As a seasoned crypto investor with battle-scarred fingers from navigating the tumultuous waters of the digital asset market, I find myself cautiously observing the recent surge in Tron (TRX). The rapid increase in TRX’s Sharpe Ratio, as depicted by the chart, has flashed a red alert that I can’t ignore. Historically, such a high-risk zone has proven to be bearish for TRX’s value, and although the current level is lower than some of the past tops, it’s hard not to feel a pang of déjà vu.

The data indicates a significant surge in the Tron Sharp Ratio, which historically has led to a decline in TRX’s value.

Sharpe Ratio Could Imply Tron Is Overheated Now

According to a recent analysis in a CryptoQuant Quicktake post, the 180-day Tron Sharp Ratio is currently signaling a warning due to elevated risks compared to its returns. Essentially, the Sharp Ratio in this context measures an asset’s performance against the level of risk it involves.

The value of this metric is determined by subtracting the risk-free rate of return from the anticipated return of the asset, then dividing the result by its volatility. Essentially, this measurement indicates whether the potential gains of the commodity outweigh the risks associated with it.

Here’s a chart presented by our analyst, demonstrating the development of the 180-day Sharpe Ratio for Tron during the past couple of years:

According to the graph, the 180-day Tron Sharp Ratio has experienced a significant surge lately and now stands at levels that traditionally correspond to higher risk, often referred to as the ‘red’ zone.

In the provided graph, the expert has pointed out occasions where the measure exceeded a particular threshold in recent years. It seems that TRX often reaches its maximum when the value of the indicator increases significantly.

Tron finds itself back in a potentially volatile area, yet the analyst predicts that the coin might not reach its peak right away because the indicator’s current reading is lower compared to some past peaks. However, the analyst advises caution, stressing this point.

Although TRX might temporarily rise, keeping investments in such high-risk areas may not be beneficial in the long run. The chance of a significant drop increases, which could limit potential profits and make it unwise to employ long-term investment strategies here.

The future direction of cryptocurrency prices is uncertain, given the pattern observed in its 6-month Sharpe Ratio.

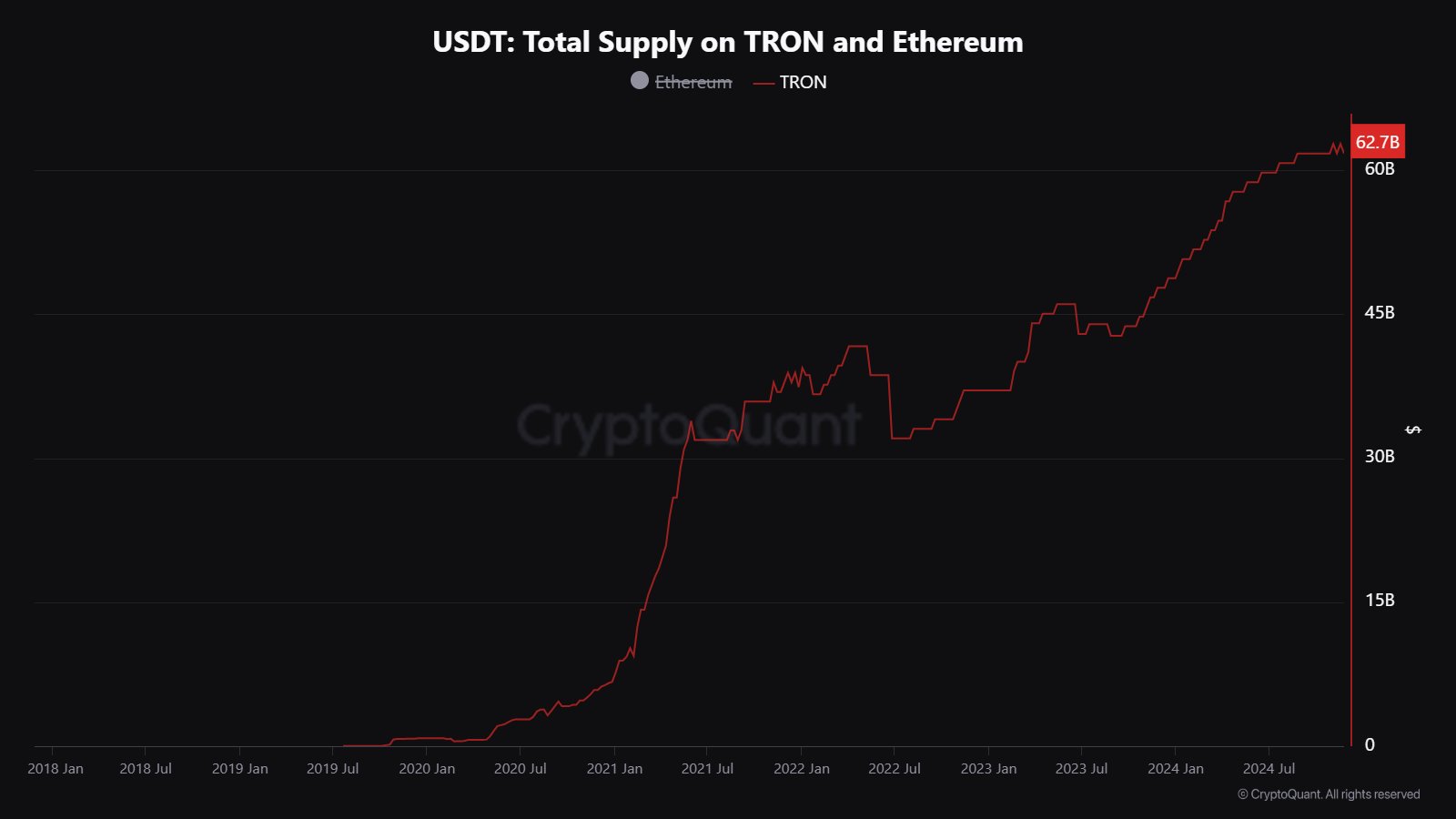

Additionally, it’s worth noting that there’s been a significant increase in the availability of Tether’s stablecoin, USDT, on the Tron network. This observation was made by the analyst Maartunn from the CryptoQuant community in a recent posting.

The USDT supply on Tron has gone from $47.75 billion to $65.7 billion over the past year, representing an increase of more than 37%. This rise naturally shows how interest in using the stablecoin has increased on the network.

TRX Price

A few days back, Tron managed to breach the $22 mark, however, its upward push seems to have slowed down lately, with the price hovering near $20.

Read More

- March 2025 PS Plus Dream Lineup: Hogwarts Legacy, Assassin’s Creed Mirage, Atomic Heart & More!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- 8 Best Souls-Like Games With Co-op

- Top 5 Swords in Kingdom Come Deliverance 2

- Reverse: 1999 – Don’t Miss These Rare Character Banners and Future Upcoming Updates!

- EUR AUD PREDICTION

- USD DKK PREDICTION

- Unlock the Secret of Dylan and Corey’s Love Lock in Lost Records: Bloom & Rage

- How to Use Keys in A Game About Digging A Hole

2024-11-29 19:42