In the crucible of Russia’s invasion, Ukraine has turned to cryptocurrency as a financial lifeline, much like a peasant clutching a rusted spade while the aristocrats burn their libraries. These digital coins, cold and unyielding as winter, have become the silent companions of a nation’s survival. They bypass broken banks, ferrying funds like clandestine messengers, while global donors, with the enthusiasm of a child buying a balloon at a fair, send money for wartime needs. One might say: what war cannot destroy, crypto will monetize. 💰

Ukraine’s embrace of crypto is a case study in desperation, a symphony of chaos and innovation. When traditional systems crumble, as they often do in the hands of men, digital assets rise like ghosts from the rubble. It is a story of human ingenuity, but also of the absurd-where a Bitcoin transaction costs more than a loaf of bread, yet feels like salvation. 🤷♂️

Read on, dear reader, to discover how this crypto surge might enrich your own coffers. Or, perhaps, not. The market is a fickle lover. 🚀

Ukraine and Nigeria Become Heavy Crypto Users

Ukraine and Nigeria now stand among the world’s top ten crypto adopters, with Turkey trailing like a dog chasing its tail. A report from the EBRD, that paragon of bureaucratic wisdom, reveals the curious dance of crypto activity across these nations. In Ukraine, transactions range from $1-10M, the stuff of oligarchs and war chests; in Nigeria, smaller sums hum like the buzz of a mosquito. One wonders if the gods of finance will bless them all equally. 🙌

Nigeria, meanwhile, thrives on retail transactions, with 13% under $1K. Turkey’s obsession with stablecoins has turned 4% of its GDP into a crypto casino. One might say: when the real economy fails, the virtual one becomes a playground for the desperate and the delusional. 🎰

As SEC Chairman Paul Atkins proclaimed, “An invasion of armies can be resisted, but not an idea whose time has come.” One might add: nor can it resist the greed of a man in a tuxedo. 🕺

But which cryptos to buy? Here are our picks, chosen with the wisdom of a man who once bet his last ruble on a horse named “Destiny.” 🐴

