Only five suns ago, the chances for a slight easing of the rates danced higher, yet now, with less than three weeks to the solemn congregation of the Federal Open Market Committee, these whimsical hopes have contracted as if shamed by their own ambition.

In But Five Days, Faith in the Fed’s Mercy Has Plummeted Like a Lead Balloon

The prospect of a rate cut at the upcoming May 7 assembly seems as unlikely as peace at a family dinner where politics are discussed. Still, nineteen days remain – a blink in history, but an eternity in Washington’s theatrics. Powell, the Federal Reserve’s captain, borrowed words from a youthful philosopher named Ferris Bueller, whispering, “Life moves pretty fast.” At the pace set by one President Trump, life sprints, stumbles, and occasionally somersaults onto the global stage.

The oracle of CME’s Fedwatch six moons past proclaimed a 39.8% chance that the Fed would slash rates by a quarter point — almost hopeful, for the somber coterie of investors.

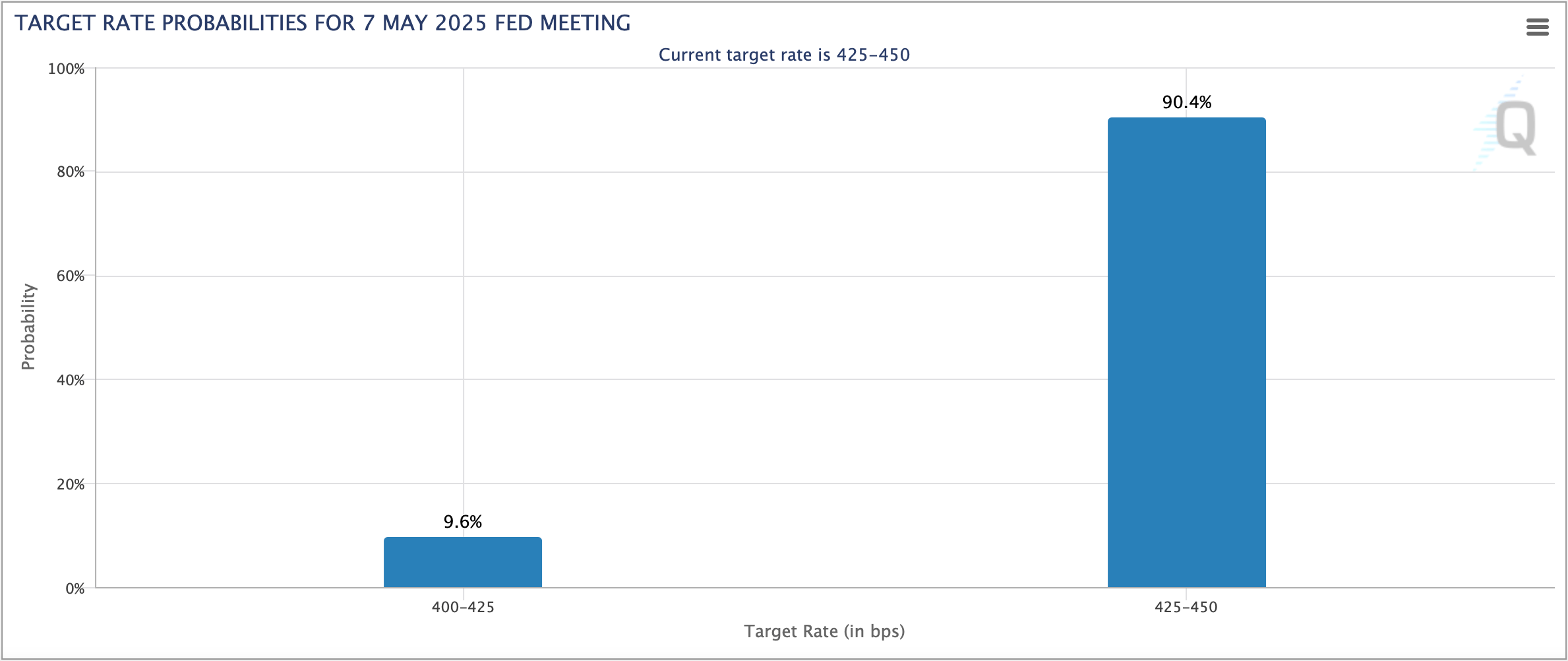

But behold! As today dawns upon April 17, the chance has shriveled to a mere 9.6%, as if the market has lost its appetite for whimsy. Nay, the probability that rates shall remain unwavering steadies at a formidable 90.4%, basking in the glow of predictability. Meanwhile, President Trump hurls barbs and threats at Chair Powell — decrying his “late” decisions as if the man were slow on the draw at a dueling ground. Trump demands rate cuts to mimic other nations juggling the fiery torches of a growing trade war.

