Major US financial institutions and banks, as reported in recent SEC filings under Form 13F, have begun buying Bitcoin ETFs. This development highlights increasing institutional investment in Bitcoin, potentially leading to broader acceptance and higher valuations for the cryptocurrency.

Julian Fahrer, the CEO of Bitcoin-focused app Apollo Sats, drew attention to this development on social media platform X by posting, “Exclusive: 13F SEC filings reveal US banks have been purchasing Bitcoin.”

US Banks And Wall Street Buy Bitcoin ETFs

Fahrer highlighted that these filings represent investments from various investment firms and wealthy families with asset portfolios ranging from $200 million to $10 billion, indicating a growing number of institutional backers. Notably, he mentioned American National Bank’s investment in Ark’s ETF as “notable” since it marked the first instance of banks purchasing Exchange-Traded Funds (ETFs).

The second biggest name in the list is Park Avenue Securities LLC with an AUM of $9.9B which bought 7,328 GBTC shares worth $ 457,780. In total, Wall Street firms with a combined $15 billion in AUM bought exposure to Bitcoin ETFs worth approximately $4 million in Q1. The detailed breakdown of these investments is as follows:

- LexAurum Advisors, LLC purchased 11,973 shares of BlackRock’s IBIT ETF, totaling $484,547.

Founders Capital Management acquired 261 IBIT shares for $10,563.

Signal Advisors Wealth invested in 20,571 IBIT shares worth $832,496.

Park Avenue Securities LLC bought 7,328 shares of Grayscale’s GBTC, amounting to $457,780.

Marshall & Sullivan Inc purchased 4,040 GBTC shares for $255,207.

Johnson & White Wealth Management, LLC acquired 9,810 GBTC shares totaling $613,125.

BCS Wealth Management bought 9,196 GBTC shares valued at $574,750.

Inscription Capital LLC invested in 4,866 GBTC shares worth $299,016.

Wedmont Private Capital bought 3,471 shares of Fidelity’s FBTC ETF for $209,336.

Gunderson Capital Management invested in 7,671 shares of Bitwise’s BITB ETF for $296,944.

American National Bank acquired 100 shares of Ark Invest’s ARKB for $7,098.

Matt Hougan, Bitwise’s Chief Investment Officer, pointed out through X that investors managing more than $100 million are required to disclose their public equity holdings to the SEC using 13-F forms on May 15th. While these filings only provide a momentary glimpse, Hougan hinted that some of the names revealed will be a positive surprise to many.

MacroScope, a well-known cryptocurrency analyst, shared his perspective, suggesting that the most intriguing companies may emerge from May filings since some investment firms choose to disclose their holdings late to preserve strategic secrecy for as long as possible. According to MacroScope’s experience, important filings are submitted between April and May, and these late disclosures could potentially reveal the most noteworthy names in the crypto space.

Institutional interest in Bitcoin through ETFs has been growing steadily, indicating a shift in institutional sentiment towards the cryptocurrency. This trust in Bitcoin’s long-term value as an asset class is becoming more solidified. The upcoming Q1 filings, due by May 15, will provide additional insights into this developing trend, suggesting that Wall Street is becoming increasingly confident in adding Bitcoin to their portfolios.

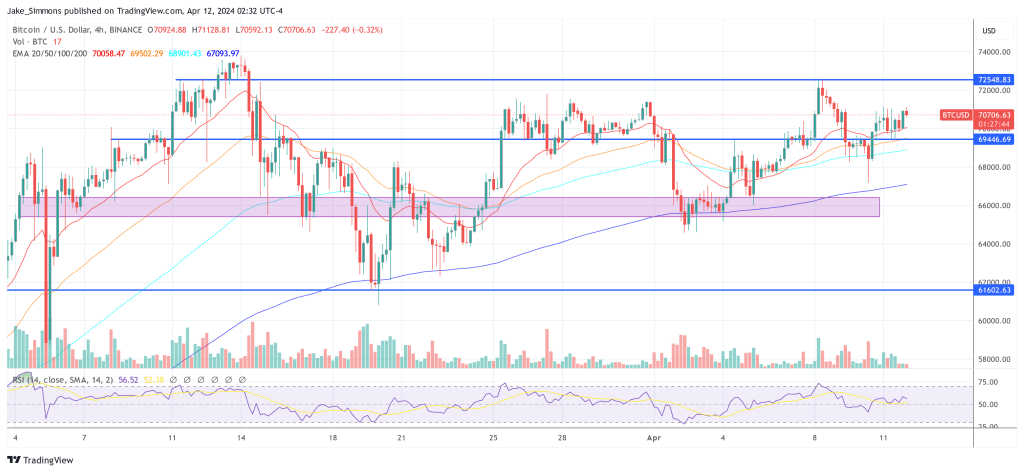

At press time, BTC traded at $70,706.

Read More

- USD ZAR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD CLP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- SEILOR PREDICTION. SEILOR cryptocurrency

- USD COP PREDICTION

2024-04-12 09:56