New data from the Consumer Price Index (CPI) showed higher-than-anticipated inflation rates in the US. This surprise finding suggests a strong upward trend in prices, which could lead the Federal Reserve to make bold moves in their upcoming monetary policies. In response, Bitcoin and cryptocurrencies experienced a sharp decline. The price of Bitcoin dipped by 2.7%, falling under $67,200. Alternative cryptocurrencies have shown an even more dramatic reaction to this news.

In simpler terms, the CPI without adjusting for seasonal changes in March 2024 rose to a yearly increase of 3.5%. This was higher than the predicted 3.4% and above February’s rate of 3.2%, making it the most significant inflation rise since last September. The sudden price hike indicates not just a brief market fluctuation but ongoing pressure leading to increased prices in the economy.

The latest Consumer Price Index (CPI) data shows that the headline and core inflation rates, adjusted for food and energy prices, rose by 0.4% compared to the previous month. This consistent increase across different sectors suggests a widespread inflationary trend that goes beyond volatile items. The annual core CPI growth rate held steady at 3.8%, exceeding predictions slightly and staying constant since February, implying that underlying inflationary forces remain robust.

❖ U.S CPI (MOM) (MAR) ACTUAL: 0.4% VS 0.4% PREVIOUS; EST 0.3%

❖ U.S CPI (YOY) (MAR) ACTUAL: 3.5% VS 3.2% PREVIOUS; EST 3.4%

❖ U.S CORE CPI (MOM) (MAR) ACTUAL: 0.4% VS 0.4% PREVIOUS; EST 0.3%

❖ U.S CORE CPI (YOY) (MAR) ACTUAL: 3.8% VS 3.8% PREVIOUS; EST 3.7%

— *Walter Bloomberg (@DeItaone) April 10, 2024

Market Reactions And Federal Reserve’s Dilemma

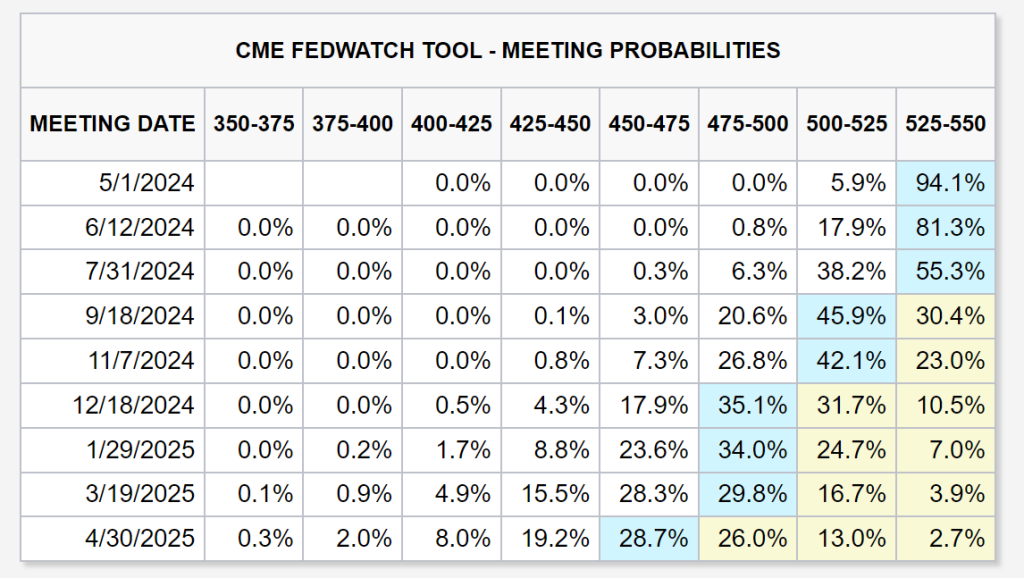

The market reacted quickly to these numbers, leading to significant changes in anticipation of interest rate movements. Specifically, the swaps market, which serves as an indicator of monetary policy predictions, suggested that the Federal Reserve was less likely to reduce interest rates in the coming months. Based on data from CME Group’s FedWatch tool, there is now a 94.1% probability that interest rates will stay the same at the May meeting and an 81.3% chance of remaining unchanged through June.

