US Credit Rating Falls! Is Bitcoin the Last Safe Haven? 😱🚀

Bitcoin (BTC) is currently riding a roller coaster with some glittering bullish signals and a side of “what just happened?” After Moody’s decided to downgrade the US credit rating, the universe of investors (and perhaps the universe itself) started to take a closer look at what might happen next. Think of BTC as that eccentric friend who’s always hedging bets on the apocalypse, and now, they’re probably feeling quite validated. 🧐

Meanwhile, on the crypto front lines—where your digital coins are either lounging on exchanges or hiding in cold storage—data shows a shrinking supply of Bitcoin on exchange shelves. Some lucky investors are apparently leaning toward holding their coins rather than throwing them into the marketplace fire. Despite this promising sign, BTC remains in a state of calm—like a cat sitting by a window, watching the world burn with a nonchalant “meh” face, waiting for the next big moment.

Moody’s Downgrade Ends US Century-Long Perfect Credit Rating Streak

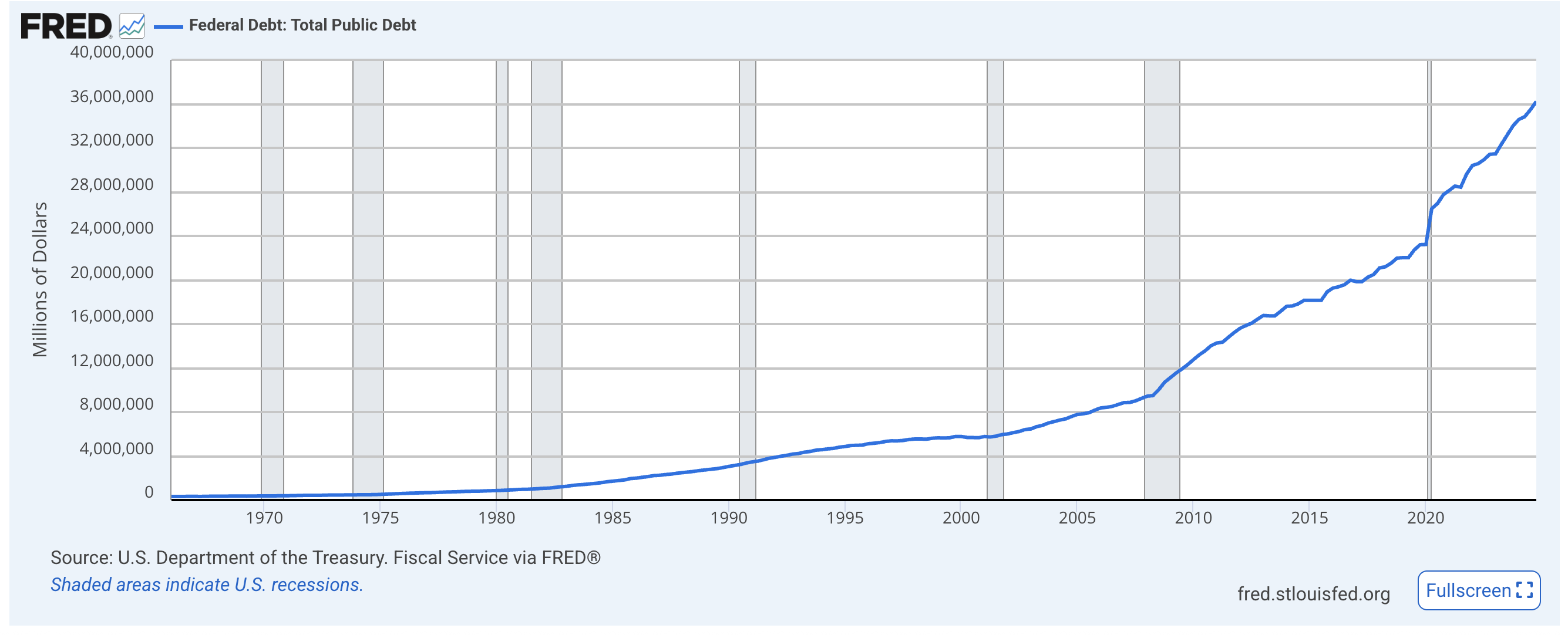

Yes, you read that right. Moody’s, that peculiar agency that loves assigning letter grades like it’s a fruit salad, has finally downgraded the US from its perfect Aaa status to the slightly less shiny Aa1. For over a hundred years, the US was the gold standard (metaphorically, of course—unless gold is now digital). But unfortunately, rising deficits, mounting interest costs, and the inexplicable tendency to ignore credible fiscal reforms led to the drastic rating slap.

The markets took this news like a toddler witnessing their ice cream fall off the cone—quickly and with dramatic flair. Treasury yields shot up, and equity futures slipped away like a shy teenager at a dance. The White House waved it off as “political drama,” while lawmakers scrambled over a $3.8 trillion spaghetti mess of tax and spending plans. Moody’s also warned that playing with Trump-era tax cuts could deepen deficits, pushing the US toward a sugar rush of debt—potentially making Bitcoin even more attractive as the rebellious, anti-establishment hero.

