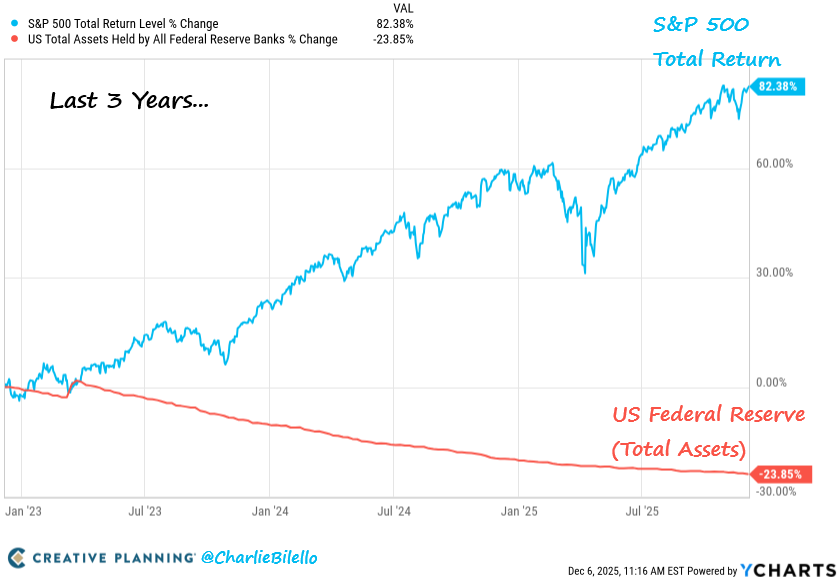

The S&P 500 has pirouetted upward by 82% over three years, while the Federal Reserve’s balance sheet, like a deflated balloon, shrunk by 27%. 💸

