As an analyst with extensive experience in the crypto industry, I strongly agree with Vitalik Buterin’s perspective on the regulatory landscape, particularly in the United States. The current system, which allows unclear projects to operate freely while heavily regulating those with clear value propositions, creates an unproductive and counterintuitive environment for innovation.

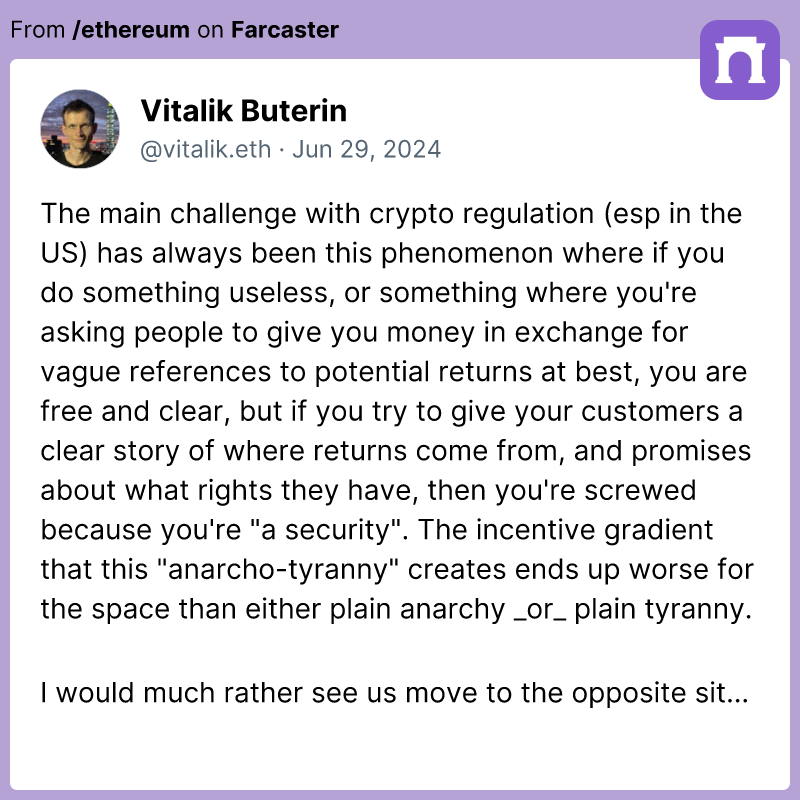

Vitalik Buterin, Ethereum’s founder, brought up a significant concern in the crypto regulatory sphere, specifically focusing on the US context. He noted that projects offering vague returns can easily flourish without much oversight, while those with clear value propositions are subjected to stringent regulations. This disparity is detrimental to the industry, as per Buterin’s perspective.

Identifying the issue with the incentive disparity brought about by this regulatory framework, he argued that it poses a threat to the entire crypto sector. In his opinion, the present regime, characterized as “anarcho-tyranny,” is more detrimental than having no regulations at all or overly stringent rules.

From a researcher’s perspective, I find it intriguing how differently various cryptocurrencies are handled in the regulatory landscape. Take meme coins such as Dogecoin for instance. Their value proposition may appear unclear or even frivolous to some. Yet, they seem to maneuver through regulatory challenges more effortlessly compared to established projects like Ethereum, Cardano, and XRP. The latter cryptocurrencies, with their detailed plans and promises to users, face more stringent regulatory hurdles due to their perceived value and significance in the market.

Good faith

As an analyst, I would rephrase Buterin’s argument as follows: I believe that regulatory bodies should reassess their approach to token issuance. Projects that fail to present a compelling long-term value proposition carry increased risk. On the other hand, initiatives with transparent and well-defined value propositions, as well as those that conform to established best practices, are likely to encounter fewer regulatory hurdles due to their reduced risk profile.

As a crypto investor, I strongly believe in the importance of open communication and collaboration between regulators and the crypto industry, including Ethereum‘s founding team. By working together in good faith, we can create a more balanced and productive regulatory framework that benefits everyone involved. This approach is crucial for ensuring the long-term success and growth of the crypto space.

As a researcher examining Ethereum’s proposed approach, I can say that this strategy, as suggested by Vitalik Buterin, aims to foster innovation while safeguarding investors and keeping them informed about their investments.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- WELSH PREDICTION. WELSH cryptocurrency

- IQ PREDICTION. IQ cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

2024-06-30 15:09