Cracked open like a dusty factory during shift change, the crypto markets hobble back to life, with ‘Made in USA’ coins swelling by a pathetic 7%. Looks like Jerome Powell, that silver-haired magician, whispered sweet dovish nothings at Jackson Hole, sending the Fed’s hopes and your tokens soaring. Oh, the audacity!

While no one can claim to hold the crystal ball, the promise of easing has stirred the pot-yet not all tokens dance equally. Among the chaos, three brave US-made coins stand on the edge, ready to pour fuel on the fire if September’s rate cuts actually happen-unless you believe all that Fed mumbo jumbo is just another theatrical skill show.

XRP (XRP)

XRP sits pretty near $3, up 6.5%-a modest poke compared to Ethereum and Solana, those show-off rockets. Apparently, the market hasn’t fully embraced the rate cut fairy tale, so XRP remains a curious creature to watch. Will it soar or slump? Only time and maybe some magic beans will tell.

Looking at the daily chart, the Chaikin Money Flow (CMF) happily pushes higher-perhaps buying the dip? The Relative Strength Index (RSI) hovers around the neutral zone at 49, just waiting for the fireworks. A little above $3.10 could send XRP a sprint towards $3.34, and breaking $3.65 might turn it into a real rally. But beware-it could just as easily tumble below $2.78 into the abyss of forgotten tokens.

#XRPCommunity #SECGov v. #Ripple #XRP-The Second Circuit said, “Dismiss that case, we’re tired.” – James K. Filan (@FilanLaw) August 22, 2025

Meanwhile, the legal victory parade marches on-Ripple’s SEC appeal dismissed, and institutional interest has suddenly awakened like a sleeper agent at a spy convention. Keep your eyes peeled; if the Fed really cuts rates, XRP is ready to take a decisive leap, or so they say. Or maybe not-who’s to judge these days?

Craving more tokens that could change your life? Sign up, or don’t-your financial destiny is probably in some other universe anyway.

Sei (SEI)

Say hello to SEI, the quiet kid on the US blockchain block, building for traders and institutions alike. Somehow, amid all the noise, Ondo Finance decided to launch tokenized treasuries on SEI-because who doesn’t love a good RWA (Real World Assets) story? Demand shot up 6,880% in two years, proving everyone’s favorite game is still “what’s the biggest hype?”

Tokenized treasuries have grown by 6,880% in 2 years. Led by BlackRock & @OndoFinance, this shows massive demand for tokenized assets. Ondo is bringing this rapidly expanding market to Sei, where institutional-grade assets meet sub-second settlement. RWAs Move Faster on Sei.

