On this autumnal Friday, September 19, a curious spectacle unfolds: around 30,000 Bitcoin options contracts, shimmering with the imaginary allure of roughly $3.5 billion, shall gracefully wither into oblivion. It’s a spectacle, one that bears a striking resemblance to its predecessor event from the not-too-distant past week, rendering an impact on the spot markets as negligible as a whisper in a Nabokovian dreamscape. Oh, and let’s not forget – the markets have bloomed anew despite the market’s serene indifference to the Federal Reserve’s ceremonial nod, reducing rates in a rather anticlimactic prelude to this Friday’s minor frolic in the financial pages.

The Byzantine Ballet of Bitcoin Options Expiry

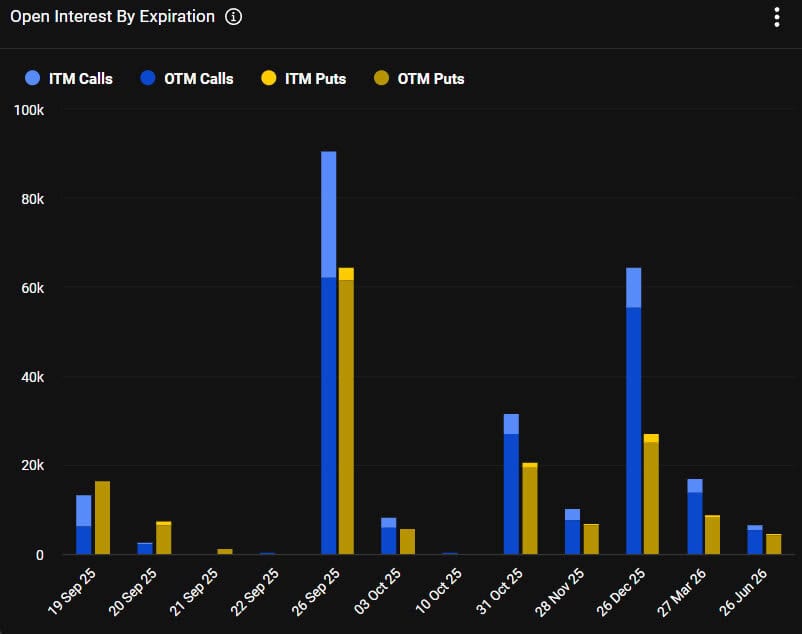

This week’s scroll of Bitcoin options contracts is adorned with a put/call ratio of 1.2, narrating a tale of more short souls departing the stage than those holding their weighted tickets to the future. The air is thick with bearish whispers, much like the morning fog in Saint Petersburg. Now, gaze down upon the grand tapestry of open interest (OI), an intricate weave valued at $140,000, soaring to $2.7 billion on heroic strokes on Deribit. A sumptuous $2.2 billion OI resides at $120,000, while the $95,000 strike price enjoys the notoriety of a darling amongst short sellers, intoxicated by its $2 billion in OI.

A dashing protagonist in this narrative, total Bitcoin futures OI, currently extends its arms to embrace $86 billion, gallantly climbing back towards the dizzying peaks of history, as chronicled by CoinGlass. “Recent actual volatility,” muses Greeks Live, that beacon of crypto clairvoyance, “has surged with the verve of Pnin chasing his elusive skirt, yet actual trading volume, that pragmatic spinner of tales, has fallen disappointingly silent; a discordant symphony of opportunity.”

In today’s cauldron of cryptographic exquisiteness, some 177,500 Ethereum contracts are set to evaporate with the notional poise of $815 million and a put/call balance of 1, adding to the Friday festivities. Together, these digital destinies contribute to a grand notional masquerade worth $4.3 billion, a number as splendidly inconsequential as a butterfly’s wing as it flutters through the global markets.

A Glimpse into the Crypto Market’s Carousel

In the grand carnival of digital assets, total market capitalization takes a modest bow, currently lingering at the precipice of $4.2 trillion, a number so close yet so distant from the heights conquered with youthful audacity since mid-July. Bitcoin, that prima ballerina, pirouetted towards $118,000 in a waltz of late Thursday, dip-danced down to $116,750, and rose phoenix-like to reclaim $117,000 as the Asiad sun graces the horizon. It hovers, a regal 5.6% shy of its crowning glory, with the stalwart pride heralding its progress through September’s unforgiving tides.

Ethereum, the unyielding understudy, retains its composure at the $4,600 threshold, still a modest 7% from its moment of unrivaled triumph. The altcoins frolic amidst the glories of their week, with Hyperlink (HYPE) and Binance Coin (BNB) leaping to the zeniths of history. Chainlink, Avalanche, and Sui play the jubilant jesters today, while the solemn members of the upper echelon remain as unmoved as the dust on Pushkin’s portrait.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

2025-09-19 08:58