Ah, dear reader, in the tumultuous realm of electronic trade, where the very fabric of time stretches to its limits, one finds that every tick of the clock, every fleeting millisecond, transcends into a monument of significance. The demands of precision weigh heavily upon the shoulders of those who dare to tread this path of commerce, be they an earnest individual with fingers trembling over the “buy” key for a capricious cryptocurrency or a grand institution maneuvering through the labyrinthine Forex markets with millions at stake. Yet, amid this cacophony and chaos, there exists an unheralded titan — the matching engine, that enigmatic figure hidden in the shadows, orchestrating the bustling dance of buy and sell orders. Isn’t it amusing how few acknowledge its tireless toil? 😂

Behold, this high-speed marvel! It champions the cause of your trade with the agility of a seasoned juggler, ensuring your whims are realized swiftly, impartially, and with an accuracy that would make even the sternest of accountants shed a tear. But lo! The average trader wanders blissfully through life, utterly oblivious to this technological sorcery weaving behind the curtains.

In the paragraphs that follow, dear companion of commerce, we shall peel back the layers of glitz and glamour that shroud this matching engine. We shall expose the essential sinews of its operation, illuminating its unparalleled necessity across myriad market categories while casting a wary eye toward its future — a future that must evolve alongside the next generation of trading platforms.

Key Takeaways

- Modern matching engines serve as the backbone of trade execution, matching buy and sell orders with the swiftness of Cupid’s arrow (minus the mischief).

