In the serene depths of a dim-lit tea house, adorned in the fashion of a bygone era, a man with a glint of mischief in his eye proclaims not just the folly of Bitcoin (BTC), but its absolute menace to the very fabric of our economy. Ah, Peter Schiff, our modern-day Cassandra, shrieking warnings that will send shivers down the spines of crypto believers! 😱

It seems, dear reader, that Mr. Schiff has once again donned his golden-hued spectacles, framing Bitcoin as the harbinger of doom for our beloved United States. A sweeping critique indeed, as he clutches onto his shiny trinkets of gold—perhaps too tightly? 🎩

As our dear cryptocurrency enthusiasts clutch their digital pearls, Schiff’s arguments, though laced with sarcasm, are harder to dismiss than a persistent neighbor at a dinner party. His musings seem to float through the air, tantalizing those who still dare to dream of riches with Bitcoin.

“Bitcoin will cause a lot of people to lose a lot of money, and it’s been very harmful to the U.S. economy,”

— Peter Schiff (@PeterSchiff) March 18, 2025

An Epic Showdown: Bitcoin vs. Gold

In a twist worthy of a Chekhovian tale, the precious yellow metal has erupted like an overcooked soufflé, now surpassing the grand sum of $3,000 for the first time—a triumph that Schiff staunchly believes is merely the opening act. Silver too has flexed its muscles, rising to the lofty price of $34.10—an achievement that makes U.S. stocks look rather pathetic in comparison. 🤷♂️

Ah, the irony! Our new U.S. administration, in its stellar wisdom, seems to be selling off domestic stocks to invest in foreign ones, all while reportedly tossing Bitcoin overboard to bathe in the glow of gold. A stage where the clever coin can be seen running nervously in circles, as smart money tiptoes toward the glittering allure of tangible assets.

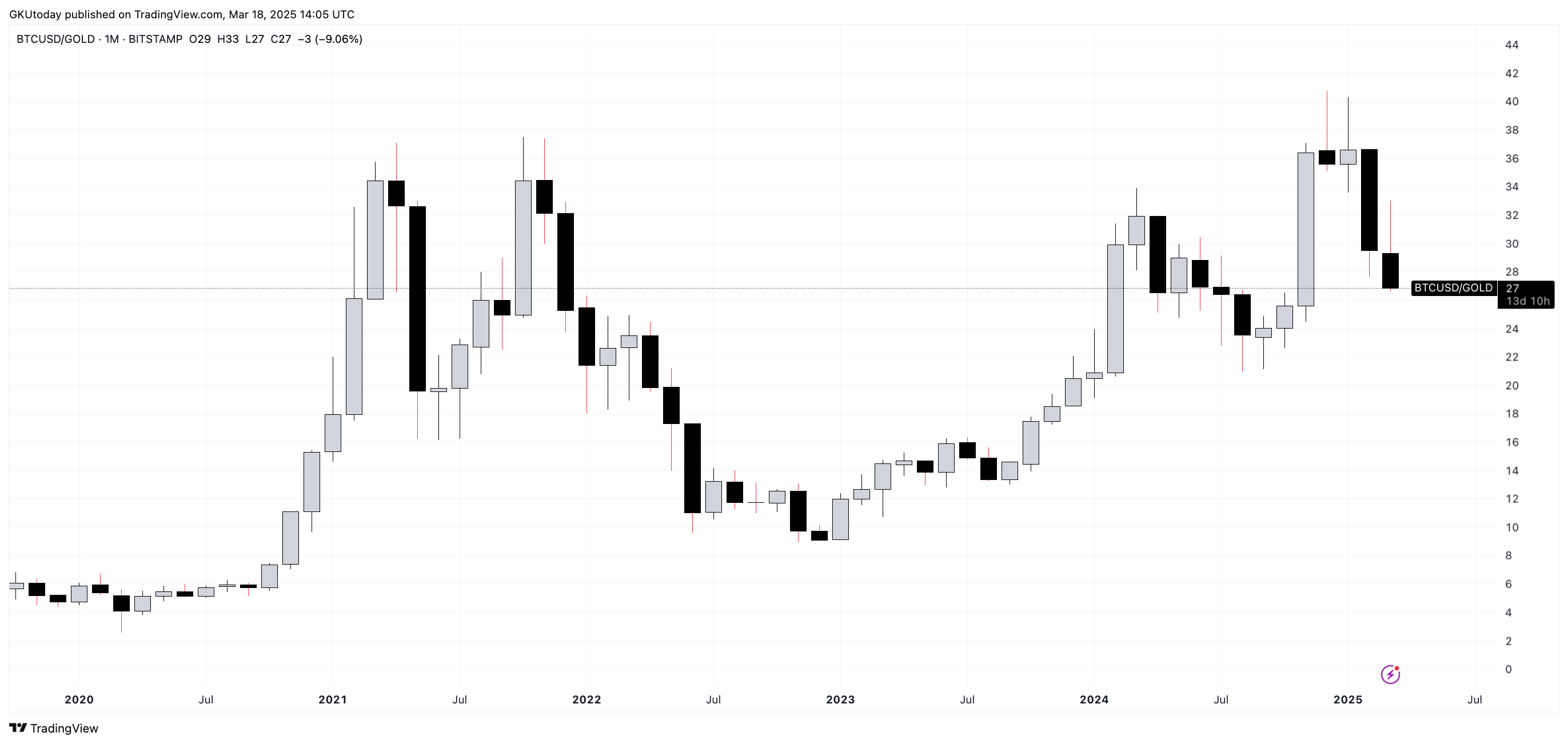

Yet, let us not stray too far from the comical character that is Bitcoin. Mr. Schiff, unimpressed by the spectacle, stands resolute. Since its euphoric peak in November 2021, Bitcoin has, rather tragically, lost a staggering 26% of its value compared to gold, a development that illuminates the exodus of disillusioned investors abandoning the digital ship in favor of more stable shores.

“What do you think they’re buying with that money?” he quips, drawing attention to Bitcoin’s plummet as if it were a comedic play unraveling before an audience of patrons. Gold, it appears, is speeding ahead, leaving cryptocurrency behind as though it were an unusually heavy suitcase in the attic. 🏃♂️💨

Inflation: The Real Culprit

As the stagehands adjust the scenery for our current economic act, Schiff points his finger at the rising cost of goods, declaring inflation as the true villain—far more nefarious than any tariff war. “Where is that Federal Reserve when you need them?” he muses, shaking his head disapprovingly.

With prices that ascend like an eager actor looking for applause, our dear gold will continue to shine, while Bitcoin’s supposed fortitude will eventually face its ultimate test as ETF investors prepare to cash out. A fascinating drama indeed.

At this moment, dear audience, Bitcoin finds itself in a rather precarious position, having lost the esteemed $82,000 price point. Whether Mr. Schiff’s prophetic warnings will ring true is a question tantalizingly poised in the air, much like a poorly thrown hat. 🎩

One thing remains absolutely certain: Schiff’s warnings, delivered with the boldness of a stage performer, are as flamboyant as they are entertaining.

Read More

2025-03-18 18:14