TON‘s Wild Ride: How a Steep Fall Became a Chaotic Rollercoaster 🛤️📉

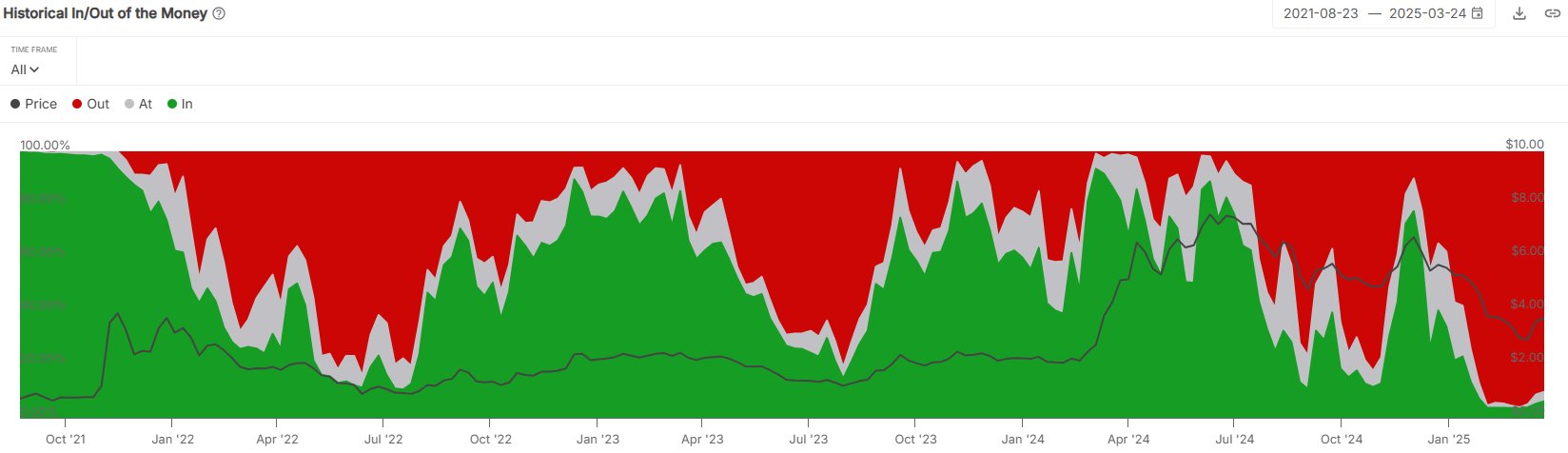

- Number of TON holders at a loss slightly eased from 100% to 90% after March’s recovery

- Several catalysts like Bitcoin’s rebound, Grok integration, and VC backing boosted TON’s recovery

Ah, Toncoin [TON], the native token of The Open Network, where fortunes plunge faster than a bankers’ wig in a Moscow sleigh race. March was a brief respite—a toast-worthy fluke—where losses eased, however marginally.

Let us set the stage: after hitting a delirious high above $7 last December, TON dove to $2.3 by mid-March—67% gone, just like your neighbor’s chicken at a village potluck. Into The Block reports suggest all holders collectively wept into their empty wallets, but alas, a 72% jump gave them just enough hope not to sell… yet.

“Its (TON) steady upswing now has roughly 10% of holders back in profit.”

TON’s Recovery Catalysts

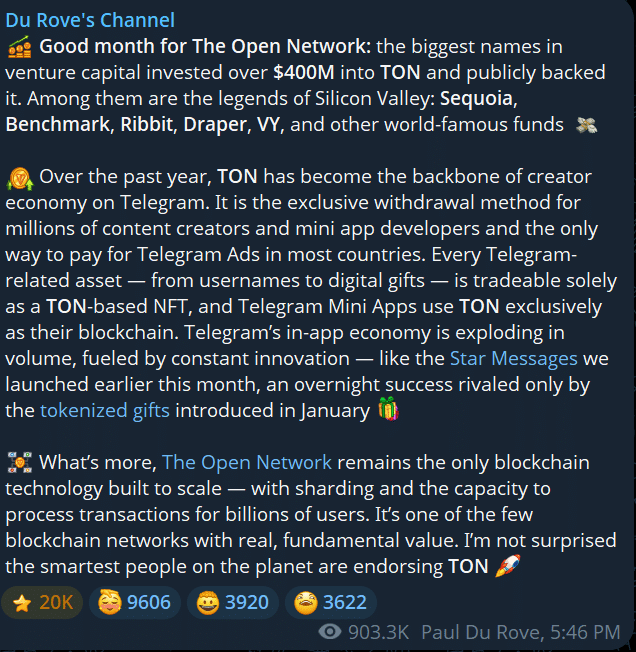

Picture this: Bitcoin strutted its way to $88k from $78k in March, lifting the mood in crypto land. Like a clever student copying its classmate, TON followed suit with a 60% climb. But wait! There’s more—TON wasn’t content stopping there. Enter Grok AI’s integration and another hefty cash infusion from Silicon Valley VCs. If TON were a gentleman, it’d be tipping its hat to them.

Even good ol’ Pavel Durov, the Telegram overlord, came out swinging with a $400M funding announcement. Confidence overflowed like warm vodka at a wedding banquet.

The euphoria wasn’t purely symbolic; 1.1 million TON tokens fled from exchanges as though fleeing a fire sale. Does this renewed accumulation mean people actually believe TON won’t wobble again? Only time—and possibly a court jester—can tell.

And yet, the crypto gods, like a cunning landlord, giveth and taketh away. BTC fell after a hot U.S. inflation report, dragging TON down by 10% faster than you could say “borsch.” From $4 back to $3.6, TON began plotting its next misstep—or recovery. Over 90% of holders remain in the red, perhaps waiting patiently for the smallest possible chance to break even. What admirable optimism! Or is that delusion? You decide.

The price charts show a somewhat poetic return to February’s dreary range of $3.5 to $4. Bulls may dream of hitting $5 (also a 200DMA), but dreams in Toncoin land are often cruel, fleeting specters.

But! (Always another “but!”) Should the winds of crypto take a sinister turn—don’t they always?—a Q2 sell-off could shove TON below $3.5, possibly down to $3.0 or $2.5. Who knows? Perhaps some courageous investors will hold on past reason, dreaming of Bitcoin’s next unpredictable move to save them.

Here’s a suggestion for these dreamers: why not track Bitcoin and macro updates like fortune-tellers reading tea leaves? It’s probably just as scientific. Or so one might hope. 😊

Read More

- Delta Force: K437 Guide (Best Build & How to Unlock)

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Slormancer Huntress: God-Tier Builds REVEALED!

- Tainted Grail: The Fall of Avalon – Everything You Need to Know

- AI16Z PREDICTION. AI16Z cryptocurrency

- Invincible’s Strongest Female Characters

- How to Unlock the Mines in Cookie Run: Kingdom

- Nine Sols: 6 Best Jin Farming Methods

- REPO’s Cart Cannon: Prepare for Mayhem!

2025-03-29 16:10