So here we are again. Ethereum is waddling above $1,800, but it can’t quite break free from its struggle to reach higher altitudes. After a modest recovery, ETH—and the rest of the crypto circus—is stuck in a critical resistance zone. It’s a game of “will it break out or collapse?” and folks, the bulls are scratching their heads, desperately trying to push through the $1,850–$2,000 wall. But guess what? The economy’s throwing punches, and the bulls are looking a little bruised.

On top of that, t

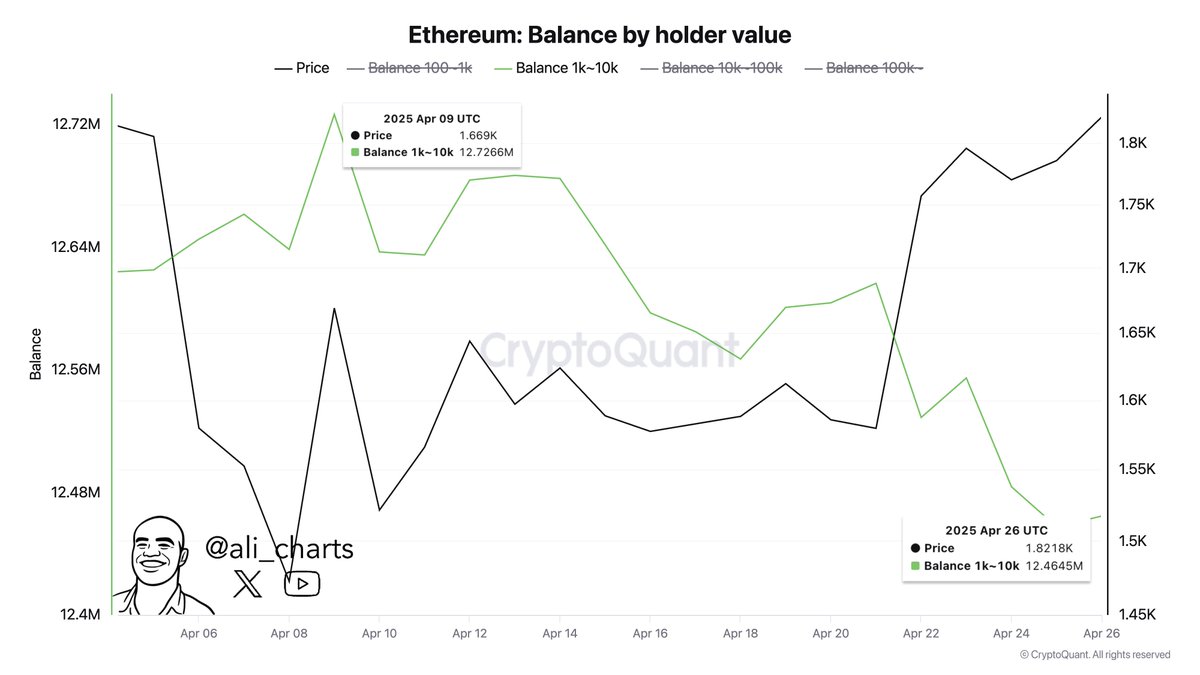

And speaking of trying, let’s talk whales. These big players, with more Ethereum than most people have savings, decided to take advantage of the recent price bump. According to CryptoQuant, they offloaded a whopping 262,000 ETH, worth about $445 million. That’s a whole lotta crypto leaving the boat! Looks like they’re either cashing out for a beach vacation or preparing for something messy. Either way, this selloff may be the thing that slows Ethereum’s climb—if the market doesn’t absorb that much selling pressure, we could be in for a rough ride.

Ethereum at a Crossroads As Whale Activity Sparks Caution

Ethereum’s been through quite the ride, losing more than half of its value since those glory days in December. It’s trying to recover, but let’s be real—it’s still under pressure, hovering just above $1,800, testing a critical zone. So, is it on the verge of a breakout, or is it just trying to catch its breath?

On shorter time frames, ETH is forming a little more structure, hinting at a possible bullish turn. The bulls are eyeing that sweet spot between $1,850 and $2,000, praying for a shift in market dynamics. But be warned, there’s still a storm of selling pressure. Analysts are watching closely, hoping that Ethereum can form higher lows and not just keep tapping out.

And let’s not forget the whales again. Top analyst Ali Martinez just dropped the bomb that those big players sold off 262,000 ETH during this latest surge. Yeah, that’s about $445 million—just casually disappearing into the wind. What does it mean? Maybe they’re expecting some volatility, or perhaps they’re just cashing out before things get worse. Either way, don’t expect any fireworks just yet.

If Ethereum can’t break above resistance and keep soaking up all that selling pressure, we could be looking at a drop back into the $1,500–$1,600 zone. But don’t worry, the real action happens if it stays above $1,750—because then, just maybe, the bulls get a second chance at glory. But let’s not get ahead of ourselves; there’s still a whole lot of waiting and watching to do.

Ethereum Price Tests Patience as Tight Range Persists

Right now, Ethereum’s hanging around $1,810, stuck in this tight band between $1,850 and $1,750. It’s like that moment before a storm hits—quiet, tense, and everyone’s waiting for something big. Bulls need to reclaim those higher levels to confirm that this isn’t just a fluke. If they can manage to break through the $1,850 barrier, we might see some real movement towards the $2,000–$2,100 zone. But remember, it’s not all sunshine and rainbows—there’s always that risk of rejection.

Here’s the catch: If Ethereum doesn’t manage to break out of that range and ends up doing a little fakeout, we could be looking at a retreat back down to $1,600 or worse. So, what’s next? Well, with the macroeconomic storm still brewing and the market on edge, Ethereum’s next move is going to determine whether the altcoin market goes full throttle or hits the brakes. Get ready, folks. Patience is wearing thin, and volatility is knocking at the door. 😬

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-05-01 06:42