In the market’s vast steppe, the Uniswap price chart unrolled itself like a stubborn certificate of character. A sharp fifteen percent intraday rise did not arise from the idle chatter of speculative pigeons; the whale counts swelled with a vigor that would alarm the calm of any village. UNI touched two dollars thirty-five cents, a mark akin to late-2020’s stubborn landmarks, and now heavy capital moves in, as if summoned by the news of BlackRock.

Is the ascent from UNI’s years-long nadir a mere chance or a providential hint? Perhaps or perhaps not. Let us look with the patient eye that history gives, for only through seeing many seasons can one discern the shape of the wind.

Why the Great Whales Move in Concert in the Uniswap Market

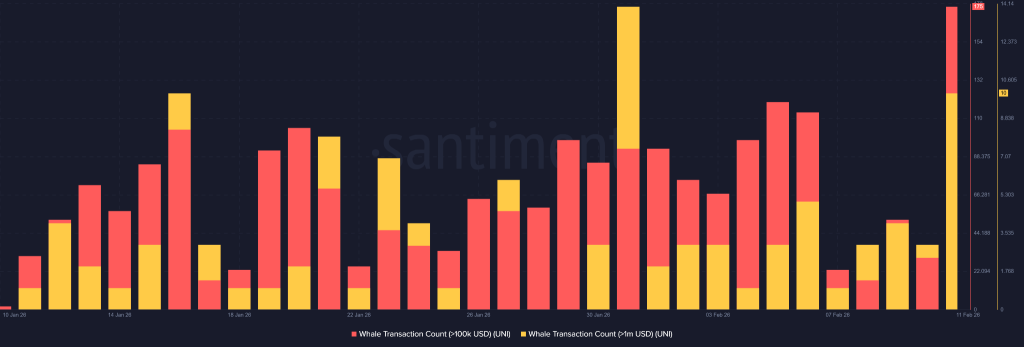

In the last twenty-four hours, as Santiment’s chronicles tell us, ten addresses dispatched transactions exceeding a million dollars, and more than one hundred seventy-five rivaled sums above a hundred thousand. This is not random shuffling of coins but a concentrated movement, a caravan of wealth rather than the shy rustle of leaves in a breeze.

Meanwhile, those custodians of vast quantities-between a thousand and a million UNI-have increased their hoards. In plain speech, the larger players are not merely trading the bounce; they are gathering, as a hunter gathers game, for a season more profitable than the last.

On the Uniswap price chart, this movement coincides with a steadiness near a long-sketched line of structural support. And while the broader market’s spirit remains fragile, such synchronized whale conduct often preludes the storm or the spring, whichever fate prefers to reveal first.

Network Activity Rebound Supports a Bullish View for Uniswap’s Price

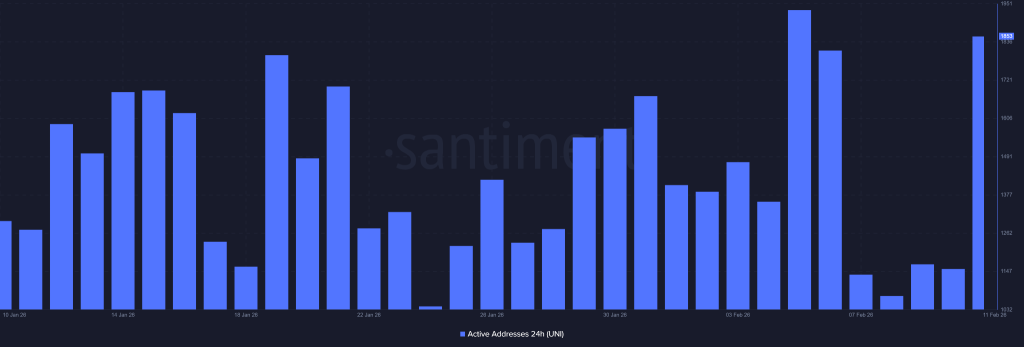

Here the tale grows more curious. Daily active addresses rose to 1,853 from 1,150 in days past. A genuine revival of on-chain participation, not mere whimsy of gamblers, and that is perhaps the most hopeful sign yet.

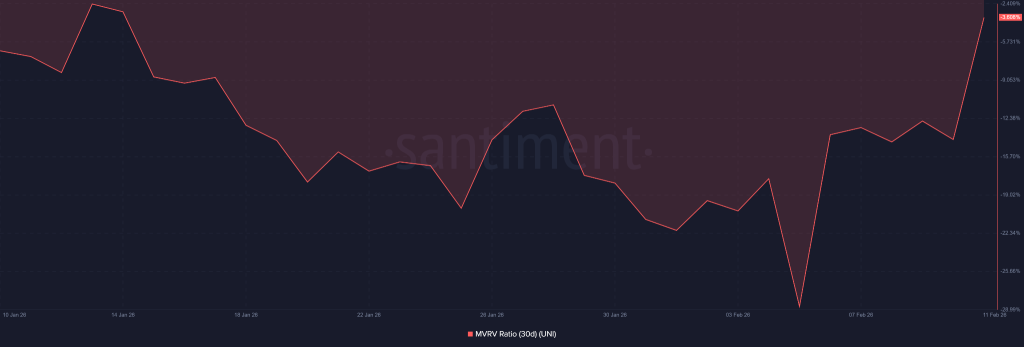

Concurrently, the 30-day MVRV ratio has improved. This gauge tracks whether recent buyers are still under water; its recovery grants the distant observers a sense of regained footing among traders from the past month. If this momentum continues, a short-term rising pressure could accumulate, like frost turning to spring rivers.

Yet let us be clear. A bounce is not a pledge that a trend has shifted its path.

BlackRock Catalyst

Where, then, does this sudden spark spring from-this flare amid a field that seemed bent toward dusk?

Uniswap Labs and Securitize spoke of a partnership with BlackRock, designed to deepen DeFi liquidity for institutional investors via the USD Institutional Digital Liquidity Fund, known by the symbol BUIDL. The alliance permits on-chain trading of BUIDL shares through UniswapX, an auction-driven protocol.

That headline, in its simplicity, jolted the UNI/USD pair higher, as if a thunderclap had found a new audience.

Institutional bridges possess a habit of bending perception swiftly. And perception in crypto-more often than not than not-propels short-term price movement with a gusto that outruns fundamentals.

UNI/USD Key Deciding Resistance Looms

Now comes the more arduous stretch, as the intraday surge, beloved by many and fueled by bullish whispers, already faced its first gate. Yet the battles are not over, for the resistance lies between $5.50 and $7.00.

To clear that band would imply Uniswap re-enters a broader bullish field. Failure to sustain the momentum, however, could drive UNUSD back into quiet consolidation, most likely below $4.00 until the wider sentiment relents.

What comes next? For the moment, the analysis of Uniswap suggests it is listening to whale hoards, improving on-chain metrics, and an institutional headline. Whether this becomes a lasting movement depends less on today’s spike and more on whether the market’s larger story decides to echo the tune.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2026-02-11 20:02