In the vast and labyrinthine realm of decentralized finance, where the shadows of avarice and deceit loom large, a drama unfolds-a drama so absurd, so laden with irony, that one might mistake it for the farcical musings of a madman. World Liberty Financial (WLFI), a project draped in the garish trappings of the Trump brand, finds itself at the center of a tempest, accused of a sin as old as time itself: the slow, methodical extraction of value from the unsuspecting masses.

A prominent trader, known by the moniker DeFi^2 (@DeFiSquared), who boasts of his prowess as the #1 ranked trader on Bybit in the years 2023 and 2024, has taken to the digital pulpit to decry what he perceives as a grave injustice. With a tone both sardonic and indignant, he proclaims, “I bring to light an alarming governance vote by World Liberty Fi this month, which appears to be the opening salvo in a slow, deliberate extraction of value from WLFI holders by the team.”

A Vote Rigged in the Shadows

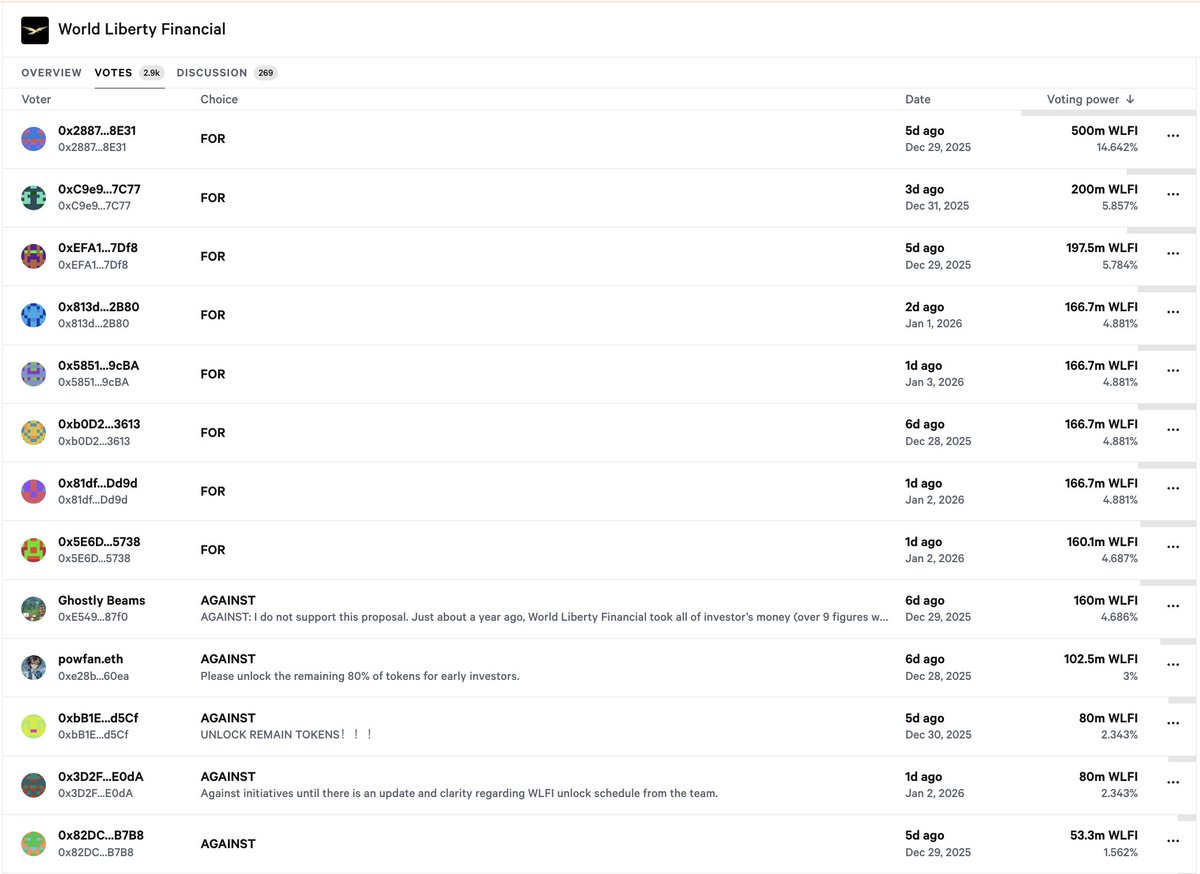

In his missive, DeFiSquared paints a picture of a vote so transparently rigged that it borders on the comical. “Behold,” he writes, “a vote where the majority of top voters are, by the very maps of Bubble, revealed to be team wallets or strategic partner wallets. A stark contrast to the real voters, who, like pawns in a grand game, remain locked out of their WLFI tokens since the TGE, unable to cast their votes until the team deigns to allow it.”

The proposal in question, dubbed the “USD1 growth proposal,” appears innocuous at first glance. Yet, DeFiSquared argues, it is the sequencing of governance that betrays the true intent. “Why,” he asks with a rhetorical flourish, “would the team go to such lengths to force this vote through, rather than addressing the token unlock that the majority of holders so desperately seek?”

The economics of WLFI, he claims, are the linchpin of this tale of woe. “WLFI holders,” he asserts, “are entitled to no protocol revenue whatsoever. The so-called ‘Gold Paper’ dictates that 75% of protocol revenue flows into the coffers of the Trump family, while the remaining 25% is apportioned to the Witkoff family.” In his view, this creates a perverse incentive, a grotesque charade where the team forces a vote to sell WLFI tokens at the expense of locked holders, all to fund a revenue stream that benefits none but themselves.

