In a bizarre twist of cosmic fate reminiscent of a half-baked 42-tipped answer, Ethereum is edging closer to a truly pivotal moment. Picture it striving, nay, valiantly lunging to reclaim the illustrious $2,600 level! It has been playing hide and seek in a rather unexciting sideways game for weeks now—much like watching paint dry but with a fluctuating number of zeros.

With ETH currently feeling rather peckish at the edge of the upper boundary of its consolidation zone, one cannot help but wonder if this marks the onset of a newfound bullish escapade for the universe’s second-largest cryptocurrency. Spoiler alert: cosmic intervention may be required! 😅

Market participants are squinting through their overpriced binoculars, eagerly observing this pivotal level while bickering amongst themselves on various chat platforms. Should a successful breakout occur—and it’s a big ‘if’ statistically speaking—above $2,600, it could be the siren song for momentum buyers to emerge from their hibernation. But let’s not pop the champagne yet; if our bullish heroes run out of steam, we might just witness Ethereum tumble back down to lower support zones like a toddler at a birthday party denied cake.

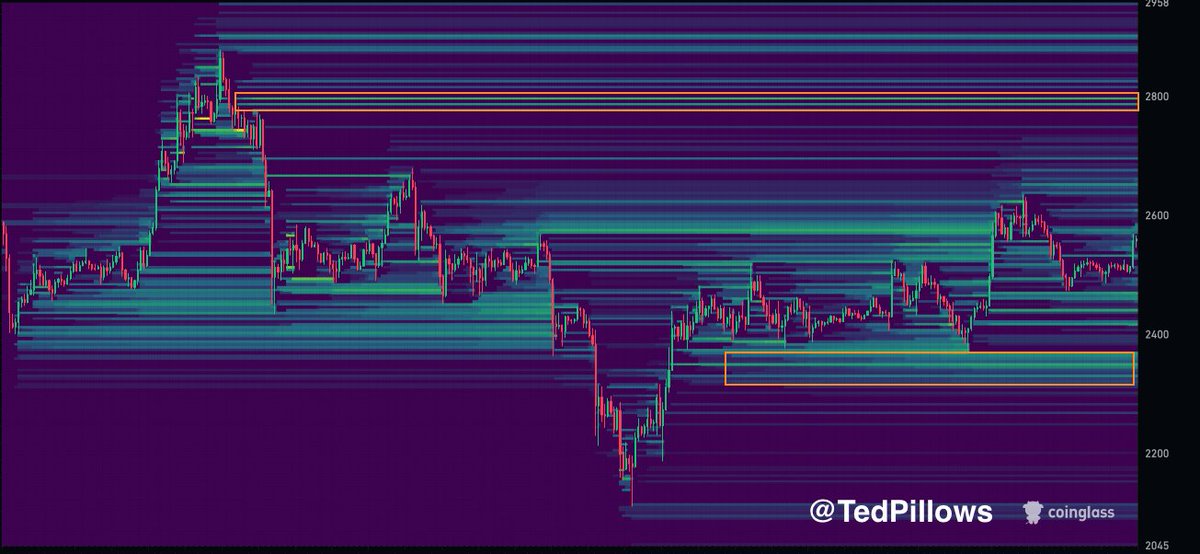

According to the well-respected crystal ball known as Coinglass data, liquidity clusters have been audaciously positioned at $2,800 and $2,350. These prices are likely to behave like magnets in the coming days, determined by how our dear Ethereum reacts to current resistance levels. A splendid jump toward $2,800 would unfurl bullish banners and send altcoins soaring, while a dramatic rejection could just serve to solidify bearish drama. Cue the gloomy music!

Ethereum’s Next Move: A Leap of Faith or a Trip on a Lego? 🦘

With altcoins lounging about approximately 50% below their celestial all-time highs, a quiet bullish momentum is brewing—like a pot of tea left too long on the stove. Ethereum, the self-proclaimed star of the altcoin market, has been locked in a rather pathetic waltz between $2,400 and $2,700 since early May. This prolonged shuffle has left the entire altcoin sector in a delightful state of utter indecision. Traders and analysts now agree: a resounding breakout is essential for Ethereum to lead any major moves without tripping over its own virtual shoelaces.

Market analyst Ted Pillows, possibly not related to the comfort variety, has spotted two key liquidity levels for ETH: the illustrious $2,800 above and the slightly scarier $2,350 below. These zones stand as likely destinations for our dear price, depending on which side decides to shatter first like a bad glass ornament. Should Ethereum strut above $2,800 with an exaggerated swagger, it’s bound to trigger fresh appetites for risk and a riotous altcoin rally. Conversely, a nosedive below $2,350 could lead to gut-wrenching corrections across the land. The stakes have never been more critical, folks!

So far, our bullish defenders have held the $2,500 level with the grace of a tightrope walker, and indications of growing open interest suggest that investors may be positioning themselves for expansions—or perhaps just another round of snacks. A decisive breakout, regardless of direction, promises to resolve weeks of exhilarating consolidation and set the stage for the short-term trend. Until then, Ethereum remains the gatekeeper of altcoin momentum. Its upcoming maneuver could very well define the course for the entire cosmic market!

ETH’s Daring Test of Resistance: A Most Uncomfortable Experience! 🚪

Currently trading at $2,563, Ethereum is like that awkward kid at a party—hovering just below the sought-after $2,600 mark, a price point that has acted as the ultimate short-term gatekeeper throughout June and early July. As chronicled in the ongoing saga known as the 12-hour chart, ETH has been ensnared in a horizontal consolidation structure between $2,400 and $2,700, attempting numerous times to break free but ending up more entangled than a cat in a ball of yarn.

Price remains hovering above the 50, 100, and 200 simple moving averages (SMAs), suggesting some positive signals for those valiant bulls. The 100 SMA at $2,532 and the 200 SMA at $2,206 have offered robust dynamic support during recent tumbles down memory lane, reinforcing the uptrend structure like a suspenseful novel’s buildup.

Volume remains at a moderate level—not too thrilling, but certainly not a snoozefest—suggesting market participants are waiting for a clear breakout to determine whether they should don their party hats or put on their solemn faces. A decisive close above $2,600 would fling open the door to a move toward the coveted $2,800, where large liquidity clusters have made their grand appearance, courtesy of Coinglass.

Yet, the stakes are perilously high! Failure to maintain this short-term momentum could send ETH trudging back toward the $2,400 support zone. Bulls have valiantly defended this level multiple times, and a break below it would likely douse the bullish setup and dramatically raise the risk of a deeper, market-wide conundrum—cue dramatic wind howl! 🌪️

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- All Kamurocho Locker Keys in Yakuza Kiwami 3

- Who Is the Information Broker in The Sims 4?

2025-07-07 22:23