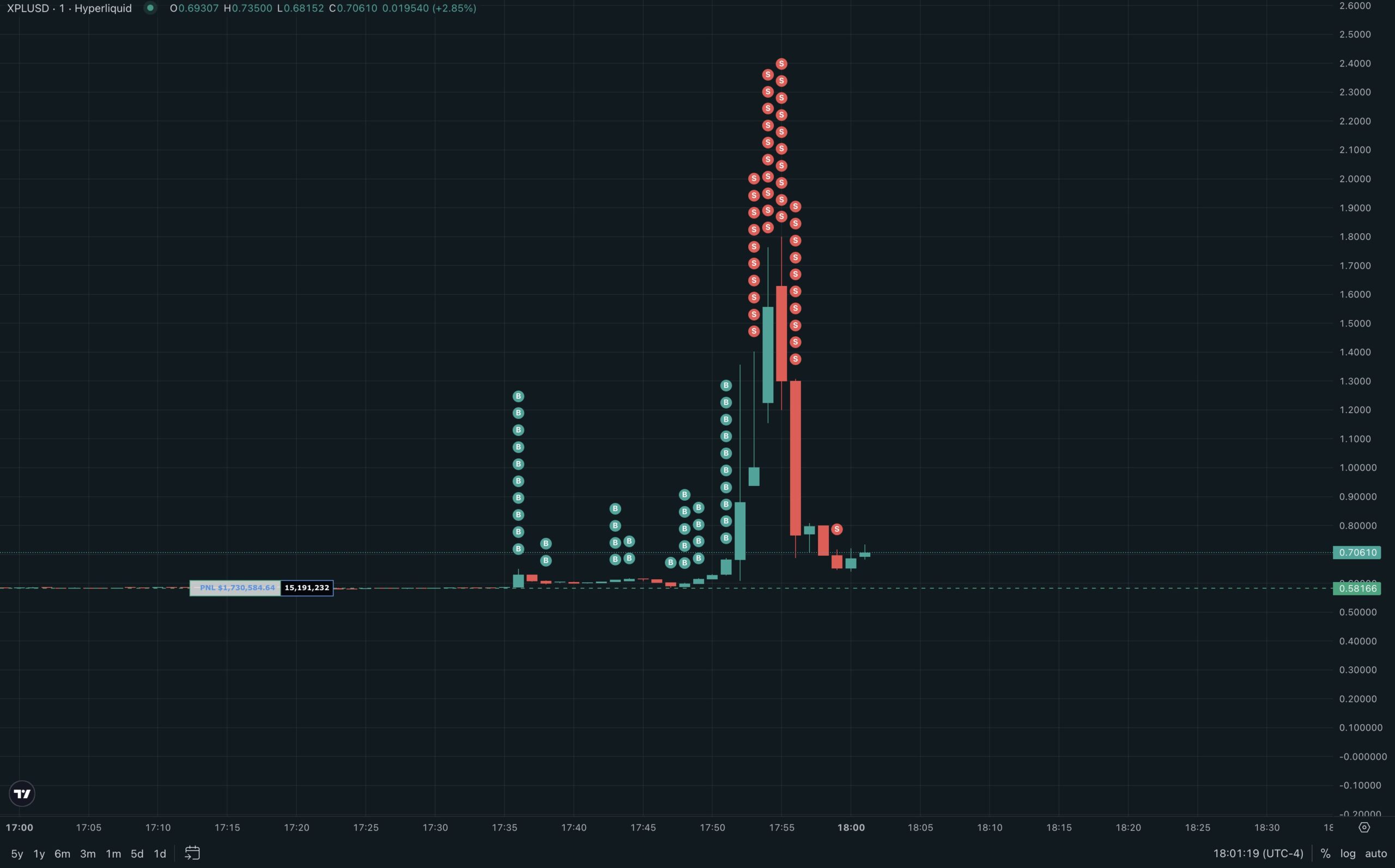

In the bustling bazaar of Hyperliquid, a wallet of considerable girth made waves, depositing a staggering 16 million USDC and unleashing a torrent of XPL long positions in mere moments. It was as if a giant had stomped through a delicate flower garden, leaving chaos in its wake.

This audacious maneuver swept the order book clean, liquidating all short positions like a broom sweeping dust from a floor, and sent XPL’s price soaring from a humble $0.58 to a dizzying peak of $1.80. It was a sight to behold, akin to watching a tumbleweed roll through a ghost town-unexpected and a little bit thrilling.

Liquidity Shock

According to the wise sages at Lookonchain, this wallet, in a flash, partially closed its position, pocketing a cool $16 million profit. Whispers in the wind suggest that this wallet might belong to none other than Justin Sun, the wizard behind the Tron (TRX) network. Who knew wizards could be so financially savvy?

“Justin Sun just locked in $16M profit in under 60 seconds. He longed millions of $XPL, nuking the entire order book and wiping traders instantly. Sent $XPL soaring to $1.80 (+200% in 2 minutes). And he’s STILL holding 15.2M $XPL ($10.2M) long. Easily one of the craziest liquidation cascades ever seen on Hyperliquid,” an X user commented, likely while sipping their morning coffee and shaking their head in disbelief.

