After a dazzling 75% sprint up the financial catwalk, SUI finds itself doing what every fashionable asset must eventually do: stare, glassy-eyed, into the abyss of resistance. The bull run, though impressive enough to earn a standing ovation from the most jaded of spectators, now appears to be pausing for a gin and tonic, while technical indicators clutch their pearls and whisper of an impending interval.

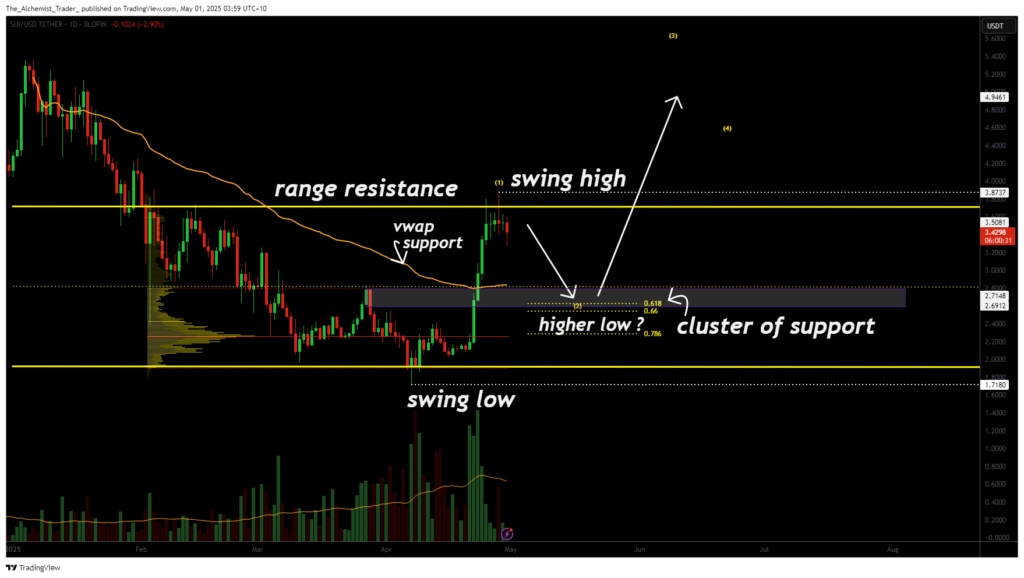

SUI’s recent price action has been the very embodiment of impulsiveness—one imagines the coin has just inherited a family fortune and embarked upon a continental tour. Yet now, as it encounters an unforgiving resistance zone (conveniently draped in the latest Fibonacci 0.618 pattern and crowned with a range high), its bravado falters.

This resistance, we should note, is no passing fancy. It was once the robust ceiling against which many a bullish aspiration was dashed. The recent failure to break it reads like a classic swing-failure pattern (SFP)—or “Icarus Moments,” as dear Aunt Agatha might sigh. Thus, a pullback of the short-term, possibly even decorous, variety threatens to unfold, as part of the broader—and naturally, ever-hopeful—trend continuation. 🗺️

Key technical observations from the smoking room:

- Major Resistance: The dreadful confluence of the 0.618 Fibonacci retracement and a range high—truly a double-breasted waistcoat of doom.

- Support Levels to Watch: $2.70 to $2.40, where the range mid and VWAP support region lounge about, pretending not to care but secretly longing for attention.

- Trend Structure: A possible “wave 3 expansion” looms after the corrective dance has played itself out, no doubt to much applause from technical analysts (and total befuddlement among the uninitiated).

Should a pullback parade itself upon the stage, rest assured it would be just the sort of “healthy correction” the Victorians might have prescribed for an overenthusiastic debutante. A higher low could form at the VWAP support, the range mid, or wherever the 0.618 retracement deigns to lend its support—these are the coveted launchpads for the next expansion, whose arrival is no more certain than the next train at Paddington.

We enter now a period of market “balance,” or as the more cynical among us might call it, a tiresome tug-of-war between buyers and sellers, conducted around a few battered price levels. This sort of indecision, one learns from bitter experience, often heralds a proper burst of volatility. The wise trader will monitor volume spikes with the anxious vigilance of an under-butler awaiting the arrival of Lady Malvern.

Despite SUI’s recent bravado, a tapering volume suggests that the crowd is, for the time being, off at luncheon. Consolidation, correction, existential malaise—the price now dawdles between $2.70 and $2.40, pending a decisive exit only volume might provide.

And what fresh antics might we expect next?

For the moment, the judicious trader does well to exercise that rarest of qualities: patience. The nature of the pending pullback—if it chooses to bless us with an appearance—will provide all the clues necessary for wagering on the next act. Should price break and hold above the swing high, the pullback thesis is unceremoniously thrown out the window. If, however, support proves alluring enough for a respectable bounce, the stage is set for further bullish hijinks. 💃📈

Read More

- Invincible’s Strongest Female Characters

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Gold Rate Forecast

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- How to Reach 80,000M in Dead Rails

2025-04-30 22:44