– Sei (@SeiNetwork) August 21, 2025

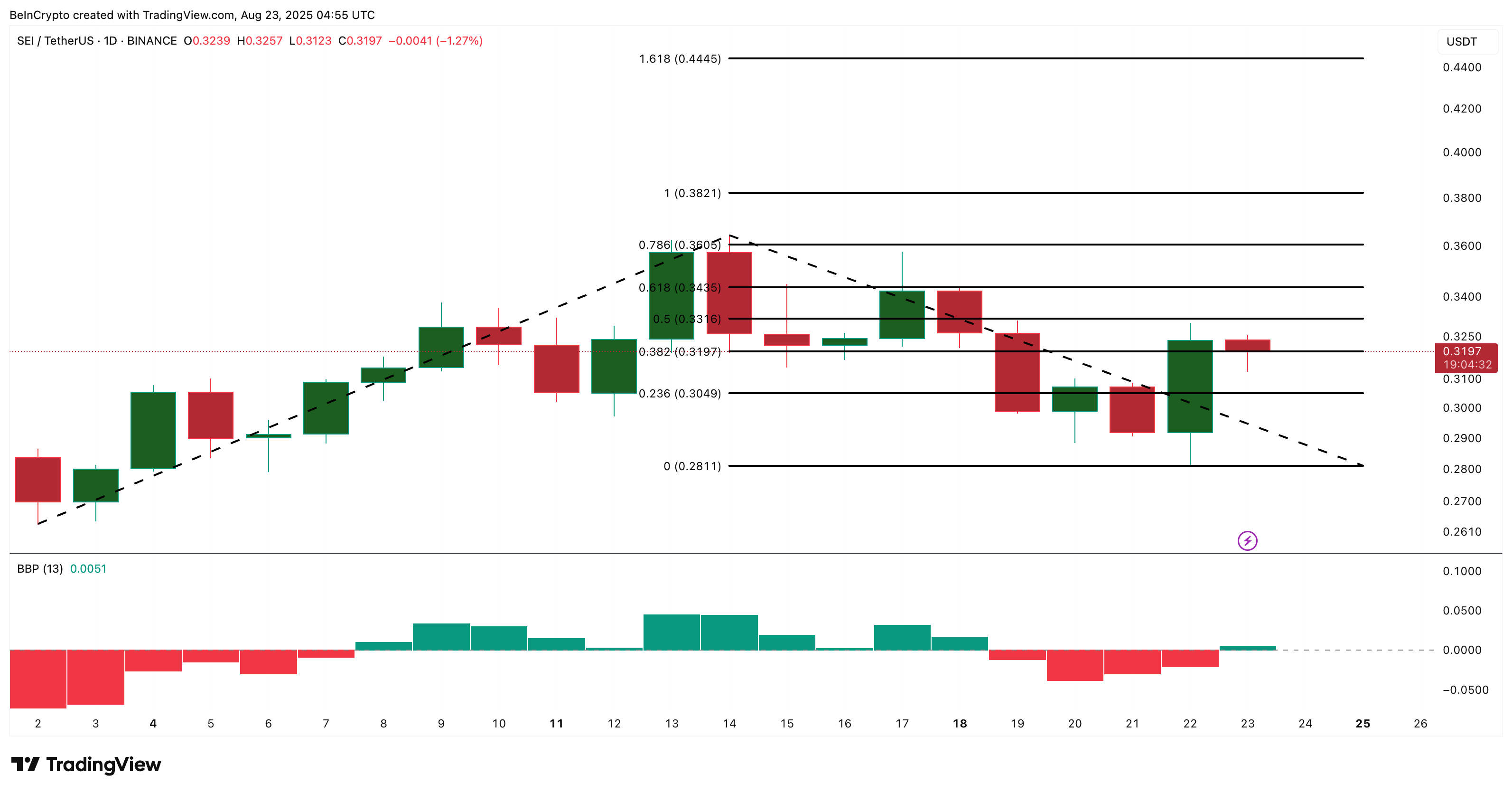

SEI’s recent nearly 10% rally shows the bulls finally got their act together after a bad four-day concert of fading. The green on the bull-bear power indicator signals they’re in control-at least until the bears decide to wake up and throw a tantrum. Resistance at $0.33 to $0.36 might push it all the way to $0.44, if luck and liquidity cooperate. Drop below $0.30, and the dance is over, folks.

Broadly, it’s been a sexy 44% gain in just three months, thanks to an uptrend that’s not ready to lose its lunch. Keep an eye-if September’s dovish rumors turn into reality, expect SEI to turn up the volume.

SKALE (SKL)