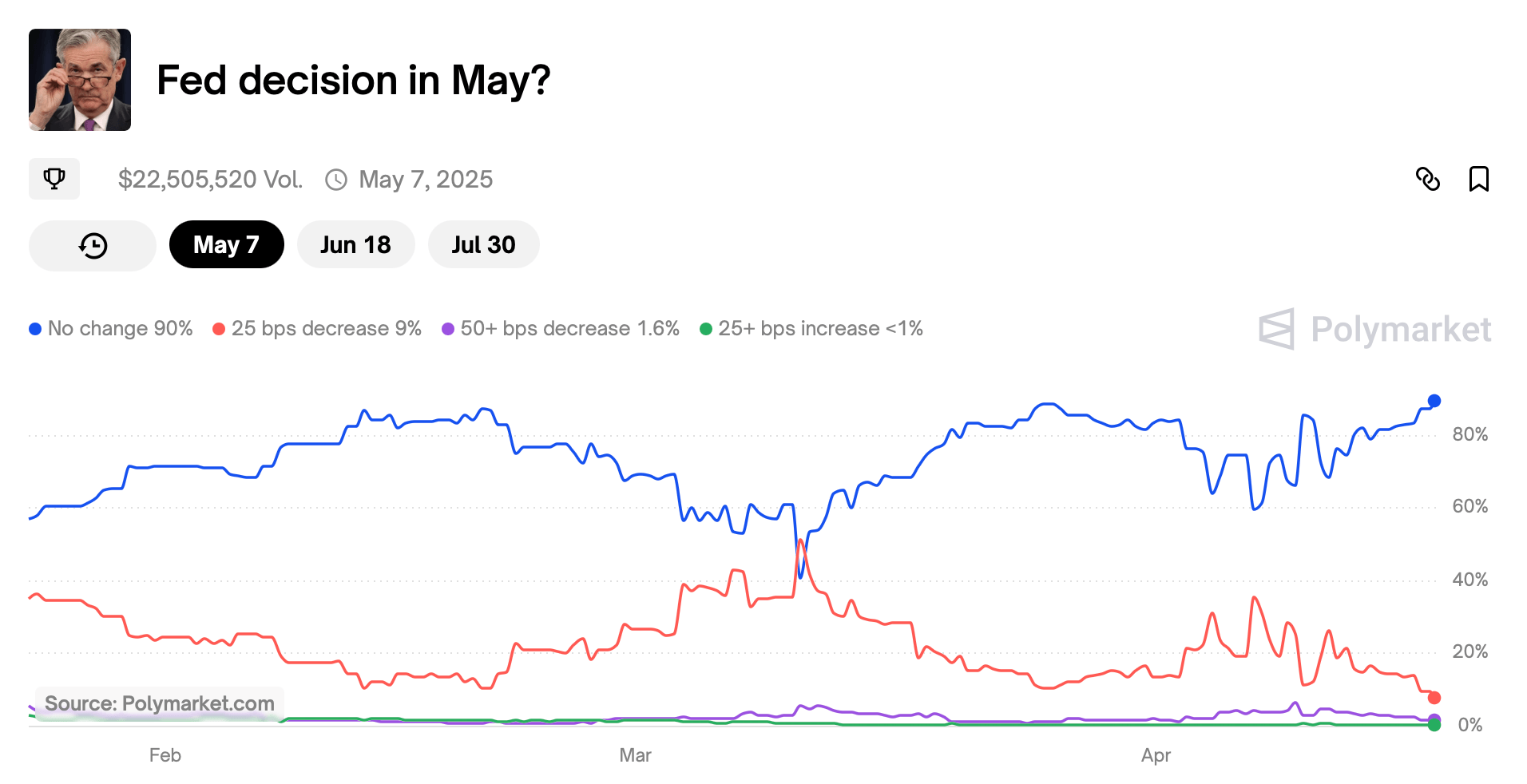

Yet despite these presidential theatrics—including ominous threats of “termination”—the CME futures markets remain as stoic and unmoved as a cat ignoring a laser pointer. Across the realms of Polymarket and Kalshi, punters exhibit a ~90% faith in no change at all, bestowing a mere 8-10% chance to the quarter-point rate slashing fandango.