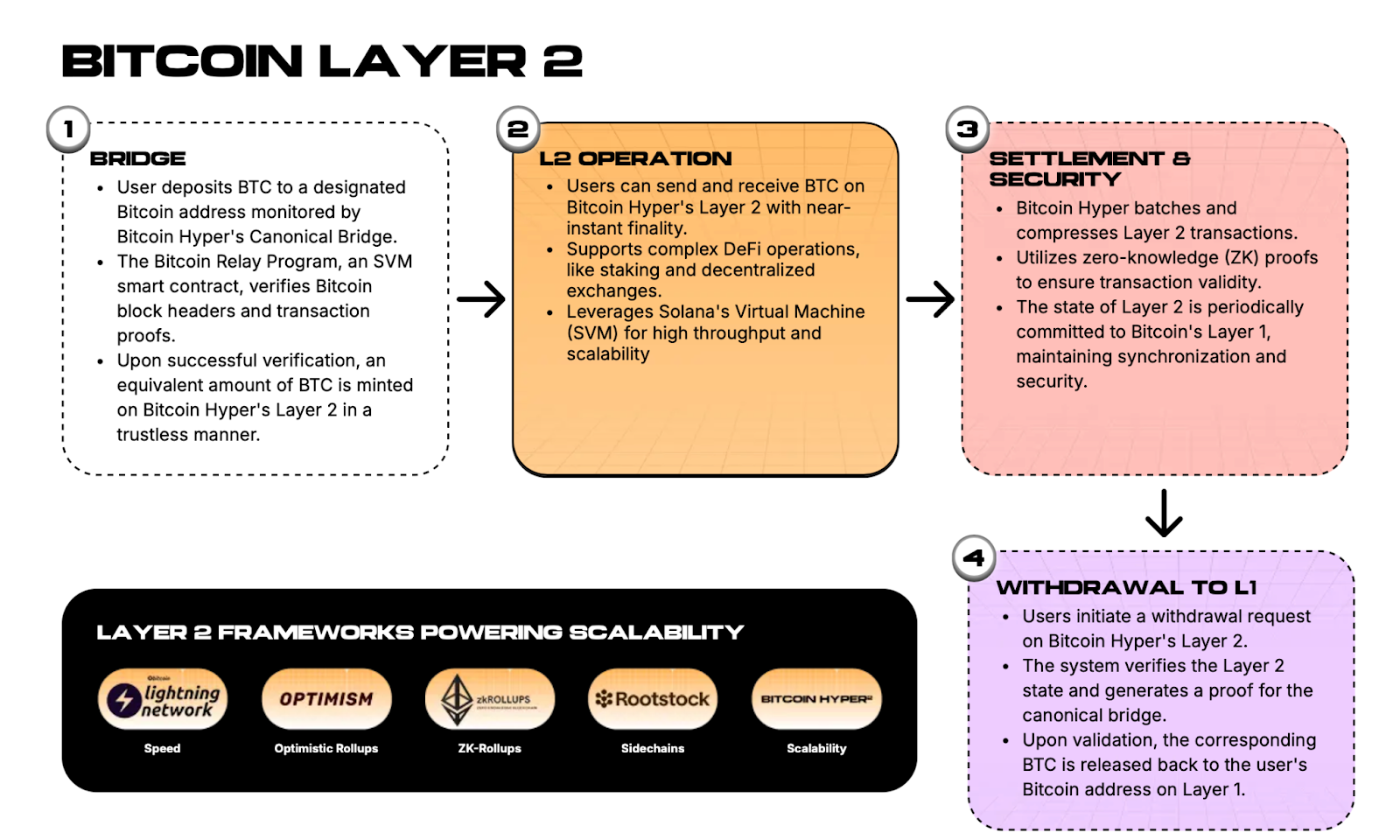

1. Bitcoin Hyper ($HYPER) – A Layer-2 Upgrade for Bitcoin

Bitcoin Hyper claims the top spot on our list, a project as ambitious as a man claiming to fly with a broomstick. It promises to fix Bitcoin’s flaws with a layer-2 solution, addressing speed and scalability. One might say: finally, a fix for the blockchain that’s slower than a bureaucrat filing taxes. 🐢

Unlike many projects that vanish like smoke, Bitcoin Hyper boasts regular tech updates, a rarity in the crypto wild west. Recent milestones, displayed proudly on X, suggest the team is as committed as a man chasing a paycheck. 🏃♂️

Bitcoin Hyper ecosystem updates on X

The project has undergone audits by Coinsult and SpyWolf, a precaution as necessary as a seatbelt in a rocket. The native token, $HYPER, is in presale, having raised $18M. Whales, those leviathans of the crypto sea, have begun circling. 🐋

Investors have a narrow window to buy $HYPER at $0.012975, a price as tempting as a free sandwich. Staking rewards of 64% await, though history suggests such promises are as reliable as a politician’s smile. 😄

2. Maxi Doge ($MAXI) is Doge Mania Reloaded

Maxi Doge ($MAXI), the gym-bro cousin of Doge, believes in hustle and 1000X leverage. It’s a meme coin, pure and simple, but with a narrative as thick as a Russian novel. 🐶

Unlike Bitcoin Hyper, $MAXI relies on community strength and storytelling, a recipe as volatile as mixing fireworks with gasoline. Yet, it’s well-positioned to ride the Doge mania wave, a trend as fleeting as a summer romance. 💕

For staking rewards of over 130% APY, visit the Maxi Doge website and join the presale at $0.000259. Just don’t forget to breathe while doing so. 🤯

3. BNB ($BNB) Has More in Store This Year

For the cautious investor, BNB is a blue-chip choice. It surged 59% in a year, hitting $1,080-a price that makes the average Joe weep into his coffee. ☕

BNB one-year price performance, source: CoinMarketCap.

BNB’s appeal lies in its efficient network, a haven for users tired of blockchain snail mail. Franklin Templeton’s BENJI Token, now on BNB Chain, hints at a future where crypto and finance kiss and make up. 💍

Benji is now live on BNB Chain, source: X

BNB is listed on major exchanges, while $HYPER and $MAXI remain in presale, offering discounted prices. Choose wisely, or let fate decide. 🎲

Read More

- How to Build Muscle in Half Sword

- Top 8 UFC 5 Perks Every Fighter Should Use

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- Epic Pokemon Creations in Spore That Will Blow Your Mind!

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- All Pistols in Battlefield 6

- Gears of War: E-Day Returning Weapon Wish List

- Bitcoin Frenzy: The Presales That Will Make You Richer Than Your Ex’s New Partner! 💸

- How To Get Axe, Chop Grass & Dry Grass Chunk In Grounded 2

- Bitcoin’s Big Oopsie: Is It Time to Panic Sell? 🚨💸

2025-09-26 13:45