Well, slap my knee and call me Silver Jack! Just when you thought the shiny stuff was cruising along to glory, along comes CME with a move so subtle you’d think they were trying to hide a pheasant under a barrel. Silver’s recent rampage met its match not in a giant crash but in the form of a standard, boring old margin hike. Fancy that! The silver bugs are howling like banshees on a bad hair day, accusing CME of masterful mischief, all while trying to keep the market from turning into a wild west rodeo. 🎩💰

Silver’s 2025 Surge Sparks Margin Hikes

In the past month, silver’s price took a flying leap-up about 48%, no less! From the humble $50s in late November to nearly $83-eerily reminiscent of a rocket on a bender. It’s been a year of wild swings, with silver charming investors by over 150%, thanks to tight supply, industrial demand, and folks fleeing inflation like rats from a sinking ship. 🚀💸

Mid-December turned the thrill up to eleven when silver broke the $60 barrier and kept on trucking. Daily ranges spread wider than a politician’s promises, liquidity thinned faster than crumpets at a garden party, and by the day after Christmas, silver hit a high just shy of $83. Volatility was no longer just a word for boring economists-no, sir, it now took center stage with a standing ovation! 🎉

Enter the CME-cue dramatic music. As silver futures soared higher than a kite caught in a gale, the exchange announced another round in its war against volatility: ramping up margin requirements. Front-month margin requirements went from $22,000 to $25,000 per contract, roughly a 13.7% increase, effective right after Santa had gone back to the North Pole. 🌨️

Maintenance margins got a similar treatment, and gold and platinum weren’t spared either-because nothing says “we’re just playing it safe” like making the market more manic. The CME insists it’s just good old risk management, hiding behind the noble shield of survival, not sinister plots-probably while sipping martinis and plotting in secret. 🍸

However, timing is everything-and this cruel coincidence of margin hikes with a slight dip in prices didn’t help the silver faithful. About 67 million ounces of leveraged bets vanished into thin air faster than you can say “margin call,” leading the faithful to cry conspiracy louder than a banshee on a windy night. 🤔

