Ah, Bitcoin! The digital coin whose price dances like a child on a sugar high. Yet, amidst this capricious ballet of numbers, a tale unfolds far more captivating than mere graphs and charts. It is the tale of those who partake in this grand spectacle of buying-specifically, the new whales lurking beneath the surface.

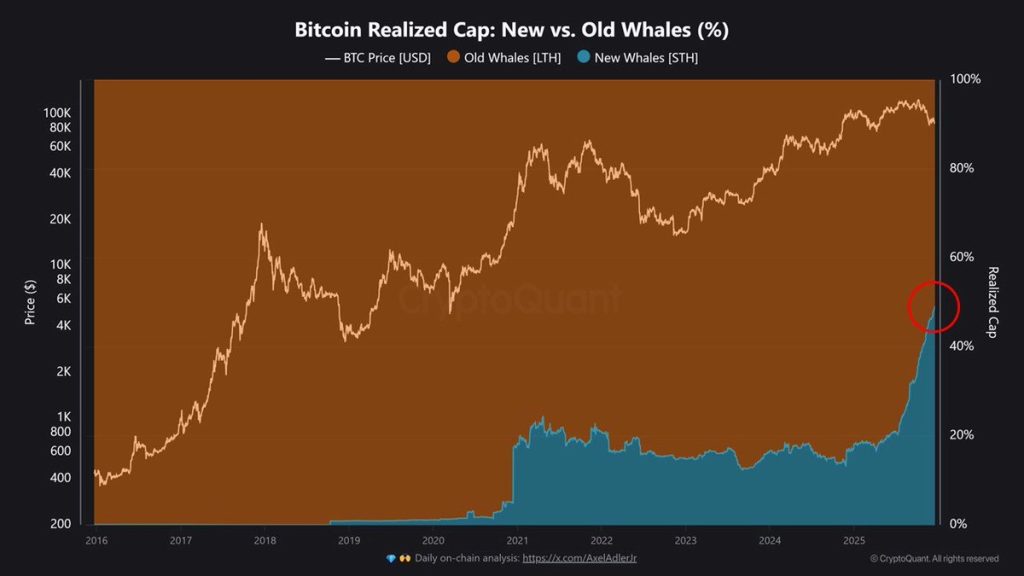

Recent on-chain revelations unveil that almost half of Bitcoin’s realized cap now swims in the hands of these new whale buyers. This marks a dramatic departure from the familiar currents of past Bitcoin cycles, where the old guard ruled the seas with their frugal accumulation during the golden days of low prices. 🐋💰

Realized cap, dear reader, is akin to the ledger of a wise merchant, tracking the value of Bitcoin based on the last price at which each coin was exchanged. When a flock of new whales suddenly claims a 50% share, one could surmise that half of all capital invested has been forged in the fiery forges of recent price levels, rather than the low-cost haunts of yesteryear.

The New Whales: Masters of a Different Ocean

According to the latest findings, these newcomers are primarily institutions and ETFs, diving into the Bitcoin pool at higher price points and in grander volumes. Quite unlike the long-term holders who accumulated coins when they were practically free and sold them at peaks, these new players partake in a different game altogether. They seem to be playing chess while the rest are still trying to figure out checkers.

And oh, their behavior during market corrections-now that is a sight to behold!

“Even amidst the stormy seas of corrections, the Realized Cap share of new whales has continued to rise,” the analysis proclaims. 🧐

This should not be hastily interpreted as a harbinger of bullish or bearish tides, but rather as proof that the very structure of the Bitcoin market is evolving, as the report thoughtfully adds.

Rising Demand, Not Just a Passing Fad

Further supporting this observation, data from short-term holders indicates that the supply held by coins younger than 155 days has grown by a staggering 100,000 BTC in just 30 days, reaching heights never before seen. This suggests a fresh wave of demand continues to crest, even as prices bob up and down like a cork in turbulent waters.

Meanwhile, our seasoned long-term holders remain largely silent, like wise old turtles basking in the sun while the young fish dart about. The flow of exchanges reveals that most selling pressure arises from the smaller participants, while the larger wallets step in, akin to sharks swooping in to feast on the leftovers.

The cumulative volume delta data further underscores this dichotomy, revealing that whale wallets boast a positive $135 million delta, while retail and mid-sized traders appear to be swimming against the current.

A Deeper Current Beneath the Surface

This data hints at something far more profound than mere numbers. Bitcoin is navigating into a phase of maturity, shaped by sustained institutional accumulation, much like a fine wine aging to perfection.

For a market long defined by the booms and busts reminiscent of a rollercoaster ride, this transformation is indeed significant. It may well elucidate why Bitcoin’s behavior increasingly resembles a structured entity rather than a whimsical dance of chaos with each passing month. Cheers to that! 🍷

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

2025-12-20 14:13