//cryptorisen.com/app/uploads/2025/07/ME-in-the-architecture-of-exchange.png”/>

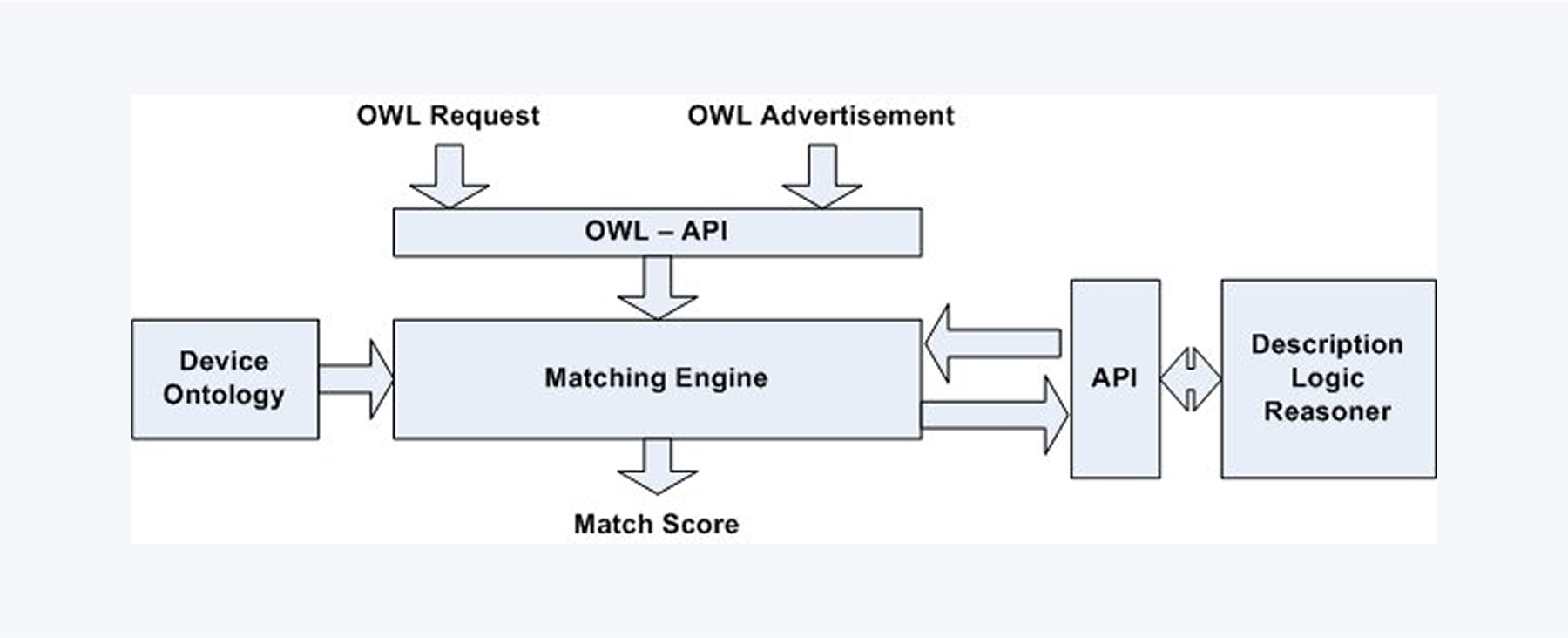

Here lies the secret! Whenever a trader proclaims their intent to acquire Bitcoin, bartering with Euro to USD, or engaging in a wager on Apple stock, it is the matching engine that scurries about, seeking the perfect counterpart from the other side of the mercurial market, swiftly encapsulating their desires in a binding agreement.

Much like a meticulous librarian, these engines employ preordained algorithms, delicate rules that govern the dance of orders. Some favor the First-In-First-Out (FIFO) method — a charmingly democratic system that reveres those who arrive first — while others prefer a pro-rata approach, a rather egalitarian form of matchmaking, accommodating multiple souls yearning for the same prize. The chosen algorithm can truly sway the quality of liquidity and the fairness of interactions — an almighty hand in the game of chance.

First and foremost, let us acknowledge that matching engines thrive on high-volume and high-speed performance. A delay of mere milliseconds could spell doom for fortunes — Alas! The tragedy of lost opportunity awaits!

How do these engines accomplish such herculean tasks? In their relentless pursuit of efficiency, they stand ready to process tens of thousands or even hundreds of thousands of transactions every single second — an exhausting endeavor that they take on with unparalleled fervor.

Fast Fact

Some matching engines possess the eccentric power to process over 100,000 order-matching events each second. Impressive, is it not? 😜

Core Components of a Matching Engine

The beating heart of a high-performance trading system lies within the matching engine. While most traders gaze upon the polished front-end interface, unbeknownst to them is the intricate machinery — the hidden gears and cogs expertly executing orders, filling trades, and delivering live price feeds like clockwork.

Whether you’re the steward of an institutional-grade system or a vibrant crypto exchange, the matching engine application glows with responsibility, facilitating a dance of seamless interaction between the eager buyers and sellers.

As we delve deeper, we shall unveil the four cardinal components of the modern-day trading matching engine, casting light upon how they collaborate to deliver the promised triad of speed, fairness, and efficiency in the bustling agora of contemporary finance.

Order Book

The order book: a modern-day tapestry, containing the chronicles of buy and sell orders, laid forth by price level and time of submission. When a trader finds inspiration to place a new order, the matching engine jumps into action, filling it forthwith if a match is found; otherwise, the order lingers in this vast ledger awaiting an eager counterparty.

This dynamic and real-time representation of liquidity serves as the driving force behind price discovery while also prohibiting any human errors — hallelujah! *Raises hands to the heavens.* It supplies the matching engine program with crucial information needed to accurately fulfill the aspirations of its users.

Matching Logic

Like a sage dispensing wisdom, the matching algorithm operates on a set of preordained rules that dictate the harmony between assorted purchase and sale orders. Most exchanges acknowledge the First-In, First-Out (FIFO) rule as the default, and this method resonates with the sound of fair play. 🎶

What follows is the Pro Rata algorithm, dividing the spoils among traders, fairly distributing advantages when multiple souls cast their nets into the same waters. Picture our three traders — all offering sails to the highest bid — and our matching engine gracefully orchestrates their rewards.