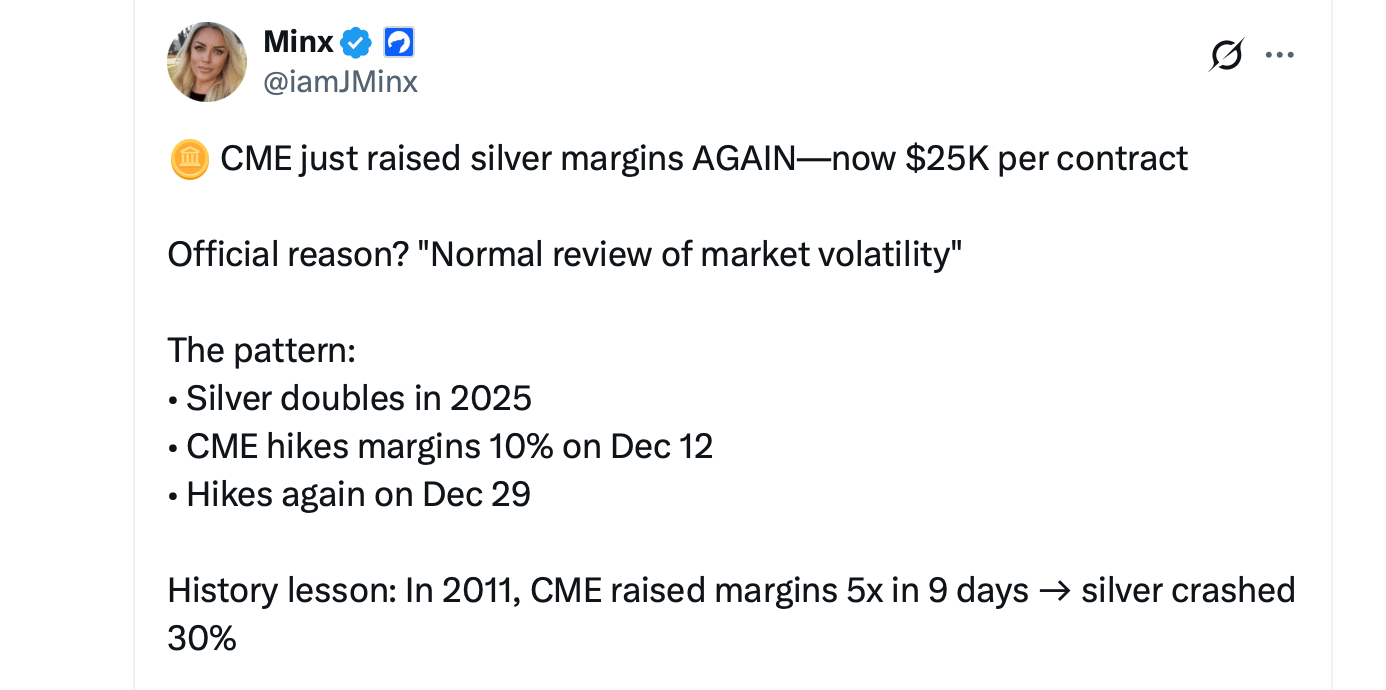

For many, it was as if the big bad exchange had stepped into the ring just when the rally was getting interesting. The chorus of social media wiseguys and silver enthusiasts shrieked that the CME was secretly lending a hand to banks-helping short-sellers knock silver prices down so they could buy physical silver cheaper. Because nothing screams “market manipulation” like raising margins during a rally, right? 🕵️♂️

One particularly pointed critic on X (the social media playground) claimed the CME is just a clever accomplice, aiding banks to cover shorts with margin calls so they can load up on real silver-because, of course, it’s always about the big banks, isn’t it? And history? Oh, just a long line of déjà vu-think 1980, 2011, and now 2025-where every rally was met with the same old song: hike margins, liquidate positions, and watch the price tumble like a certified scandal. 🎭

The ghost of the Hunt Brothers still haunts the halls of silver lore-they heroically tried to corner the market back in the late 1970s, driving prices from a modest $6 to nearly $50 a pop, only to get squashed in Silver Thursday’s crackdown. Today’s rally? Different story altogether. The supply constraints are real, the demand is industrial, and the “manipulation” accusations are just the latest episode in a long-running soap opera. 🛢️📉

Supply-side fundamentals haven’t changed, despite the chatter. Physical buyers-be they manufacturers, governments, or long-term hunks-aren’t bothered much by CME’s rubber-stamped risk rules. These folks are busy trying to get real ounces, not paper promises. Prices? They’re likely to bounce back once the dust and drama settle. Meanwhile, the CME spiced things up across metals-gold, platinum, and palladium-proving this isn’t some silver-specific conspiracy, but a general volatility remedy. 🩺

Deep down, the fervent believers aren’t convinced. Past actions-like JPMorgan’s questionable dealings-have left scars and doubts deeper than a vampire’s fang. Silver’s cyclical saga rumbles on; in 2011, the CME played its part by doubling margins five times in nine days, pushing prices down about 30%. And just like that, the rally was crushed faster than a dollar store pinata. 🎊

In the end, calling it outright manipulation might be a stretch, but it’s a neat lesson: leverage is a wild beast, and margin hikes are their leash. When markets are hot, the rules change faster than a chameleon at a rainbow festival. Traders tiptoe through the volatility, clutching borrowed money and hoping the roller coaster doesn’t land them upside down. 🎢💥

Silver’s recent sprint into record territory is a story worth telling-whether it’s an epic or a cautionary tale depends on whether you believe in supply, demand, or government shenanigans. And on Monday, all eyes will be glued to silver, the ‘poor man’s gold,’ just waiting for the next act in this grand circus. 🎪

FAQ ❓

- Why did silver prices shoot up so sharply in December?

Tight supply, industrial demand, and a dash of macroeconomic chaos-think of it as silver’s version of a perfect storm. ⛈️ - What are CME margin requirements for silver futures?

They’re the cash deposits you must put up to keep your leveraged bets alive-think of it as paying your dues to play the game. 💰 - Are CME margin hikes market manipulation?

Legally, just risk management. But anyone with a heart and a sense of humor might smell something fishy. 🐟 - How does this compare to the Hunt Brothers saga?

Both involved margin hikes during rallies, but today’s game is played on a much bigger, more complicated field-think of it as silver’s versus silver’s. 🥇

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

2025-12-29 11:03