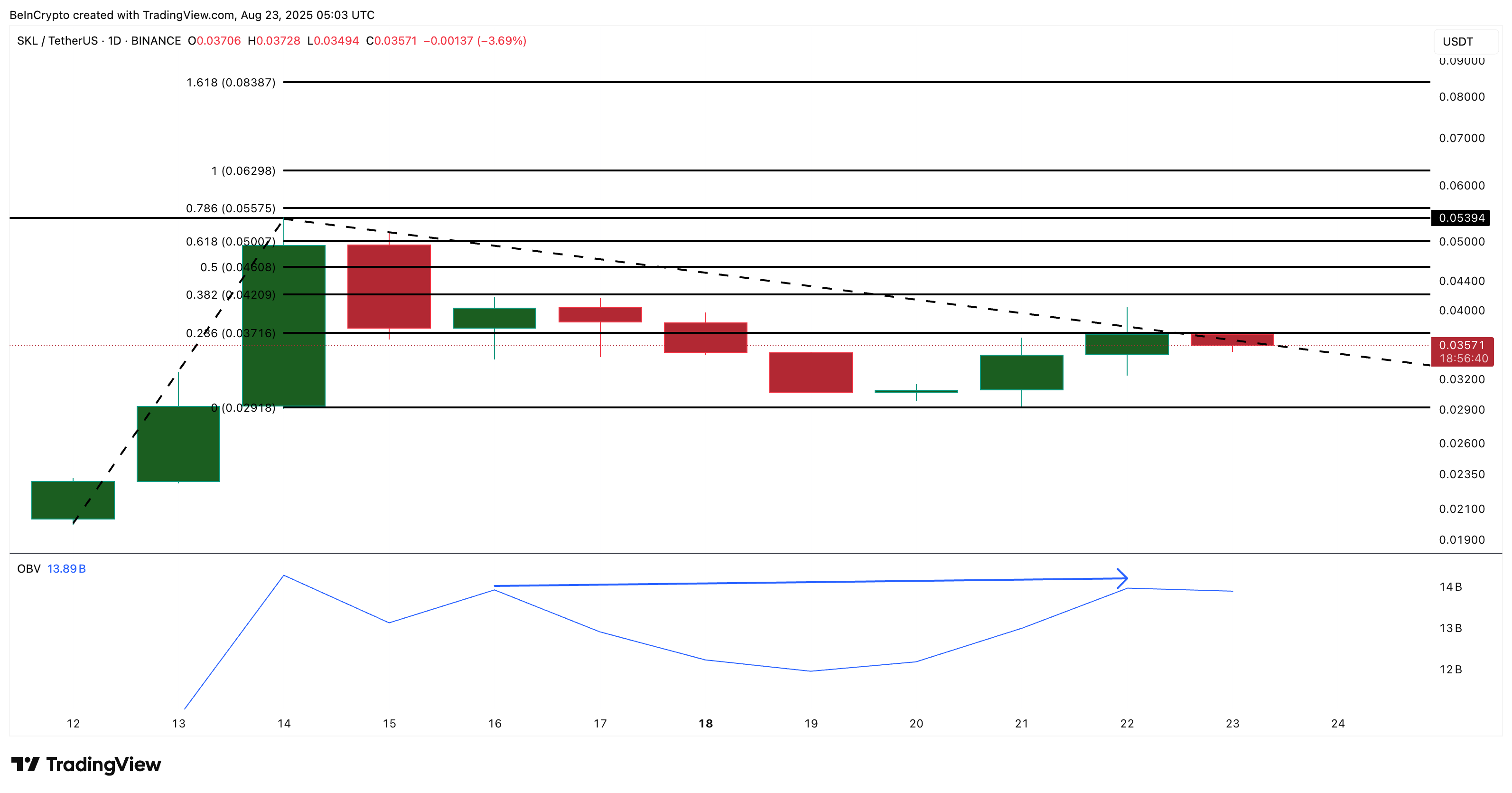

Now, meet SKALE-an Ethereum scaling solution from the US, just quietly flexing in the background. It surged 50% earlier this month, thanks to whales and maybe a secret Google handshake (or just wild speculation). Since then, the price slowed down, but the momentum remains steady at around $0.035, promising more surprises ahead.

On-balance volume isn’t lying either: it crept up from 13.93 billion to nearly 20 billion, even as prices took a little breather. Outflows are steady but easing, which is a lovely way of saying-buying might be quietly sneaking back in. If SKL can crack $0.055 and hold, the next stop is a glorious $0.083, perhaps powered by a fed rate cut or a miracle.

Drop below $0.029, though, and it’s back to square one-with new lows on the horizon. Still, in the grand scheme of things, SKALE’s potential makes it the dark horse of the US-coins race, just waiting for its moment in the spotlight.

So here they are-the relentless trio of USA-made tokens, all dancing on the edge of chaos and opportunity, waiting for September’s rate cuts to either turn them into legends or just another trivia fact.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Who Is the Information Broker in The Sims 4?

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- All Kamurocho Locker Keys in Yakuza Kiwami 3

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-08-23 15:08