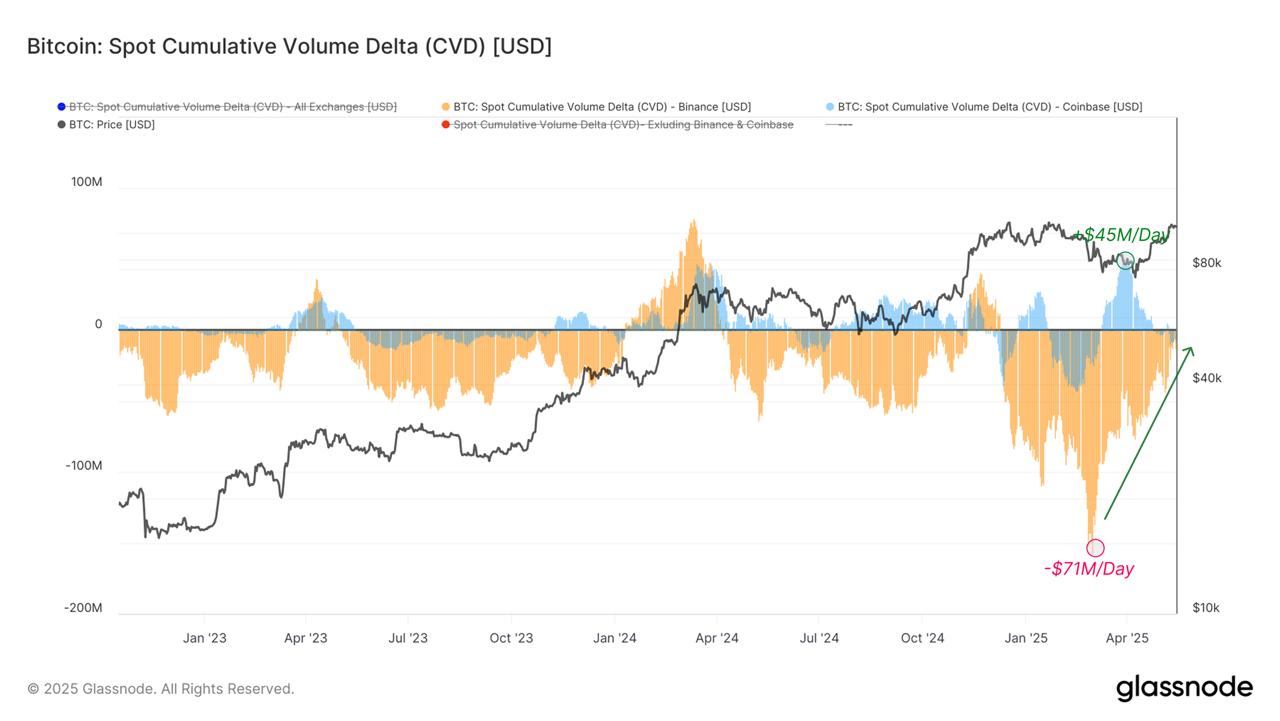

Ah, the magic of numbers, the enchanting dance of Bitcoin’s fortunes! One of the most fascinating metrics these days is the Spot Cumulative Volume Delta (CVD). Don’t let the fancy name fool you, dear reader—it’s simply tracking whether the spot order books are experiencing a surge of buying or selling pressure. A rather humble task, but one with massive implications for Bitcoin’s wild ride!

Look closely, friends, at the chart below, showcasing Binance and Coinbase. It seems that since mid-April, Coinbase has been the place for the bold, the brave, the relentless buyers, with CVD soaring to a dazzling +$45M per day. Truly a spectacle to behold, don’t you think? 🤑

And what happened next, you ask? Well, lo and behold, this surge in buying pressure was *perfectly* timed with Bitcoin’s upward movement, driving the price to a cool $104k. It’s almost as if the market had been secretly preparing for the grand rally. Meanwhile, Binance—poor, poor Binance—has shifted from a violent -$71M per day in net selling pressure to a less furious -$9M today. A slight reduction, sure, but one must wonder: has Binance learned the art of subtlety? 🤔

Spot Demand and On-Chain Signals Align—Is it Destiny?

