Hold onto your hats, folks, because tokenized private credit has just soared to a staggering $15.95 billion! The numbers are flying higher than a kite in a hurricane, but not without a few cracks in the foundation. Could this be the next big thing or a house of cards waiting to tumble? 🤔

Loan Counts Tumble as the Tokenized Credit Market Finds Its Feet

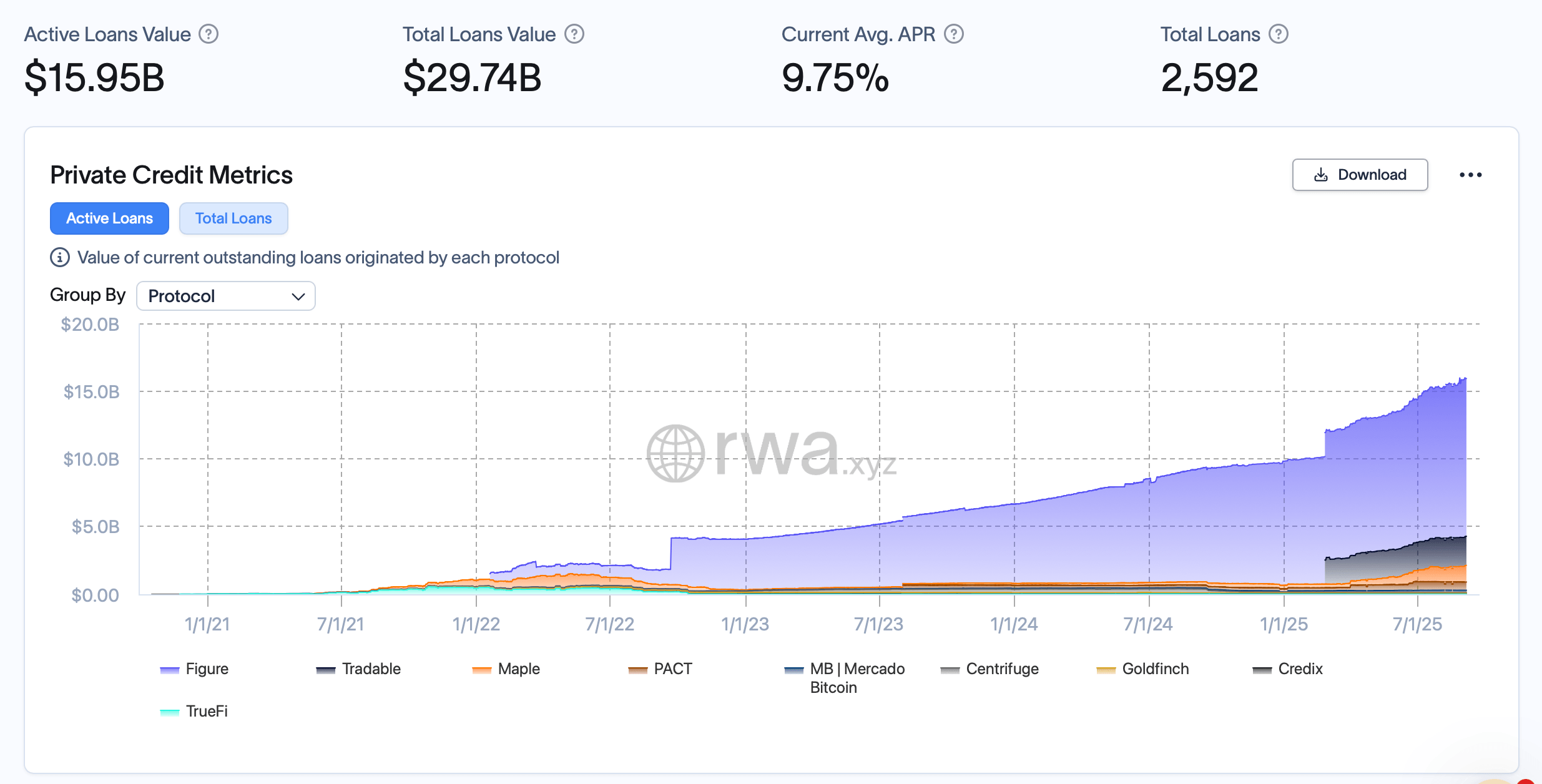

The world of tokenized private credit has been growing faster than a toddler on an espresso binge since mid-June. With a cool $2 billion added to active loans and a cumulative $4.3 billion in lending, things are definitely heating up. As of September 6, rwa.xyz stats reveal active loans have now hit $15.95 billion, while total loans originated are a mighty $29.74 billion across 2,592 onchain loans. In a surprising turn of events, the average annual percentage rate (APR) has slipped from a slightly saucy 10.33% to a more sedate 9.75%, implying that lenders might be shifting to safer bets-or just offering a discount. 🙄