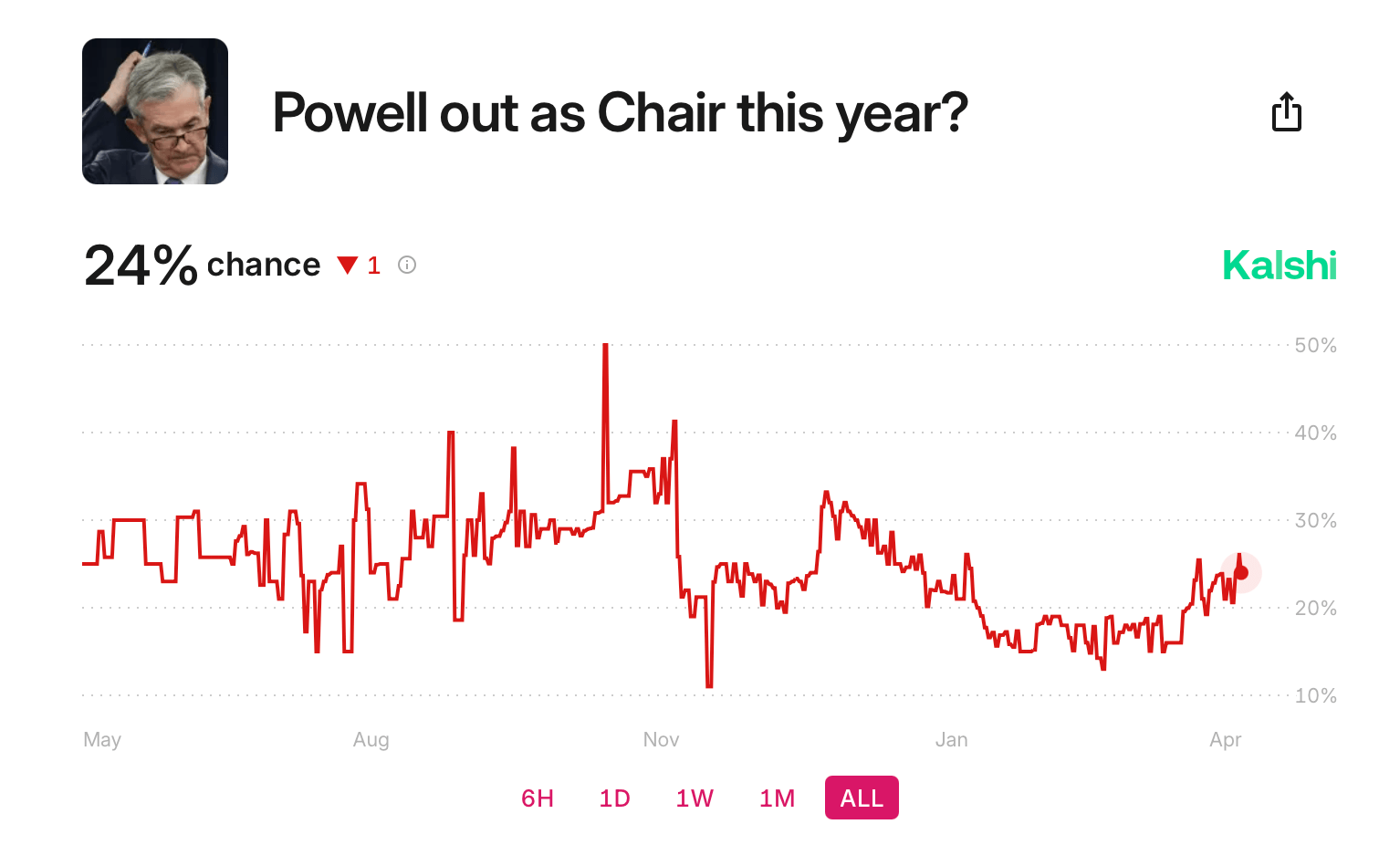

Moreover, Kalshi’s soothsayers whisper of a 25% likelihood that Powell might find himself unceremoniously shuffled off the board before year’s end — a prospect that surely spices the political stew. Polymarket concurs, though with a slightly less sanguine 20% chance.

Still, amid this delicate dance of tariffs and turmoil, the Fed is like a man caught between a rock and a hard place — a predicament that might yet compel a sigh, a blink, or a reluctant trim of rates. Until then, the markets watch, wager, and wait, as the rollercoaster of economics twists on, much faster than Ferris might have imagined. 🎢📉

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- USD ILS PREDICTION

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Gold Rate Forecast

- How to Get 100% Chameleon in Oblivion Remastered

- Invincible’s Strongest Female Characters

2025-04-17 22:29