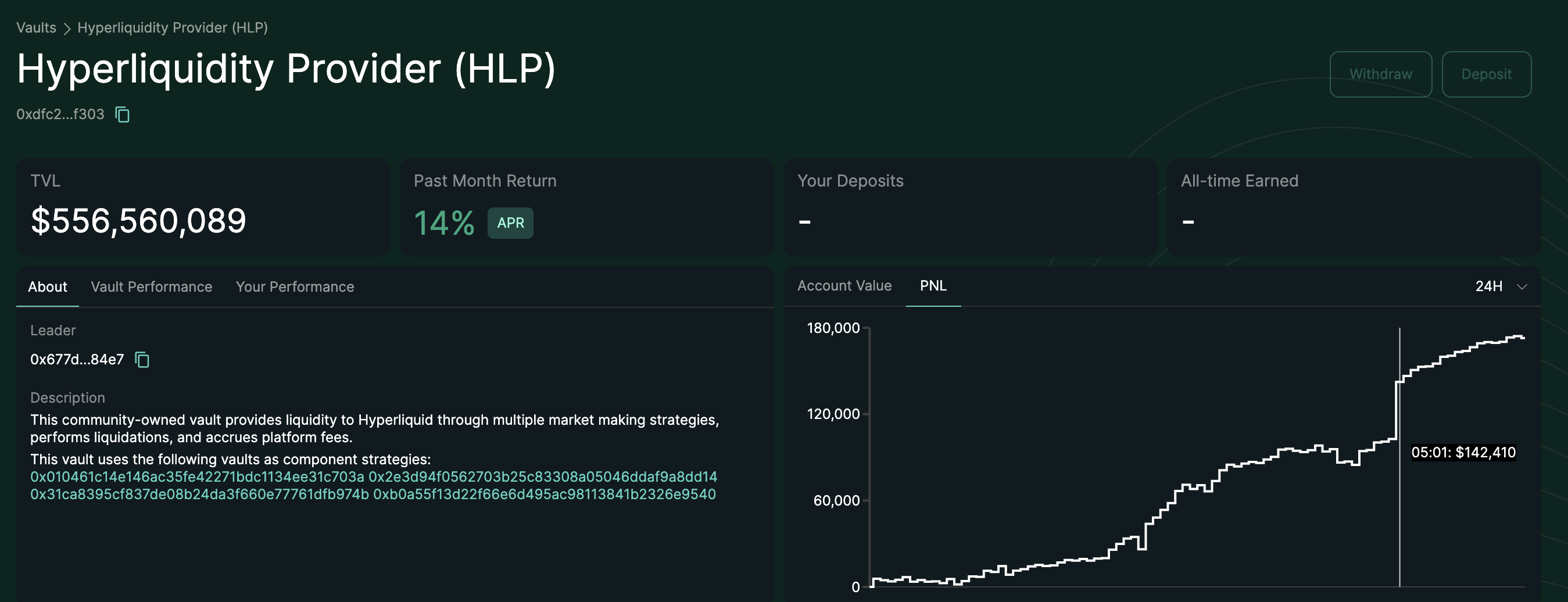

But it wasn’t just the whales who danced in the rain of profits; Hyperliquid’s HLP vault also managed to rake in about $47,000 from this wild ride. Yet, in a twist of fate, the vault had previously suffered a near $12 million loss in a similar escapade. It’s a classic tale of the double-edged sword of liquidity providers: they can earn fees while simultaneously facing the grim reaper of significant losses when volatility strikes like a thief in the night.

Before the XPL spectacle, Hyperliquid had already witnessed a similar drama unfold with the JELLY token. Back then, the price swings were so unusual that the HLP vault found itself nursing a nearly $12 million wound, caught in the crossfire of liquidity provision during an order book “wipeout.” Talk about being in the wrong place at the wrong time!

In response to the JELLY squeeze, HyperLiquid decided to play the good Samaritan, refunding affected traders and tightening security measures to prevent future calamities. The common thread in both tales? A mighty whale’s move in a thinly liquidated market, triggering a cascade of short squeezes that left many traders gasping for air.

Risks for Retail Traders

The XPL price explosion serves as a stark reminder of the “order book sweep” mechanism on decentralized derivatives exchanges. When liquidity is as thin as a whisper, a sufficiently large order can slice through multiple price levels, triggering a chain reaction of liquidations. It’s like watching a row of dominoes fall, each one leading to the next in a spectacular display of chaos. In this instance, Hyperliquid’s order book was nearly devoured whole, leaving retail traders floundering, unable to react, and facing a tidal wave of liquidations.

This pattern unveils the lurking dangers of trading in markets with limited liquidity. Whales, those behemoths of the sea, can manipulate short-term trends, turning profits into massive losses for the unsuspecting minnows swimming nearby.

For the individual investor, the XPL event on Hyperliquid offers three pearls of wisdom. First, steer clear of high leverage when market liquidity is as scarce as a good cup of coffee at a gas station; a “squeeze” can wipe out accounts faster than you can say “oops.”

Second, keep a watchful eye on order book depth and on-chain cash flows before diving into a position, lest you find yourself in a zone exploited by those crafty whales.

Finally, for those brave souls participating in liquidity vaults like HLP, it’s crucial to recognize that short-term profits may come with the risk of significant losses during unexpected volatility. After all, in the world of finance, it’s always wise to expect the unexpected-preferably with a good sense of humor and a hearty laugh. 😂

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

2025-08-27 06:37