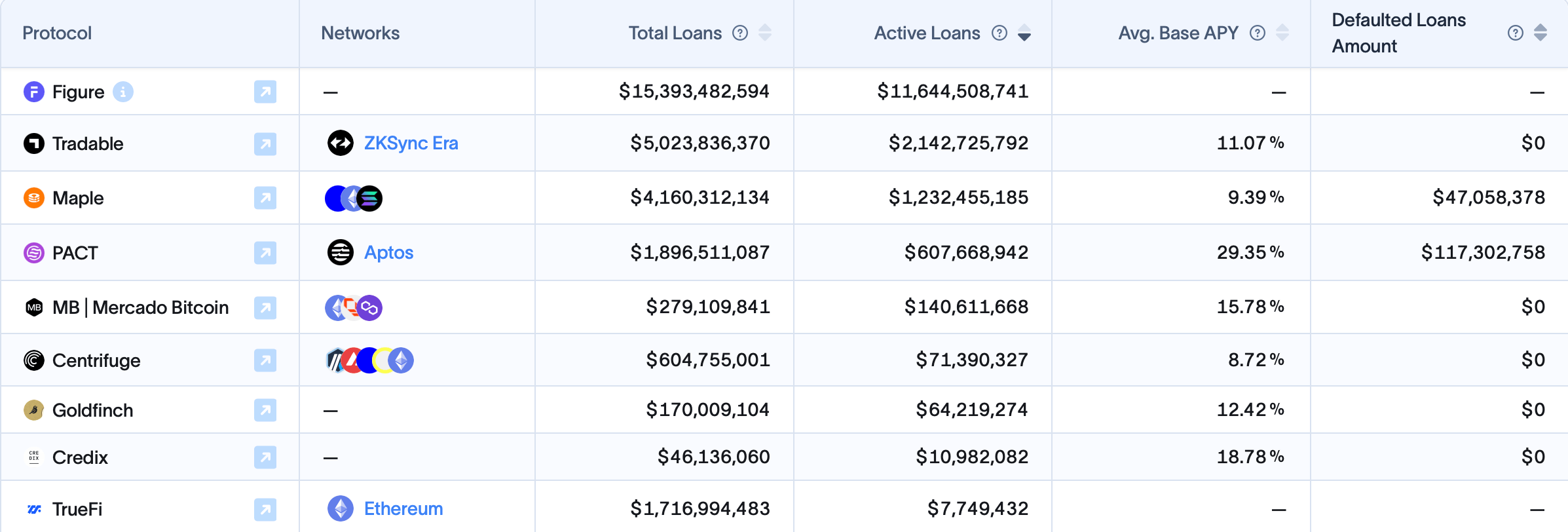

It’s not all sunshine and rainbows, though. Loan numbers have dipped from 2,665 to 2,592, suggesting that while deals are getting bigger, the quantity of loans is shrinking faster than a soufflé in a draft. Figure, the reigning champion of protocols, still holds the lion’s share with $11.64 billion in active loans, dominating the market like a heavyweight champ. Tradable, meanwhile, built on the Zksync Era, is making waves with $2.14 billion in active loans, out of over $5 billion in originations. 🍿

Maple is still growing, with $1.23 billion in active loans and $4.16 billion total, but it’s not all smooth sailing as they face a cool $47 million in defaults. Ouch! PACT, which operates on Aptos, is strutting its stuff with a jaw-dropping 29.35% average base APY, but it’s also carrying the largest default total at $117 million. Credix and Centrifuge are the silver lining, showing growth without any defaults, while Goldfinch is keeping it steady with $64 million in active loans and a modest 12.42% APY. 💸

It seems like the game isn’t just about how much money you can throw around, but also about how well you can manage risk. While defaults are still fairly isolated to Maple and PACT, these guys are big enough to make us all take note. Credit vetting is becoming the name of the game as decentralized finance (DeFi) platforms dip their toes deeper into the real-world lending pool. 🌍

The big takeaway here? Tokenized credit is on the rise, and it’s picking up speed faster than a kid on a sugar rush. Active loans have surged by more than 14% since June, and with APRs taking a downward dive, it looks like the protocols are starting to mature. The future of institutional-style lending is here, and it’s all happening on-chain. Time to grab your popcorn, folks. 🍿

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Mewgenics Tink Guide (All Upgrades and Rewards)

2025-09-07 01:28