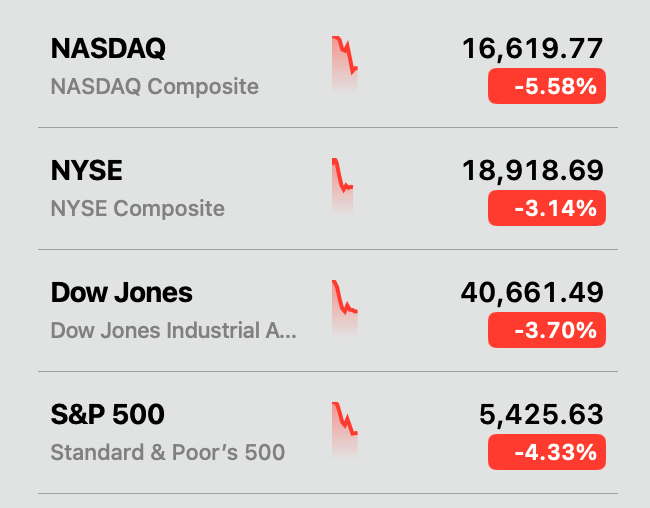

Dearest readers, let us muse upon a day of spectacular financial drama, where the Dow Jones plunged like a spurned lover at a ball, mere hours after President Trump’s grand “Liberation Day” proclamation. One might ponder if such a spectacle was part of a grander design, a Machiavellian scheme to slow down the relentless march of inflation and lighten the burden of debt, with Wall Street’s woes but a mere afterthought.

When Trump Strikes with Tariffs, Who Really Gets the Jolt? 💡

In a twist as unexpected as a witty retort at a dinner party, Treasury Secretary Scott Bessent attributed the market’s melancholy mood to a tech sell-off, specifically singling out the “Magnificent 7,” a group as illustrious as they are volatile. He hinted that the true villain was the rise of foreign AI, casting a shadow over Silicon Valley’s once unchallenged reign. Oh, the indignity!

Bessent, with the nonchalance of a man who has just polished off a glass of vintage port, declared, “This is a Mag 7 issue, not a MAGA issue.” The decline, he assured us, was limited to tech stocks, not the broader implications of Trump’s trade policies. Yet, whispers abound that the administration may be orchestrating a deliberate downturn to restructure the nation’s debt, a strategy as audacious as it is risky.

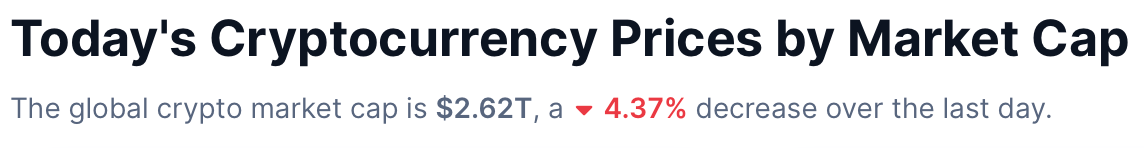

Cryptocurrencies, those darlings of the digital age, have found themselves caught in the crossfire. The strategy, if one dares call it that, seems to revolve around lowering interest rates ahead of the impending debt refinancing cliff. Measures include reducing oil prices, trimming government jobs, and, of course, raising global tariffs. Quite the recipe for economic turmoil, wouldn’t you say?

As Jacob Canfield reminded us, we’re $37 trillion in debt, and the cost of servicing it is astronomical. His solution? Crash the market, force the Fed’s hand, and watch as interest rates tumble. When rates fall, the U.S. can refinance its debt more cheaply. It’s a game of high stakes, but the rewards could be immense.

Short term: chaos reigns supreme for real estate, stocks, and crypto, but gold shines like a beacon. Long term: new all-time highs across the board. 🌟🔥

Bitmex co-founder Arthur Hayes seems to agree, predicting that the Fed will eventually cave under pressure. “Trump’s tariff formula is further proof of his singular focus on reversing economic imbalances,” Hayes observed. “Without exports, foreigners can’t buy our bonds. The Fed and banking system must step up to ensure a well-functioning treasury market, which means Brrrr.” Yes, dear reader, Brrrr indeed.

Administration officials, ever the optimists, have embraced this strategy with open arms. Commerce Secretary Lutnick, in a moment of candor, admitted that the stock market isn’t driving outcomes. Treasury Secretary Bessent, for his part, waved away concerns about “a little volatility” like an aristocrat dismissing a servant. The stage is set for a period of transition, and analysts warn that the path chosen risks a self-fulfilling prophecy of decline.

And so, dear friends, we find ourselves in the midst of a synchronized retreat, where Wall Street and the digital asset markets dance to the tune of Trump’s trade measures. It’s a symphony of uncertainty, a ballad of doubt, and we can only wait to see how the music ends. 🎶…

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-04-03 19:03