Bitcoin Consolidates: Falling Exchange Supply Meets Ichimoku Indecision

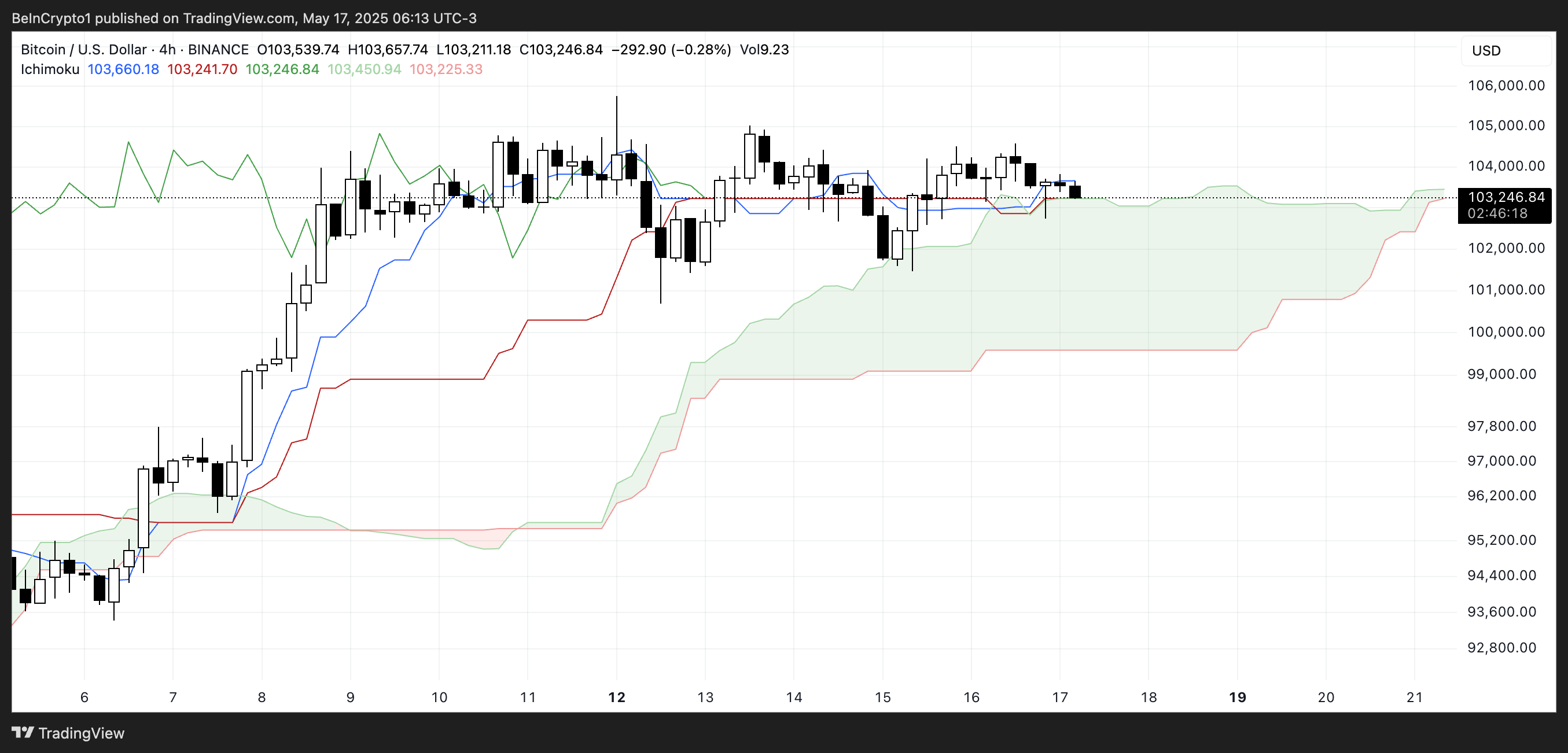

Meanwhile, Bitcoin supply on exchanges did its best impression of a sinking ship—dropping from a brief spike of 1.43 million back down to 1.41 million. Apparently, investors are getting the memo that holding is the new selling. Or at least, they’re trying to sit on their digital hands and wait for the market to decide if it actually wants to go somewhere. Meanwhile, the Ichimoku Cloud—like a foggy morning in the market—shows no clear direction, just some flat lines and a faint hint of hesitation.

The current market state resembles a annoyed squirrel deciding whether to cross the road—equilibrium with a touch of “possibly yes, possibly no.” The price hovers near the support of the flat cloud, waiting for someone to throw the next punch or maybe just a warm cup of coffee to make up their mind.