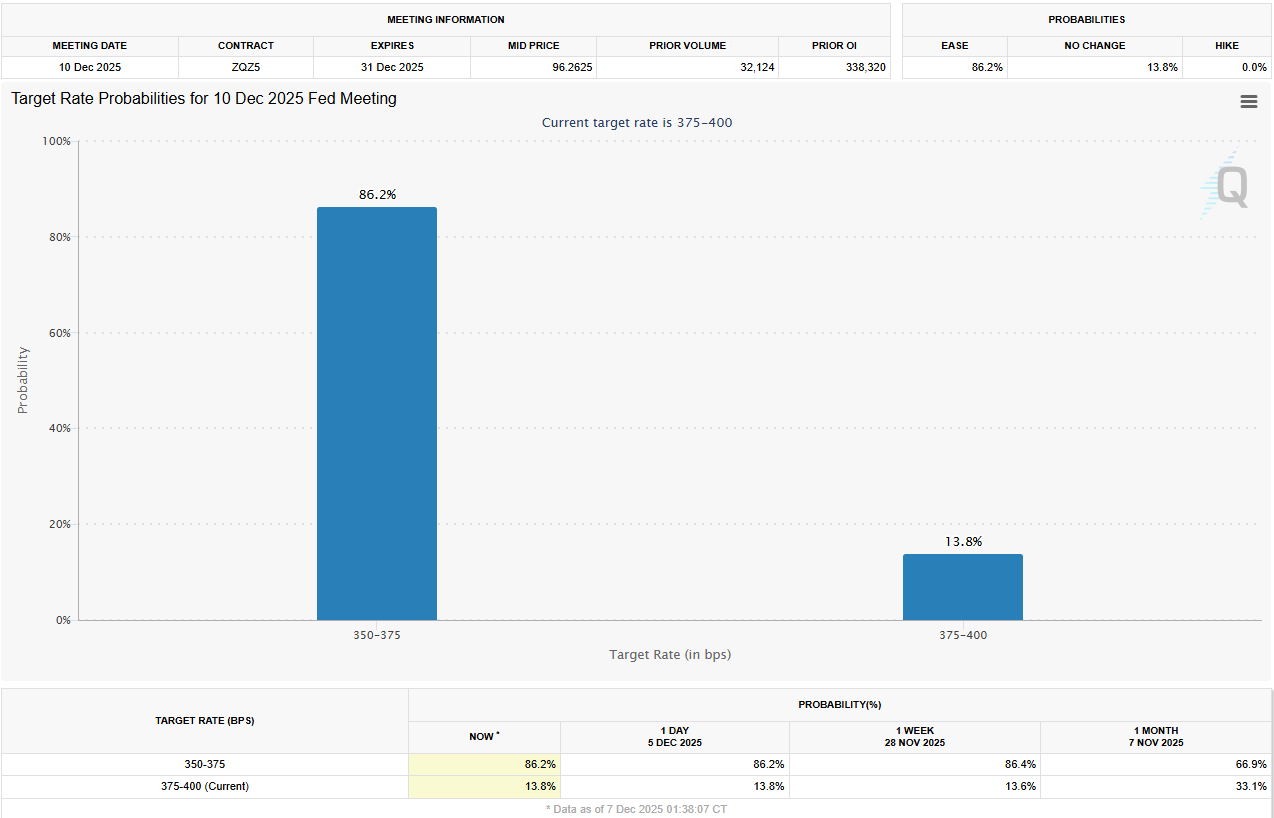

Markets, ever the optimists, now price in an 86% chance of a 25 basis point rate cut this week. Yet economic stress and whispers of Fed leadership swaps loom like uninvited guests at a masquerade ball. 🎭

Market Performance: A Farce Where Even Ibsen Would Blush

The equity rally during quantitative tightening has shattered old-school market dogma. It’s as if the stock market decided to host a tea party and forgot to invite the Fed. 🫖

BREAKING: The Fed’s balance sheet fell -$37 billion in November-to $6.53 trillion, its lowest since April 2020. They’ve trimmed assets by -$2.43 trillion (27%) since launching QT. The end? December 1st. The drama? Unending. 🎭

– The Kobeissi Letter (@KobeissiLetter) December 7, 2025

Charlie Bilello’s data reveals the S&P 500’s 82% leap as Fed assets dwindled. It’s a divorce, darling-equities found new sugar daddies: fiscal deficits, buybacks, and foreign cash. 💰

Analysts, clutching pearls, cite “alternative liquidity” as the new black. EndGame Macro quips: Markets marry expectations, not balance sheets. 🤵

But let’s not pretend-gains are hoarded by tech titans. The rest? A tragic chorus of sectors gasping under economic fundamentals. 🎭

Economic Stress: The Skeleton in the Closet

Stock gains mask a Gothic tale: Corporate bankruptcies near 15-year highs. Credit cards, auto loans, and student debt-delinquencies bloom like weeds. 🌿

Commercial real estate? A ghost town. Indices ignore these “minor” tragedies, prioritizing mega-caps over mortal companies. 💀

The Fed’s task? Herculean. Stock indices sing of easy money, while the economy hums a dirge. 🎵

Fed’s Reputation: A Comedy of Errors

James Thorne calls the Fed a “massive boondoggle”-a relic clinging to broken models. Secretary Bessent’s verdict? “The Fed’s a universal basic income for PhDs. If air traffic controllers did this, planes would crash. 🛫💥

“The Fed is a bloated, backward-looking relic. Investors treat Powell’s Fed like an oracle? How quaint. If only oracles came with refunds.”

– James E. Thorne (@DrJStrategy) December 7, 2025

Critics sneer: The Fed lags markets like a tortoise chasing a Tesla. 🐢

Leadership Drama and Inflation: A Telenovela

Kevin Hassett, Powell’s likely successor, is a dove in a hawk’s nest. His loose policies could reignite inflation like a phoenix on caffeine. 🔥

Bond markets panic: The 10-year yield rises as investors bet on Hassett’s “accommodative” era. 📈

Two rate cuts in 2026? Likely. If Hassett takes charge in February, Powell’s final act may be as relevant as a silent film. 🎬

Charlie Bilello reminds us: Bull markets outlast bears 5:1. But this rally’s Achilles’ heel? Economic stress and a Fed in flux. 🐂🐻

Bull markets: 5x longer than bears. Bulls: +254% over 5 years 🐂 Bears: -31% over 1 year 🐻 Markets prefer compounding to chaos. Interrupt? A crime against finance. 📊

– Charlie Bilello (@charliebilello) December 7, 2025

The rally may endure, but like a Wildean hero, it’s burdened by contradictions: concentrated gains, economic strife, and a Fed whose shadow grows longer by the day. 🕯️

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Sony Shuts Down PlayStation Stars Loyalty Program

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- EUR USD PREDICTION

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

2025-12-08 00:18