Ah, the eternal optimists at CEX.io are at it again, predicting a record year for venture capital investment in crypto 🤑. One can almost hear the champagne corks popping in the distance.

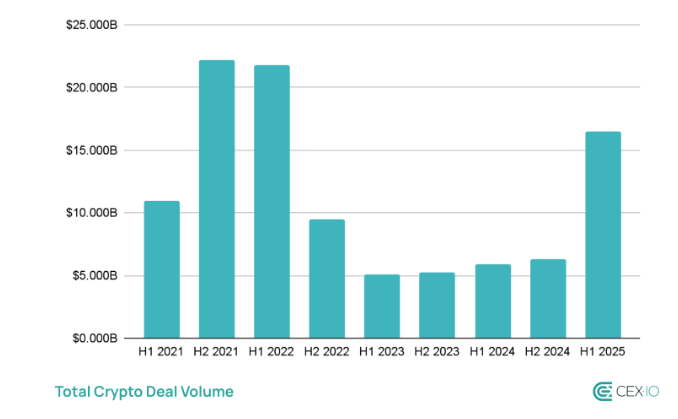

After a few years of relative stagnation, it seems the venture capital world has once again fallen under the spell of crypto’s siren song 🧙♀️. According to CEX.io’s report, published on Thursday, July 17, venture deals in the first half of 2025 reached a staggering $16.5 billion 💸. This, of course, suggests that 2025 could be on track to become the record year in venture deals. Because, as we all know, records are made to be broken 🏆.

This volume already surpasses the $12.2 billion recorded in all of 2024, and exceeds the $10.9 billion in 2021, which was previously the highest year on record 📈. For this reason, CEX.io suggests that 2025 may become the top year ever for crypto startup funding. One can only imagine the jubilation in the crypto community 🎉.

Additionally, the crypto industry accounted for 5.3% of global venture funding—its highest share in three years 📊. This figure has steadily grown since the 2024 U.S. elections, indicating that a shift in policy may be a key driver of renewed investor confidence. Ah, the power of politics 🤝.

Finance, the Belle of the Ball

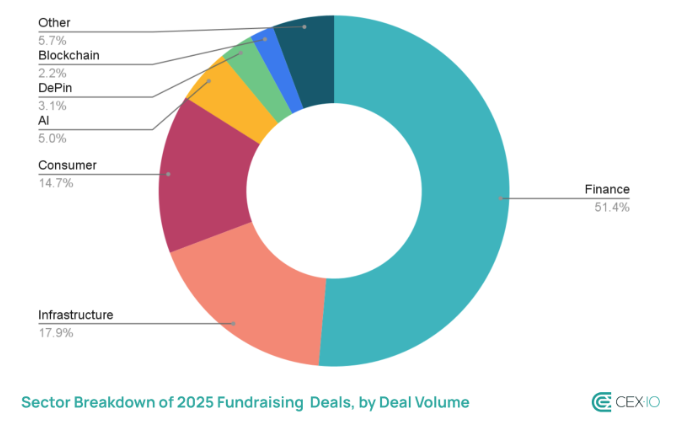

The industry segment attracting the most funding remains finance, which captured 51% of deal volume 💸. This includes both centralized and decentralized finance projects, which continue to dominate the scene 👑. Infrastructure, encompassing hardware, security, bridges, and oracles, also saw a notable increase, driven by large deals involving Bitmain and TWL Miner 🚧.

Blockchain L1 and L2 network deals saw a significant contraction, and now accounts for just 2% of deal volume 📉. At the same time, the AI-focused crypto project share is steadily increasing, now reaching 5% of total deal volume 🤖. One wonders what the future holds for these fledgling projects 🔮.

While the total size of funding has grown in recent years, the number of funding rounds has declined 📊. Notably, the average size of funding rounds hit a record $20 million in the first half of 2025, marking a sharp rebound from the downturn following the 2022 market crash 📈. It seems the crypto world is once again awash in cash 💸.

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

2025-07-17 23:28