The stars have aligned, my friends. On-chain accumulation and off-chain spot demand are in perfect harmony, as if they were fated to join forces and drive Bitcoin towards greater glory. This is no mere coincidence—oh no, it’s the dip-buying enthusiasts working in tandem, their collective strength pushing Bitcoin’s price higher. With such consistency in buyer strength across both on-chain and off-chain metrics, we can’t help but feel that the rally to $104k is here to stay. For a while, at least. 💪

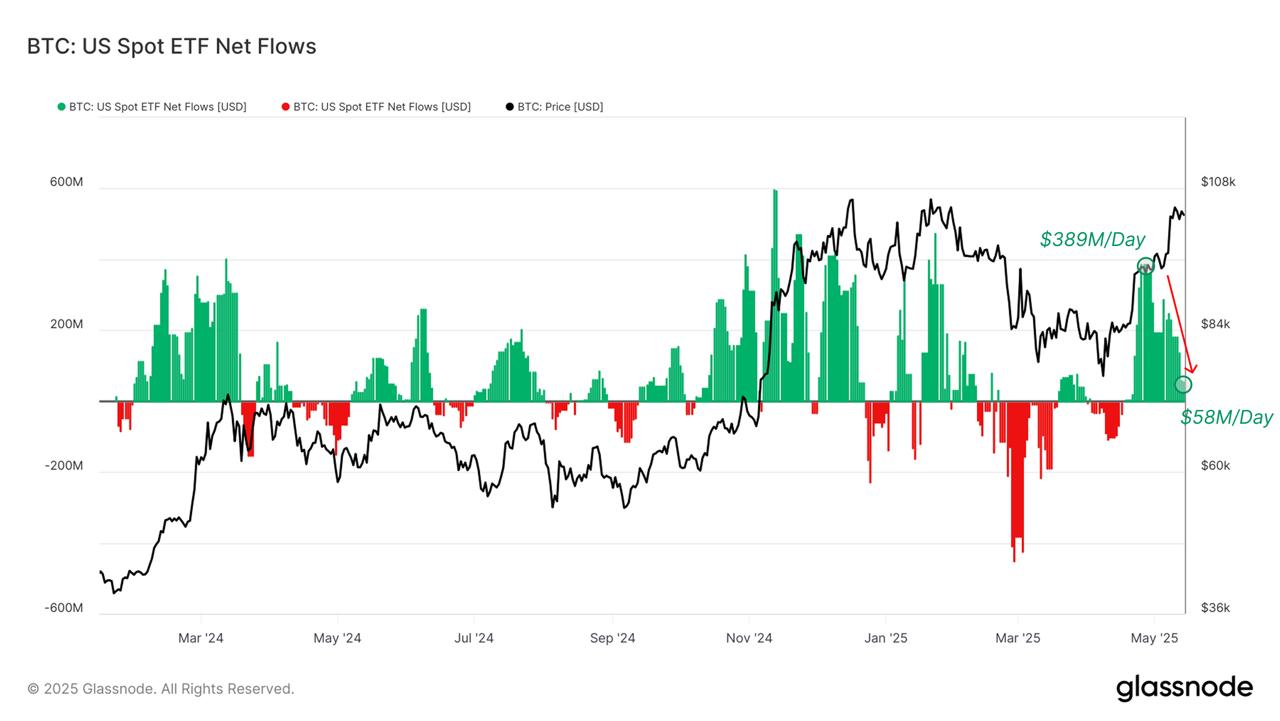

Institutional Interest: The Big Money Is Watching

Ah yes, the institutions—how could we forget them? BTC’s allure has grown stronger than ever with the introduction of spot ETFs, and tracking the flows of these glittering products is like peering into the soul of the financial world. On April 25, the weekly average net inflow to ETF wallets peaked at $389M per day. A perfect storm of spot-driven buying, propelling Bitcoin to $104k with the elegance of a ballet dancer. 💃

Since that heady peak, ETF inflows have cooled down to a still-impressive $58M per day. Yes, it’s a slight dip, but still, institutional interest is as strong as ever. Could it be that the big players are in it for the long haul? Time will tell. ⏳

Bitcoin’s Future: Will It Keep on Soaring or Fall Like a Deflated Balloon?

With ETF flows remaining robust, it’s clear that institutional interest in Bitcoin isn’t going anywhere anytime soon. In fact, these inflows are beginning to resemble those of previous rallies in 2024. As long as demand continues to pour in from both retail and institutional investors, Bitcoin’s outlook is as positive as ever. Of course, the future is never certain—Bitcoin’s volatility might decide to throw a tantrum. But for now, the horizon is bright. 🚀

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-05-17 19:19