The indicators suggest that Bitcoin is basically chilling in the middle ground—neither crashing nor soaring. It’s like a teenager refusing to admit they’re interested in a new band, all while secretly listening to their songs at full volume.

Moody’s Downgrade: The Long-term Bitcoin Bull Signal? Possibly. Maybe.

So, with the US losing its shiny, perfect credit badge after Moody’s injections of disappointment, Bitcoin’s appeal as a decentralized, unbreakable digital fortress just got a shiny new badge—at least in the minds of those optimists who see the glass as half digital currency. Though you won’t see Bitcoin suddenly hitting all-time highs overnight (probably because it’s too busy contemplating its own existence), this move adds fuel to the long-term narrative of “Hey, maybe everything’s falling apart, and Bitcoin’s the only thing left standing.”

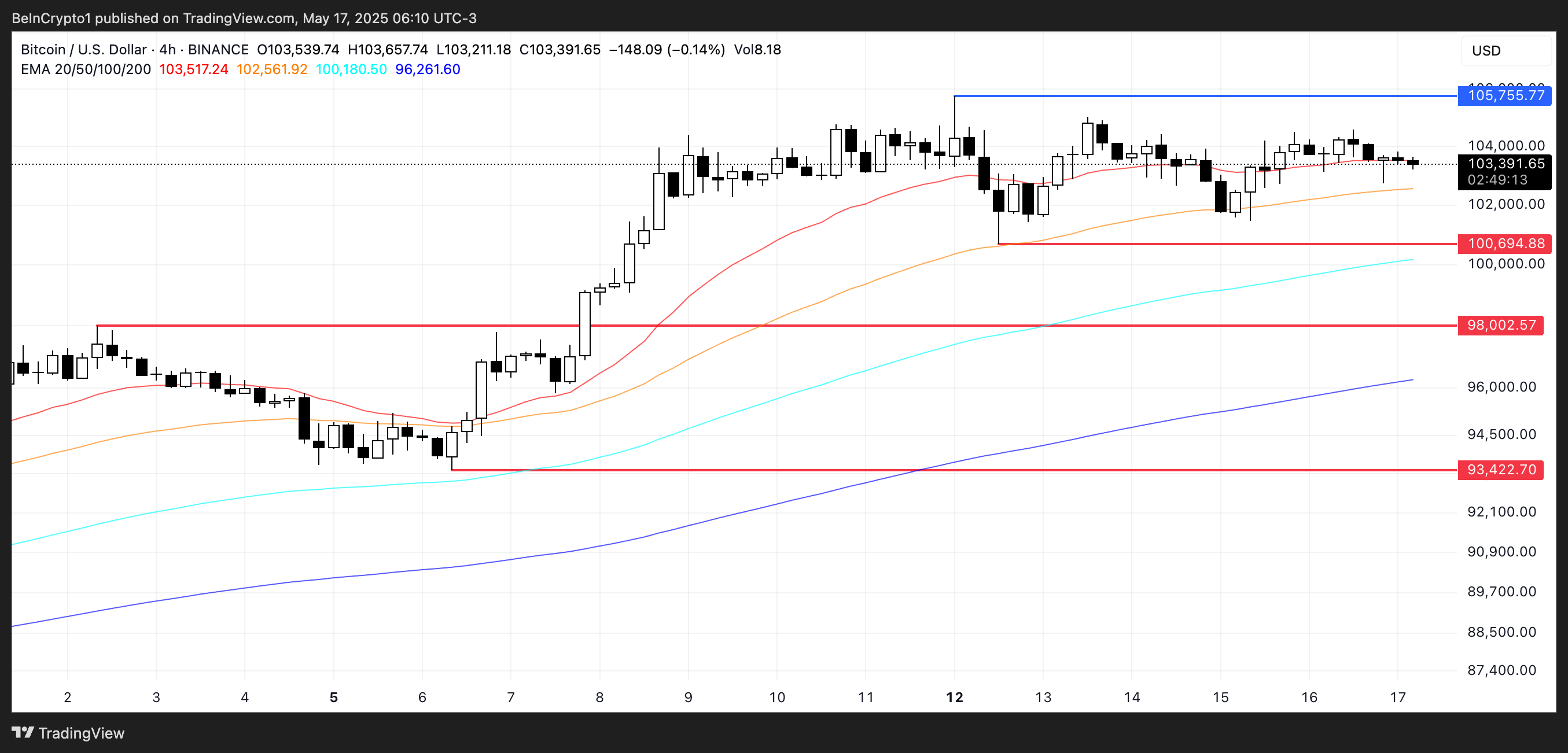

For now, Bitcoin remains in a financial twilight zone—above $100,000 but flattened out like a pancake pondering life choices. To stir the bullish pot back into action, BTC will need to push past resistance at approximately $105,755, while holding above $100,694 remains the key to avoiding a plunge down to $98,002 or even $93,422—if it becomes possessed by the spirit of financial chaos.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-05-17 13:56