Mohamed A. El-Erian expressed his viewpoint, indicating that the market currently anticipates fewer than two Federal Reserve interest rate reductions in 2023. This comes as the major stock indices are declining by more than 1%, and the dollar is strengthening. The Fed now faces a challenging situation where they must consider the overall economic picture, but it remains unclear if they will do so.

Christopher Inks attempted to calm down the crowd by bringing up that the Federal Reserve generally relies on the Personal Consumption Expenditures (PCE) Price Index when evaluating inflation.

“With many people discussing anticipated rate cuts from the Fed in response to today’s CPI announcement, I feel compelled to remind you that the Fed has paid little attention to the CPI for approximately ten years. Instead, they primarily consider the PCE index, which is released towards the end of each month.”

Implications For Bitcoin And The Crypto Market

The cryptocurrency market is keeping a keen eye on the latest data releases. According to Charles Edwards, the combination of increasing inflation and decreasing liquidity could negatively impact cryptocurrencies. He explained, “Inflation is on the rise once again, surpassing expectations. It’s also plausible that this trend is connected to the recent drop in market liquidity. This isn’t positive news for crypto if these patterns persist.”

Matt Hougan, Bitwise’s CIO, and Dave Weisberger, Chairman of CoinRoutes, presented an opposing perspective, implying that the present market situation might ultimately benefit cryptocurrencies. According to Hougan, the Federal Reserve’s decision to lower interest rates by 0.25% in June is not the primary determinant of Bitcoin prices at this time. Instead, he emphasized that ETF inflows and growing deficits are more significant factors, and they are aligning favorably for Bitcoin.

Weisberger, in agreement with Hougan’s perspective, stated, “I also believe this is a good time to buy, as these figures represent some of the most significant signs yet that the dollar’s hegemony in the FIAT monetary system is weakening… For now, gold is making accurate predictions, and Bitcoin will likely follow suit. In the interim, the strategy of large investors, or ‘whales,’ to manipulate the market by selling to buy at lower prices remains effective.”

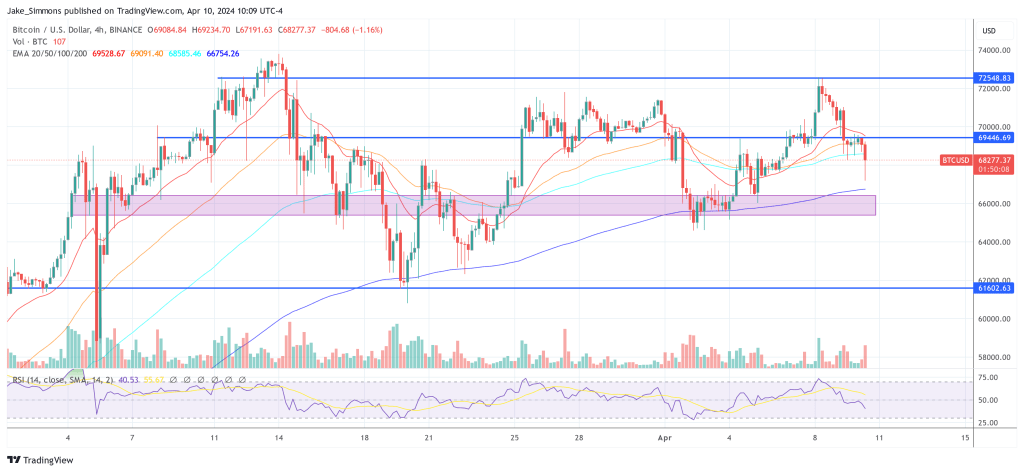

At press time, BTC traded at $68,277.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- EUR RUB PREDICTION

- SBR PREDICTION. SBR cryptocurrency

- KATA PREDICTION. KATA cryptocurrency

2024-04-10 19:12