In a brisk little episode that would have suited a satirical column in a once fashionable newspaper, two alleged Polymarket insiders now find themselves under arrest in Israel: a reservist of the IDF and a civilian, charged with turning state secrets into speculative currency on a crypto forecast market.

As the joint proclamation from the Israel Police, Shin Bet, and the Ministry of Defense makes clear, the reservist plucked non-public operational intelligence from his military duties and passed it along to his civilian colleague, who then committed trades on Polymarket markets tied to Israeli military actions.

Authorities reckon the venture yielded around $150,000 in profits. The markets themselves were not disclosed in full, but local whisperings suggest they bore upon the timing of Israeli operations during the June 2025 encounter with Iran.

Significant chance Israel made these very public arrests because they got the green light from Trump yesterday and they don’t want these dumbasses tipping off Iran with their bets 😭😭😭

– Mel (@Villgecrazylady) February 12, 2026

DISCOVER: Best Solana Meme Coins By Market Cap 2026

Insider Trading On Prediction Markets

The case casts a sharp light on a tension within the crypto world. Prediction platforms are decentralised and operate across borders, yet traders remain subject to local laws, especially when matters of national security are at stake.

Geopolitical markets have become among the most liquid on Polymarket, moving with a velocity that would make a Venetian gondolier blush. They price in real-time expectations, which is grand until one discovers that speed can tempt insiders to crook the rules with state secrets as their briefcases.

Platforms such as Polymarket have surged in popularity, recently embracing native USDC support to streamline betting infrastructure.

While prediction markets are often used for sports or crypto, the spectacle here concerns markets with sovereign heft. In this instance, the ability to wager on specific dates of military action created a direct incentive to misuse confidential information.

EXPLORE: What is the Next Crypto to Explode in 2026?

Role of Lahav 433 and Shin Bet In The Arrest Of the Two Polymarket Insiders

The inquiry was conducted by the Israel Defense Forces, the Shin Bet internal security service, and the Lahav 433 unit of the Israel Police. A joint statement indicates the reservist accessed classified documents to inform the civilian conspirator, who then executed the trades.

Reports suggest the betting account wagered tens of thousands on markets such as “Israel strike on Iran,” yielding more than $150,000 in profits. Prosecutors intend indictments for aggravated espionage, bribery, and obstruction of justice.

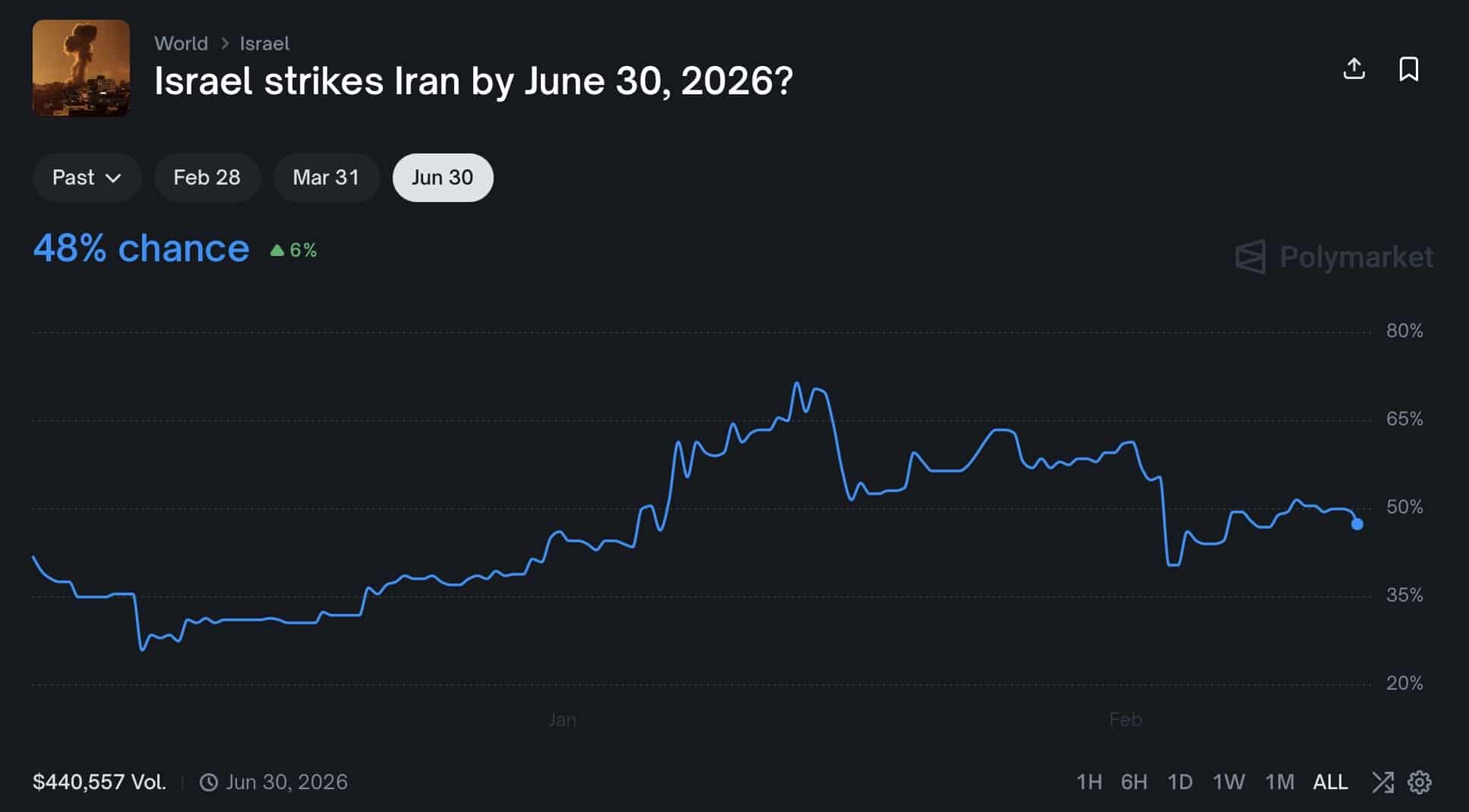

Investigators say the wagers were not isolated: traders placed multiple bets on outcome contracts about when Israel would strike Iran. People are plainly still betting on the possibility of an attack, such as one projected for June 30, 2026.

Israel strikes Iran by June 30, 2026? Source: PolyMarket

The Ministry of Defense underscored the gravity of the breach in a formal statement:

“The use of classified information for financial gain poses a real security risk to IDF operations and national security.”

DISCOVER: 10 New Upcoming Binance Listings to Watch in February 2026

Crypto Legal Precedents

This case may set a precedent for how crypto and decentralised ledgers intersect with state jurisdiction. While the protocol itself remains decentralised, the actors are still subject to local laws concerning espionage and financial fraud. The story unfolds as prediction markets continue their global regulatory dance, with Polymarket currently entangled in litigation to block a sports prediction ban in Massachusetts.

Appears to be the first arrests related to insider trading on Polymarket. One user made $150k last year on Polymarket trading on the war between Israel and Iran.

– Nick Cleveland-Stout (@nick_clevelands) February 12, 2026

The incident furnishes fuel for those who argue that prediction markets could tempt corruption or leaks of sensitive information. Yet the sector persists in growing, with rivals like Hyperliquid offering competing outcome contracts, suggesting the industry will endure even as state authorities sharpen their forensic talons.

Read More

- EUR USD PREDICTION

- TRX PREDICTION. TRX cryptocurrency

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Xbox Game Pass September Wave 1 Revealed

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2026-02-13 19:04