Of course, some matching engines indulge in hybrid or specialized logic to accommodate the moods and whims of diverse asset classes, demonstrating a flexibility worthy of a circus acrobat. The architecture of the chosen algorithm can sway the very tides of market liquidity, driving the inevitable push and pull of trade executions.

Latency Management

In the fervent world of finance, low latency reigns supreme. A moment’s hesitation may lead to a missed opportunity or unfavorable pricing — oh, the treachery of fate! Thus, the most formidable trading engines exist in a perpetual state of optimization, racing against the clock to avoid the grim grasp of delays.

Reducing latency requires each link in the engine’s workflow to be an efficient machine; the order’s passage from inception to execution must flow seamlessly, vanquishing any threat of stagnation.

With ultra-efficient code, servers deployed near critical hubs, and finely tuned hardware, some platforms execute up to several hundred thousand order-matching events each second. Inevitably, the traders bask in the glory of rapid execution. 🏎️

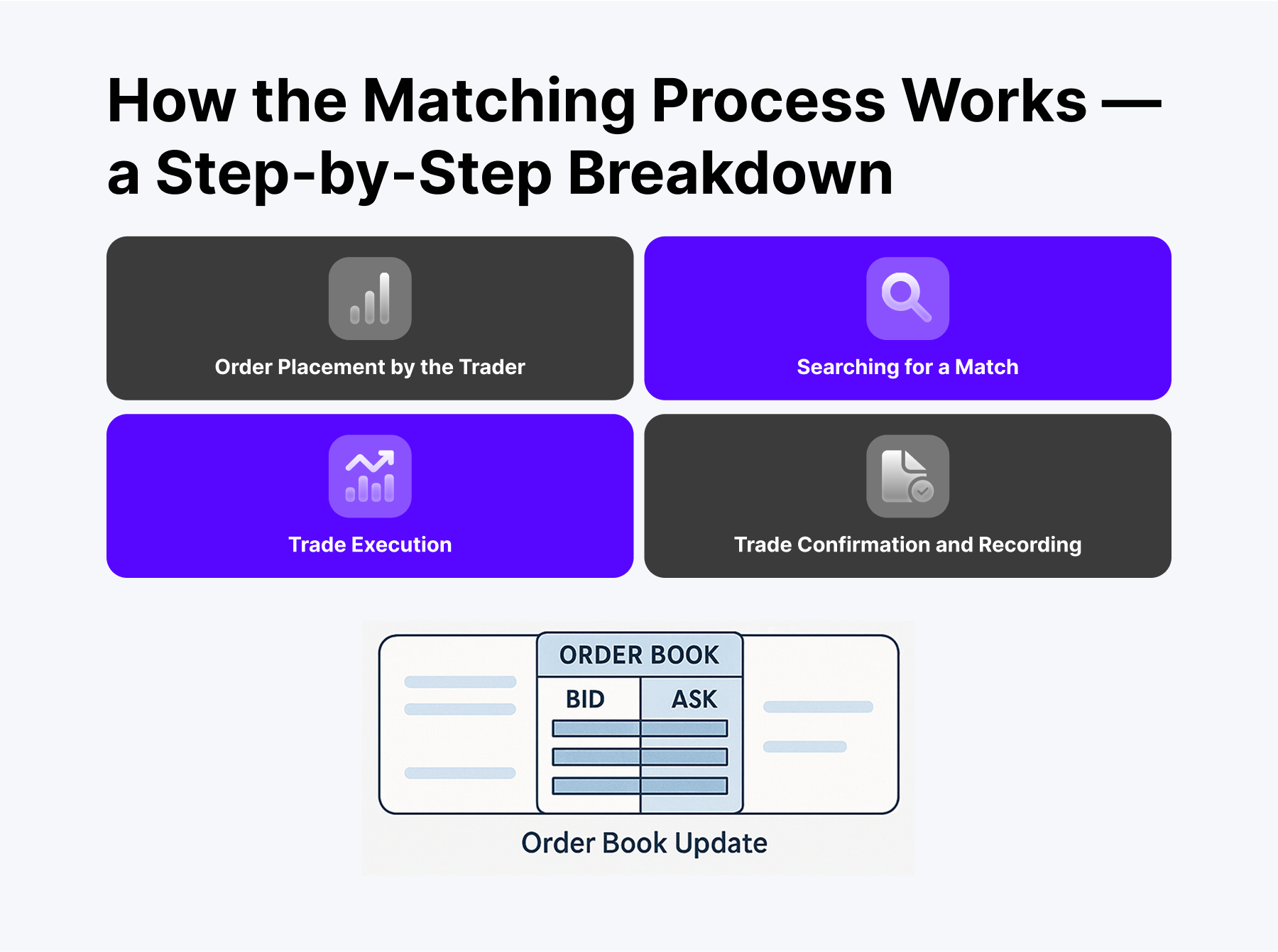

Order Placement by the Trader

Thus, it begins with the trader, placing a buy or sell order through the auspicious trading terminal, aligning vital information regarding the asset, price, volume, and order type. Once set in motion, the order is inevitably forwarded to the primary order book.

Searching for a Match

Our matching engine awakens! It scours the order book, hunting for any competing orders eager to fulfill the request. Suppose a trader wishes to buy at a particular price; the engine rapidly verifies the lowest available sell order at or beneath this price. Such diligence breeds harmony in trade executions, guided by the light of price-time priority.

Trade Execution

Once this fortunate match is procured, the system executes the trade without trepidation. The mutually agreed-upon price and quantity manifest like magic — in the blink of an eye, transactions are complete! ⚡

Trade Confirmation and Recording

With the speed of Mercury himself, both traders receive confirmations, encapsulated in the annals of trade. Time of execution, price, and trade volume become etched eternally into the system ledger. For the sake of compliance and auditing, let not the records be disturbed.

Order Book Update