The vote, he alleges, was manipulated in its final hours. “It was failing,” he writes, “until the team and their partners, with a flourish of arrogance, forced it through.” He adds, with a touch of scorn, “The team holds 33.5% of all tokens, strategic partners another 5.85%, while the public sale was allotted a mere 20%.”

Post-vote, he points to on-chain flows as evidence of the team’s malfeasance, citing transfers such as the movement of 500 million WLFI tokens to Jump Trading, while investor allocations remain locked in a digital purgatory.

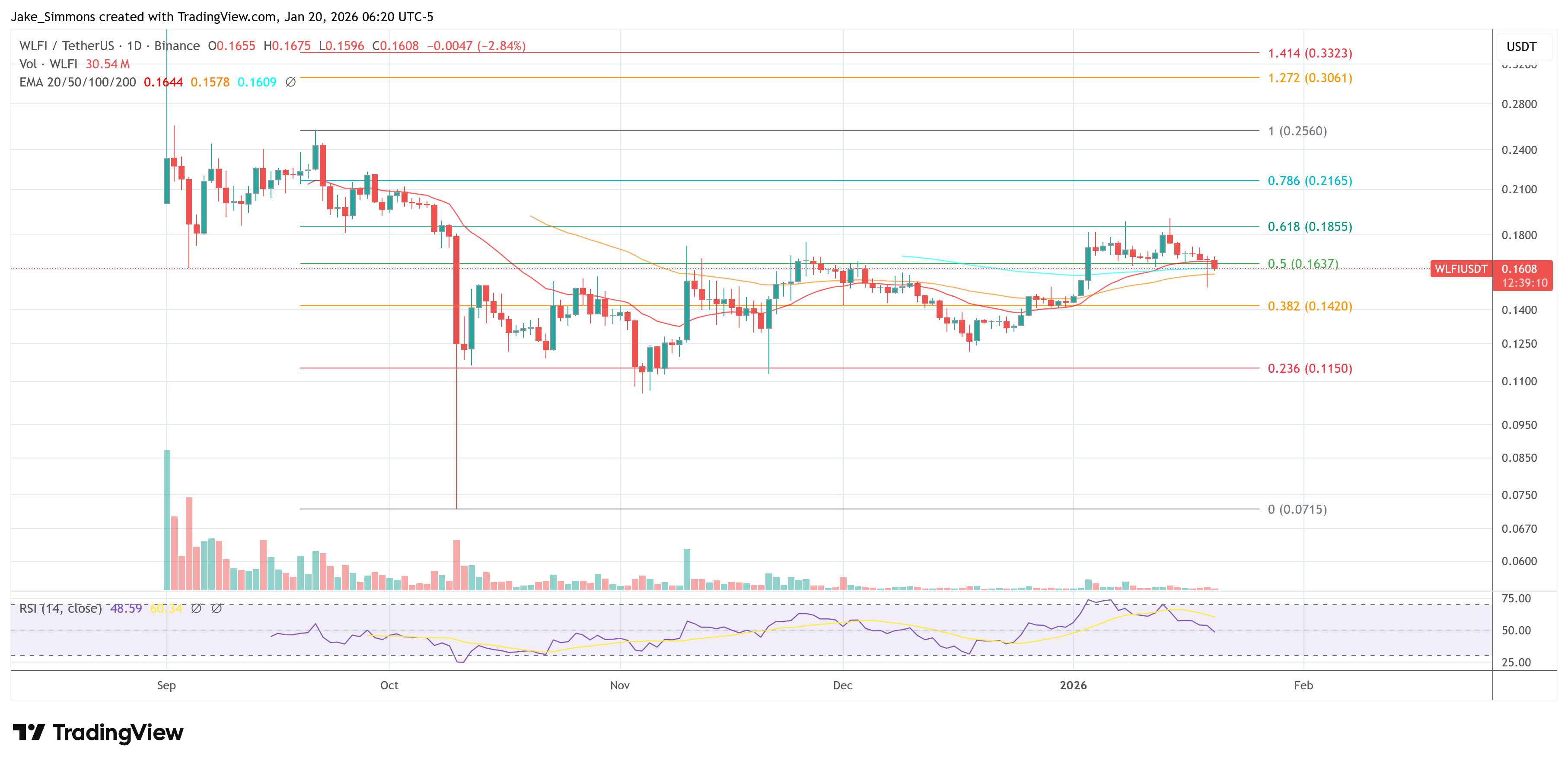

In closing, DeFiSquared offers a valuation that is as damning as it is humorous. “It is difficult,” he muses, “to discern the intrinsic value of a 17 billion dollar token that offers no real governance power, no revenue share, and is subject to the whims of a team intent on selling for their own benefit.” He reveals that he has shorted WLFI “on and off since pre-market prices above $0.34,” and predicts continued downside due to dilution, intentional extraction, and “other factors related to Trump’s final term in office.”

At the time of writing, WLFI trades at $0.1608, a price that, in the grand scheme of this farce, seems almost fitting.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- How to Unlock & Upgrade Hobbies in Heartopia

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Borderlands 4 Still Has One Ace Up Its Sleeve Left to Play Before It Launches

2026-01-20 17:56