As a seasoned crypto investor with roots tracing back to the early days of Bitcoin, I’ve witnessed the evolution of the digital currency landscape like a silent spectator watching a blockchain-powered game of chess. The latest move by VALR, a Pantera Capital-supported exchange, to introduce the Circle’s EURO Coin (EURC) and facilitate Euro deposits through SEPA and SWIFT transfers, is not just another pawn’s movement in this grand game – it’s a knight’s leap that could potentially alter the course of the entire game.

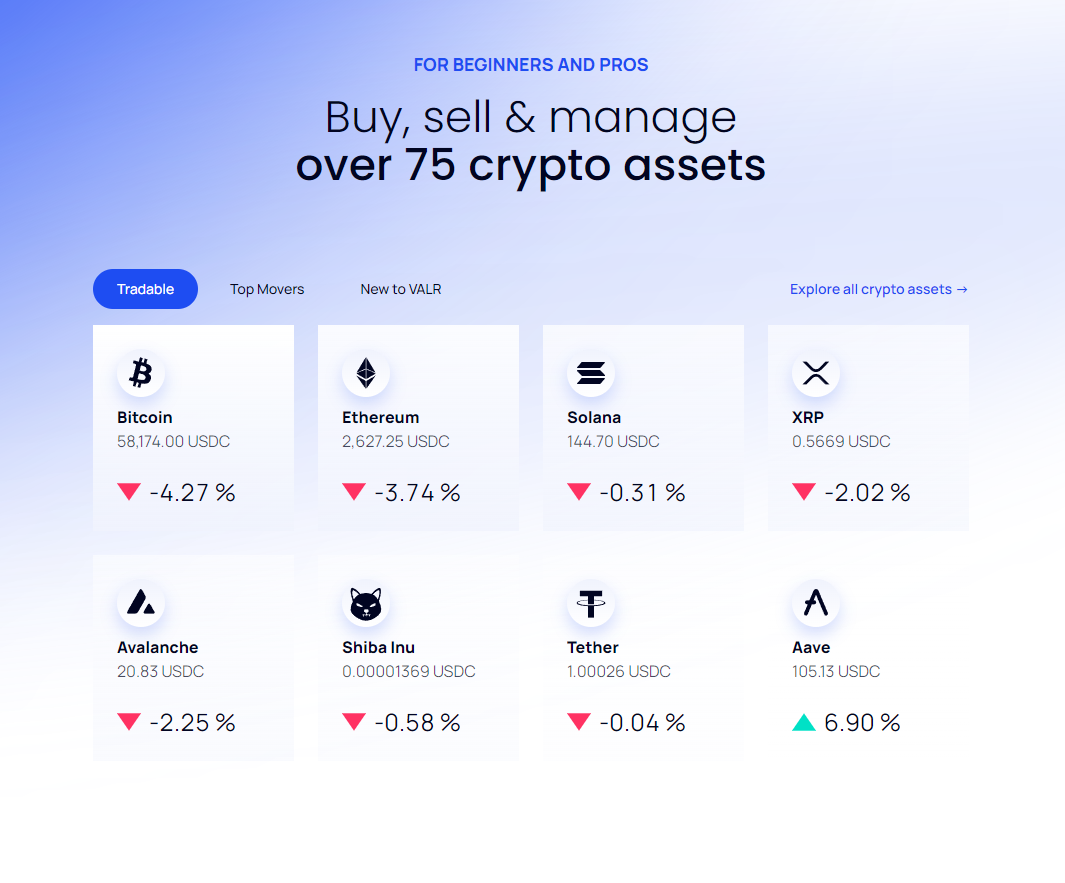

Adding Circle’s EURO Coin (EURC), a stablecoin tied to the euro, has expanded VALR’s cryptocurrency exchange offerings, backed by Pantera Capital. Now traders can exchange EURC with USDC, Bitcoin (BTC) and the South African Rand (ZAR). This launch signifies a significant expansion of VALR’s service portfolio.

Apart from facilitating wire transfers for Euro deposits, VAR is also introducing three new trading pairs: EURC/USDC, EURC/BTC, and EURC/ZAR. This means users can now directly deposit euros into their accounts using SEPA or SWIFT transfers. For converting euros to euros within the platform or larger transactions, VAR’s partnership with Circle ensures a seamless and efficient process through direct purchase or via their OTC Trading Desk.

Farzam Ehsani, CEO and co-founder of VALR, highlighted the significance of the latest features, explaining that their addition of EURC and facilitation of Euro deposits aligns with VALR’s mission to enhance cryptocurrency accessibility. He stressed that the collaboration with Circle aims to provide a secure and user-friendly service tailored to the diverse needs of VALR’s clients.

Founded in 2018 and headquartered in Johannesburg, VALR has grown into a globally recognized cryptocurrency trading platform, serving approximately 700,000 individual traders and more than 1,000 corporate clients. The exchange’s operations are authorized by the Financial Sector Conduct Authority (FSCA) in South Africa, while Dubai’s Virtual Asset Regulatory Authority (VARA) has granted it preliminary approval. Notable investors like Pantera Capital, Coinbase Ventures, and Avon Ventures have invested $55 million in VALR through equity funding.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- TON PREDICTION. TON cryptocurrency

- Strongest Magic Types In Fairy Tail

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- TWT PREDICTION. TWT cryptocurrency

2024-08-15 11:21