As the trade concludes, our trustful order book updates itself tirelessly. Should the original order be partially filled, its remaining portion lingers, poised for future fulfillment until matched with an enthusiastic order or canceled at the trader’s whim.

Matching Engine in Different Markets

Though the primary task of every matching engine remains unchanged — the matching of orders swiftly and accurately — its operations diverge across varied markets!

Whether in the realm of Forex, crypto, or venerable stock exchanges, each asset category brings its own unique tribulations, temperaments, and technological demands. Allow us to unravel the nuanced behaviors of this technology amid fluctuating financial atmospheres. 🍃

Forex

The bewitching world of Forex reigns supreme as the largest and most liquid financial marketplace, ever in motion — 24 hours a day, across all days of the calendar year! Unlike a singular, centralized exchange, this chaotic orchestra operates through a network of brokers, banks, and liquidity providers. Precious liquidity! 🏦

Here, the trading matching engine serves as the architect of aggregated quotes from various sources, tirelessly executing trades at the best possible prices. With every tick, the need for low-latency performance becomes more pressing. A vast sea of transactions, each demanding agile execution, lest they lose their footing against the tides. 🌊

Crypto

In the wild west of cryptocurrency, a battleground of continuous trading persists, devoid of centralized authority. Each exchange presents its own unique matching engine stemming from a pool of liquidity — a fragmented marketplace where price is dictated by the tumultuous dance of order books and fervent trading activity.

These engines champion the cause of flexibility, effortlessly accommodating a myriad of tokens and asset classes — spot, futures, margin, and perpetual swaps mingle in this frenetic hall of commerce.

In an era of increasing scrutiny over transparency, the accessibility of deep order books remains paramount. Crypto exchanges often prefer the FIFO matching system, pledging allegiance to fairness while fostering the blooming flower of market liquidity. 🌺

Stock Exchanges

Timeless bastions such as NASDAQ, NYSE, or their defunct cousins operate under strict governance, shrouded in a tapestry of regulatory compliance. Their deft engines must embrace the burdens of audits, documenting every transaction — for in such worlds, fairness must reign eternal.

