As a seasoned financial analyst with over two decades of experience in the industry, I have witnessed numerous market cycles and learned to respect the wisdom of those who have lived through multiple bull and bear markets. Shibetoshi Nakamoto’s recent warning about an eventual market correction resonates deeply with me.

Shibetoshi Nakamoto, one of Dogecoin’s (DOGE) co-creators, voiced apprehensions about the market’s future during a recent interview. In response to a query regarding the current state of the stock market, he remarked, “A correction or crash is inevitable at some point.”

By July 2024, the S&P 500 has been showing exceptional growth and is close to hitting new record highs, with a return of around 15% so far this year. This strong performance places 2024 among the top performing years for the index over the past 25 years.

there will always be a crash at some point in the future

— Shibetoshi Nakamoto (@BillyM2k) July 14, 2024

In simple terms, the technology industry has been leading the way in this economic surge. Notable tech firms such as Nvidia, Alphabet (Google), Amazon, and Meta have observed substantial rises in their stock values. This upward trend underscores investors’ robust belief in the continued advancement of artificial intelligence and other innovative technologies.

Laggard effect?

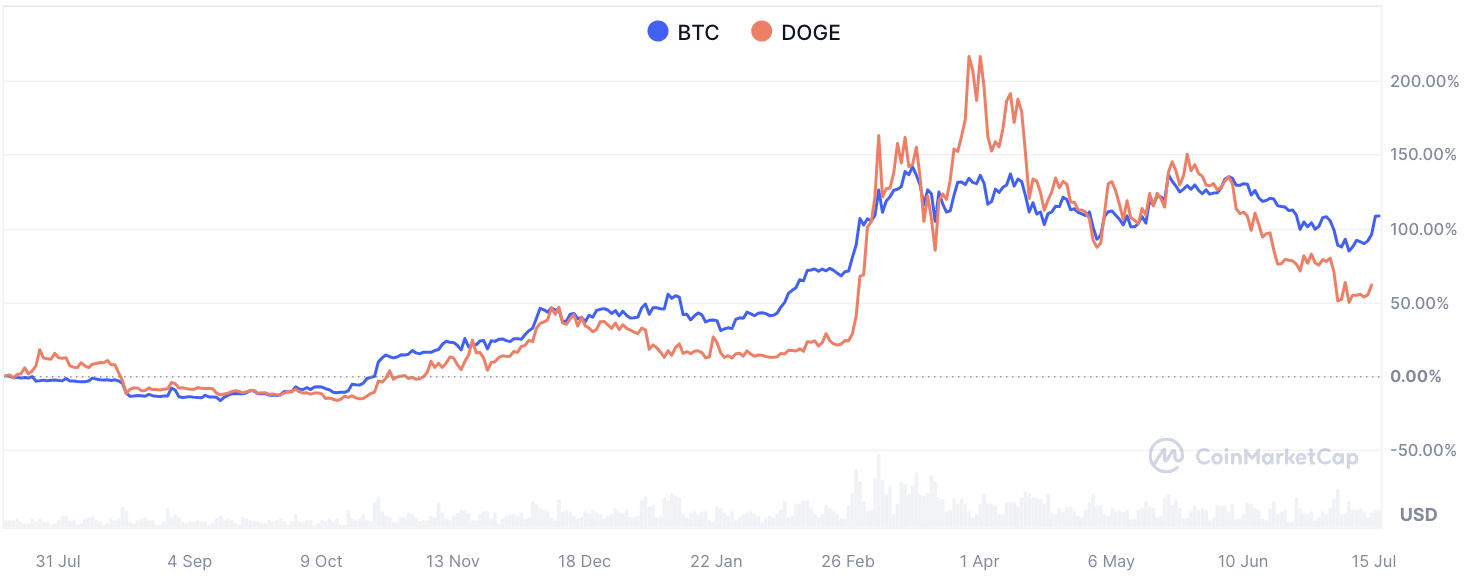

Unlike the consistent upward trend of the S&P 500 this year, the crypto market, specifically Bitcoin, has shown greater volatility. Before the April 2024 halving event, Bitcoin underwent substantial growth and reached a new peak price. Yet, it also endured notable declines, causing billion-dollar liquidations and reflecting a tumultuous market. Contrary to the “up only” pattern observed in the S&P 500, Bitcoin’s price chart demonstrates significant fluctuations.

Dogecoin‘s year-to-date return amounts to 32.6%. While this figure may not reach the heights of Bitcoin or other markets, it represents a more subdued, yet still favorable, performance compared to the broader market.

Will the S&P 500 continue its upward trajectory, or are we on the brink of a market correction?

Read More

- SOL PREDICTION. SOL cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD PHP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- EUR CLP PREDICTION

- USD COP PREDICTION

2024-07-15 12:09