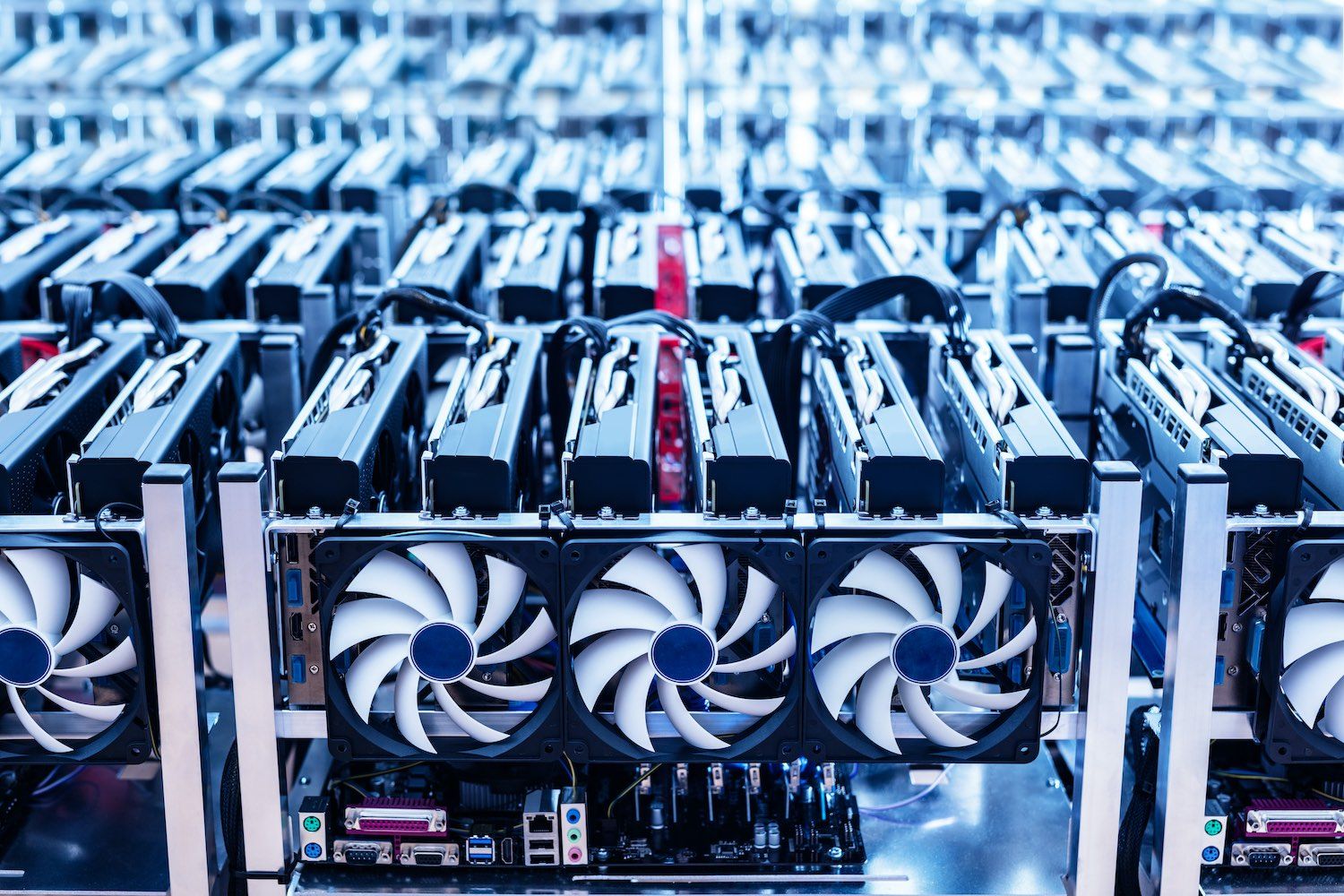

- TeraWulf, in a fit of audacity, has upped its convertible note offering to a staggering $850 million, presumably to fund its data center expansion. Notes maturing in 2031 with a paltry 1% annual interest rate-because nothing says “financial prudence” like a 132-year loan. 🧠

- Shares, ever the fickle lover, dropped 5% after the announcement, a modest setback for a company that previously surged 100% on a Google-backed AI deal. Such is the volatility of the stock market-where hope is a currency, and reality is a foreign exchange. 📉

TeraWulf’s (WULF) breakneck rally, once a spectacle of frenzied investors, took a nosedive on Tuesday as the firm unveiled its $850 million convertible note sale. A masterclass in corporate theatrics, if you’ll permit the metaphor. 🎭

The notes, set to mature in 2031, will be exchangeable into cash, stock, or both-TeraWulf’s way of saying, “We’re not sure what we’re doing, but let’s gamble on it!” The initial conversion price of $12.43 per share is a 32.5% premium to last week’s close, because why not? 🤷♂️

Net proceeds of $828.7 million will allegedly fund data center expansion, while $85.5 million is earmarked for “capped call transactions”-a fancy term for “we’ll try not to dilute our shares, maybe.” Buyers may add another $150 million, because nothing says “confidence” like a 13-day window to panic. 🚨

WULF fell 5% below $9, a humbling retreat from Monday’s $10.7 high. After a 100% rally fueled by a Thursday deal with FluidStack, backed by Google, the stock’s trajectory now resembles a yo-yo with a death wish. 🪀

Under a 10-year hosting agreement, FluidStack will expand operations at TeraWulf’s Lake Mariner campus in New York, with Google’s $1.4 billion debt support for the project. Google now holds warrants for a 14% equity stake-because nothing says “strategic partnership” like owning a slice of a company’s future. 🤝

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- I Used Google Lens to Solve One of Dying Light: The Beast’s Puzzles, and It Worked

2025-08-19 18:15