Ah, the grand theater of finance, where the Bitcoin exchange netflow, that fickle mistress, has chosen to remain in the depths of negativity for yet another week. One might ponder, what does this signify? The whales, those enigmatic leviathans of the crypto sea, are in a frenzy of accumulation, as if they were hoarding gold in a time of famine.

Bitcoin Exchange Netflow: A Tale of Woe and Wealth

In a recent missive on the platform known as X, the astute minds at IntoTheBlock have unveiled the latest chapter in the saga of Bitcoin’s Exchange Netflow. This term, dear reader, refers to an on-chain indicator that meticulously tracks the net amount of this digital asset as it flits in and out of the wallets tethered to centralized exchanges. A veritable dance of digits!

When this metric graces us with a positive value, it suggests that investors are depositing a net number of tokens into these platforms. Ah, but beware! For such a trend often heralds a bearish omen, as holders, like moths to a flame, rush to sell their precious coins. The irony! The very act of seeking profit can lead to ruin.

Conversely, when the indicator dips below zero, it reveals a curious truth: the outflows are triumphantly outpacing the inflows. Investors, in their infinite wisdom, withdraw their coins from the clutches of these exchanges, seeking to hold onto their treasures for the long haul. Such behavior, my friends, is often a harbinger of bullish prospects for Bitcoin’s price. A paradox wrapped in a riddle, indeed!

Now, feast your eyes upon the chart shared by our analytical savants, which illustrates the trend in Bitcoin Exchange Netflow over the past week:

As the graph reveals, the Bitcoin Exchange Netflow has stubbornly clung to its negative value, suggesting that investors have been diligently withdrawing their net amounts from the exchanges. A curious spectacle, indeed! Even amidst the latest plunge in the asset’s price, these whale entities remain optimistic, as if they were the last bastions of hope in a world gone mad. If this trend of accumulation persists, one might dare to dream of a bullish rebound for Bitcoin.

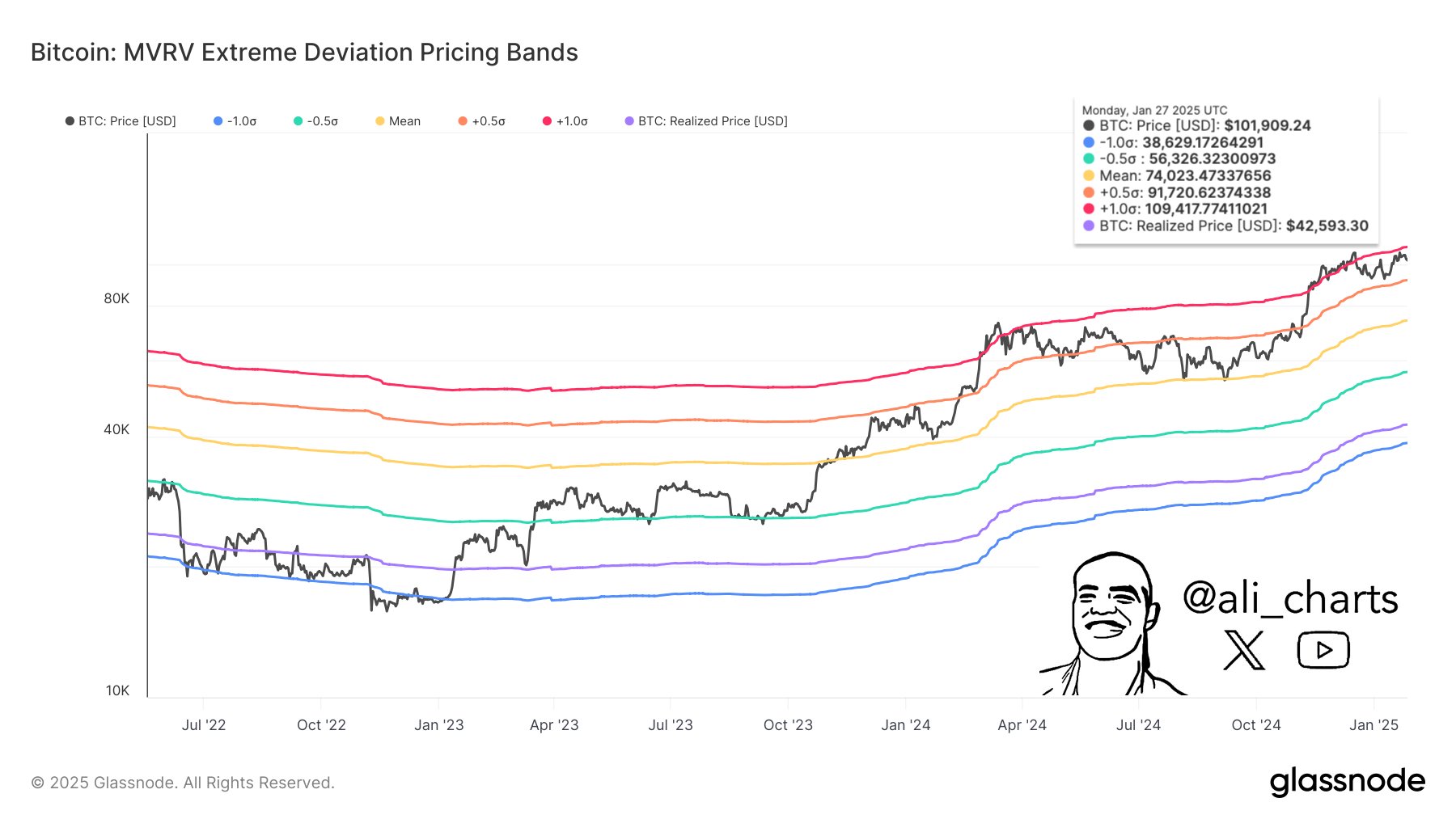

In other news, the latest correction for Bitcoin followed a rejection from the lofty heights of the Market Value to Realized Value (MVRV) Extreme Deviation Pricing Bands, as the ever-astute analyst Ali Martinez elucidated in a post on X. A tale of rejection, much like a love story gone awry!

This pricing model, based on the revered MVRV Ratio, keeps a watchful eye on investor profitability. When profits soar to dizzying heights, a mass selloff becomes a tantalizing possibility, leading to a peak in the asset’s value. The upper pricing band serves as a boundary, a cruel reminder of the fleeting nature of fortune.

As Martinez sagely notes,

Bitcoin $BTC was rejected at the upper red pricing band at $109,400. Failing to reclaim this level shifts focus to the next critical support at the orange MVRV pricing band, currently sitting at $91,700.

BTC Price: A Comedy of Errors

As I pen these words, Bitcoin languishes around $102,400, down a modest 2% over the past week. A fitting reflection of the absurdity of our times!

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Unlock the Mines in Cookie Run: Kingdom

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- How to Reach 80,000M in Dead Rails

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- REPO: How To Fix Client Timeout

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

2025-01-29 12:13