In the past 24 hours, Toncoin (TON) has experienced a substantial increase in high-value transactions, suggesting increased activity among large investors, even as the overall crypto market faces a sell-off worth $482 million. Data from the blockchain indicates that there’s been an uptick in TON transactions valued above $100,000, hinting at these big investors either buying more or rearranging their Toncoin holdings.

As an analyst, I observed a continuation of the sell-off from the previous session in the cryptocurrency market, which extended into Thursday. According to data from CoinGlass, a significant $482 million worth of crypto positions were liquidated over the last 24 hours, demonstrating the widespread selling pressure impacting most digital assets.

For three days straight, Bitcoin dipped, losing approximately 2.26% over the past 24 hours. Notably, most significant cryptocurrencies experienced a similar decline. Dogecoin dropped by about 3.83%, while Cardano (ADA) saw a more substantial decrease of 6.83%.

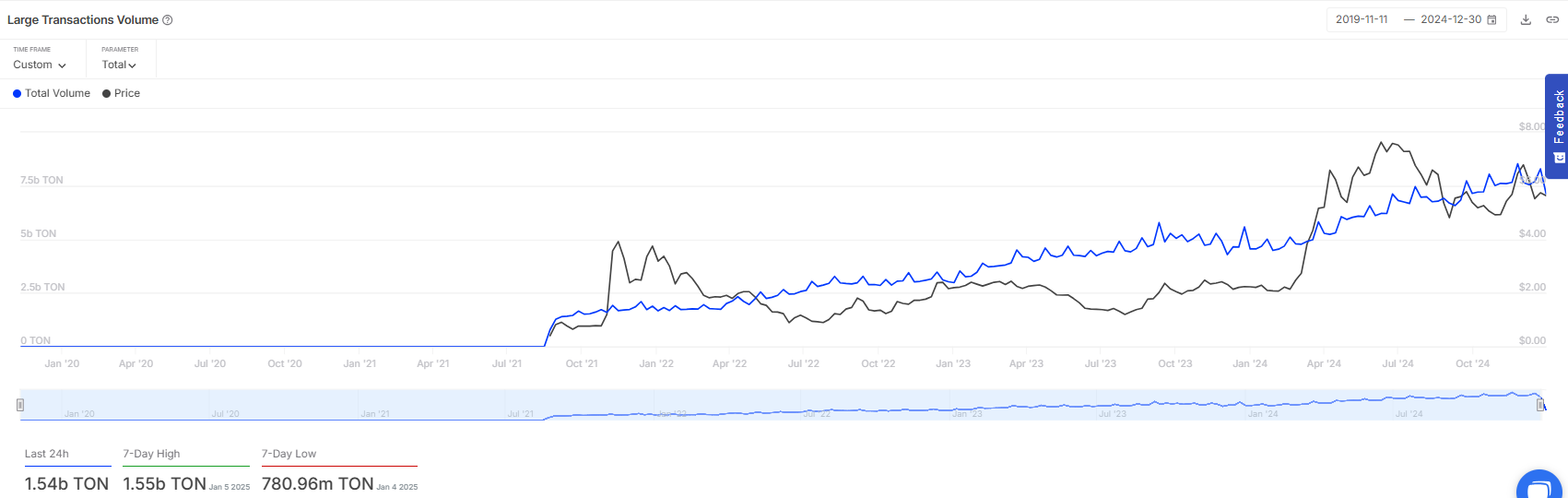

In recent times, Toncoin has experienced a significant rise in high-value transactions. As per IntoTheBlock’s data, these transactions amount to approximately $8.21 billion or 1.54 trillion TON, indicating a notable jump of 94% within the past day. A spike in large transaction volumes often points towards heightened activity among ‘whales’, suggesting either increased buying or selling.

Currently, TON is demonstrating early indications of a recovery, having increased by 0.09% over the last day, but decreased by 7.49% over the previous week.

Inflation concerns stoke market sell-off

The downward trend in the cryptocurrency market continued following the release of the Federal Reserve’s minutes from their December meeting, held on Wednesday. During the discussion, Federal officials indicated a potential reduction in the speed of interest rate decreases in 2021, causing unease among investors about potential inflation.

Most of the attendees concluded that the chances of higher inflation were more likely than before, based on unexpectedly robust inflation data and anticipated impacts from alterations in trade and immigration policies,” as per the meeting records.

This week, a large amount of employment-related information has been disclosed, and investors are anxiously looking forward to the nonfarm payrolls update due this coming Friday. This report is one of the crucial remaining economic indicators that will be made public before the Federal Reserve’s gathering at the end of January.

Read More

- REPO: How To Fix Client Timeout

- UNLOCK ALL MINECRAFT LAUNCHER SKILLS

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- 10 Characters You Won’t Believe Are Coming Back in the Next God of War

- 8 Best Souls-Like Games With Co-op

- Top 8 UFC 5 Perks Every Fighter Should Use

- All Balatro Cheats (Developer Debug Menu)

- Unlock Wild Cookie Makeovers with Shroomie Shenanigans Event Guide in Cookie Run: Kingdom!

- How to Reach 80,000M in Dead Rails

- BTC PREDICTION. BTC cryptocurrency

2025-01-09 15:22