The rigorous nature of stock interactions ensures that our matching engines comply with pre-established rules while ever maintaining a complete audit trail — lest the regulators come knocking on the door for an explanation! 🚪

Emerging Trends in Matching Engine Technology

As trading unfolds at spectacular speeds, so too does the technology that animates them. Modern matching engines don’t merely boast speed and precision; they embody adaptability, intelligence, and decentralized qualities that would make even a philosopher nod in agreement. 🧠

We shall now explore the most groundbreaking advancements that shape the future of matching engines in this brave new world of trade.

Cloud-Native Matching Engines

The winds of change have swept through our fair trade engines towards cloud-native designs! No longer bound by the constraints of high-performance physical servers huddled near financial hubs, the landscape shifts toward the ethereal — exchanges can now leverage cloud infrastructures like AWS, Google Cloud, or Azure to dynamically spin up matching engines in various regions.

The consequences of this shift can be monumental! Enhanced scalability and significantly reduced overhead costs come into view, heralding a future ripe with possibilities for fast-moving exchanges eager to stand responsive without sacrificing performance. A most dazzling turnaround, indeed! 🌐

AI-Powered Order Routing and Risk Checks

Artificial Intelligence has transmogrified from a mere buzzword into an omnipresent force, breathing life into trade technology. With AI permeating the very fabric of matching engine technology, areas like order routing and real-time risk management now bask in its glow.

Behold! As our matching engine discerns where to route orders based on the intricate dance of market conditions, liquidity levels, and trader activity, we witness intelligence at work. This smart routing surpasses mere rule-based logic, ensuring trades achieve the optimal price with minimal slippage. A marvel worthy of applause! 👏

In risk management, those algorithms watch over order flow and user activity, identifying anomalies or signs of possible fraud. Cue the applause for an extra layer of safety, all without compromising execution speed.

Blockchain and DEX Matching Engines

With the rise of blockchain technology comes a new era of decentralized exchanges (DEXs). In a world free from controlling authority, smart contracts and distributed ledger technology facilitate peer-to-peer exchanges, ushering in a transformative experience.

In this brave new world, the traditional matching engine undergoes a metamorphosis. No longer confined to centralized servers, the DEX’s matching engine flourishes within the blockchain, dreaming of trustless order matching, transparency, and verifiability. But wait! There are no intermediaries involved. Wouldn’t you say that’s a delightful utopia? 👌

Some forward-thinking DEXs are blending decentralized custody with centralized matching, creating a harmonious balance between speed and control. This burgeoning evolution aligns perfectly with the expanding domain of decentralized finance (DeFi), ensuring that the matching engines of tomorrow will play an essential role in our electronic trading future.

Conclusion

Though the matching engine graces the world silently, it embodies the tireless force that breathes life into every trade. From orchestrating global buy and sell orders in mere milliseconds to transcending the peculiarities of Forex, crypto, and stock markets, this technology serves as the backbone of our digital trading infrastructure.

As AI, blockchain, and cloud computing continue to redefine the landscape, these matching engines become increasingly intelligent, adaptable, and decentralized. Who would have thought that within the mechanical world of finance could lie such a maelstrom of innovation? 🌪️

FAQ

What is a matching engine in trading?

Ah, a matching engine is the silent but powerful software that harmonizes buy and sell orders, executing trades on a trading platform.

Is a matching engine the same as a trading platform?

No, indeed! The matching engine fuels the trading platform, tirelessly working behind the scenes while the platform greets you in its most glamorous attire.

Are matching engines used in crypto trading?

Yes, all cryptocurrency exchanges depend upon matching engines for executing trades, oftentimes with a particular focus on speed and transparency. It’s a wild ride! 🎢

Can matching engines run in the cloud?

Indubitably! Many modern engines have embraced their cloud-native existence, permitting scalability and cost-efficiency without sacrificing performance. A true revolution!

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- INR RUB PREDICTION

2025-07-19 16:03