Oh, the tragic ballet of Bitcoin! A celestial body once soaring at $123,200 now pirouetted downward, its luster dulled by the clammy hands of tariffs and the melancholic sighs of economists. The markets, those fickle muses, recoiled like a startled octopus, ink-blotted by weak jobs data and the specter of 15% tariffs—Trump’s economic haiku.

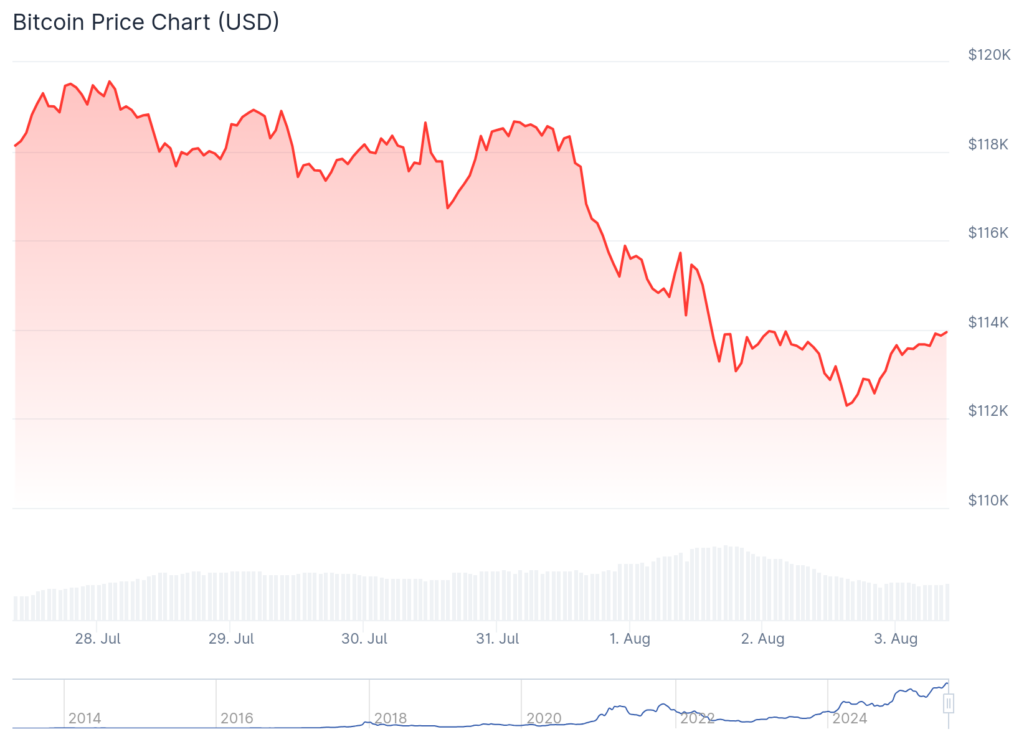

At last glance, Bitcoin lingered near $114,000, a 3.5% decline over seven days. A mere shadow of its former self, yet still a glittering enigma. Behold the evidence:

a duet of despair 🎻💣

Tariffs and Fired Encores 🎭

Enter Trump, maestro of chaos, imposing 15% tariffs on imports—a fiscal firework show with unintended consequences. The jobs report arrived like a funeral telegram: 73,000 new jobs, a third of expectations. The BLS revised past numbers downward, revealing a meager 35,000 jobs added—since 2020, no less! Trump, ever the showman, dismissed BLS commissioner Erika McEntarfer. A move William Beach, his predecessor, decried as “a dangerous precedent,” as if statistics were stage props in a political farce.

Technical Theater: Bitcoin’s Chart as Omen 🎩

Observe the daily chart—a canvas of drama! Bitcoin’s peak at $123,200 crumbled to $112,000, a level once the pinnacle of May’s euphoria. This break-and-retest pattern, a sly conspirator in the market’s masquerade, whispers of a potential rebound. Should BTC cling above $112,000, the 50-day moving average beckons like a siren. A breach below? The 100-day average at $107,890 awaits—a safety net woven by time itself.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Who Is the Information Broker in The Sims 4?

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- All Kamurocho Locker Keys in Yakuza Kiwami 3

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-08-03 16:39