This article discusses the recent performance of Berkshire Hathaway Inc. and its contrasting market valuation compared to tech giants, as well as Berkshire’s investment in Brazilian fintech company Nubank and its involvement with cryptocurrencies. The article also mentions Berkshire’s record cash reserves and the potential impact of Bitcoin ETFs on traditional financial institutions.

As a financial analyst, I’ve closely followed the investment insights of billionaire magnate Warren Buffett, who goes by the moniker “Oracle of Omaha.” In 2018, he voiced his disdain for Bitcoin, describing it as “rat poison squared” due to its perceived lack of inherent value. Buffett drew an analogy between Bitcoin’s appeal and the thrill of gambling at a roulette wheel.

Charlie Munger, Vice Chairman of Berkshire Hathaway, has recommended that the U.S. consider following China’s example and prohibit Bitcoin. He described Bitcoin as a biased gambling contract where the odds are significantly stacked against the participants.

Last year marked Berkshire Hathaway’s most profitable annumal performance to date. Notably, the company now holds crypto assets in its portfolio. This development could indicate a significant shift in the perspective of institutional investors towards digital currencies. As stated by prominent cryptocurrency advocate Anthony Scaramucci:

As an analyst, I’ve observed that Charlie Munger has been critical of cryptocurrencies. On the other hand, Warren Buffett chose not to invest in Microsoft despite their frequent bridge games with Bill Gates. However, presently, Buffett is a significant shareholder in Apple. It’s intriguing to ponder if it wouldn’t be ironic for him to consider purchasing Bitcoin as a protective measure for his substantial cash reserves? After all, “never say never.”

— Anthony Scaramucci (@Scaramucci) February 24, 2024

Value investing

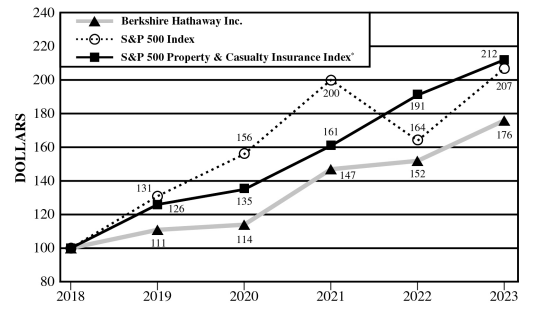

As a financial analyst, I would highlight that I personally find Berkshire Hathaway, under Warren Buffett’s leadership, among the most prominent companies in the S&P 500 index based on market value. This significant size places it in the vicinity of tech giants when considering market capitalization.

In spite of Berkshire Hathaway’s substantial stock growth, the company’s varied business holdings and robust insurance results have earned favorable opinions from industry experts.

Sector | 2023 (in millions) | 2022 |

Insurance-underwriting | $5,428 | $(30) |

Insurance-investment income | $9,567 |

$6,484 |

Railroad | $5,087 |

$5,946 |

Utilities and energy | $2,331 |

$3,904 |

Other businesses and miscellaneous items |

$14,937 | $14,549 |

Operating earnings | $37,350 | $30,853 |

As a analyst, I’ve noticed that Berkshire Hathaway’s large size poses challenges when it comes to identifying and executing substantial acquisitions. Buffett himself acknowledged this in his letter to shareholders. The company’s impressive cash reserves are evidence of its difficulty in finding attractive deals with reasonable valuations in the current market. Buffett has cautioned us not to expect “jaw-dropping results” from Berkshire in the near future.

Berkshire’s best year

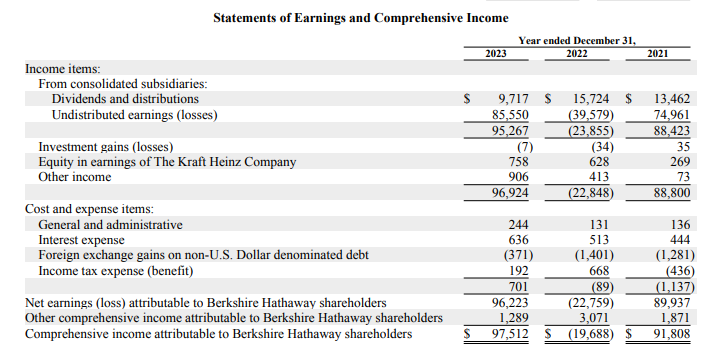

In my analysis, Berkshire Hathaway achieved its all-time highest annual profit in the previous year, reporting net earnings amounting to an impressive $97.1 billion. This represents a significant turnaround from the company’s substantial loss of $22 billion in 2022, which was primarily due to investment declines.

Last week, Berkshire Hathaway Inc.’s stock pulled back from approaching an all-time high, reducing its market worth to near $1 trillion. Although it had reached a market capitalization of over $925 billion, the stock finished the day with a 1.9% decrease following a previous day’s increase of 3.1%. This represented Berkshire Hathaway’s most significant one-day price change since August.

As a crypto investor reflecting on Berkshire Hathaway’s latest financial report, I’m pleased to note that their operating earnings for the fourth quarter surged to $8.48 billion from $6.63 billion in the previous year. The primary reasons behind this impressive growth were enhanced insurance underwriting profits and increased investment income. These improvements were driven by higher interest rates and more favorable weather conditions.

Although Berkshire Hathaway delivers strong results, its market value is noticeably different from that of current tech industry leaders. Its stock comprises two types: the costly Class A shares among them.

In the first quarter of this year, Berkshire Hathaway announced a net profit of $12.7 billion, marking a significant decrease of 64% from the previous year’s $35.5 billion. However, over the past twelve months, the company managed to generate approximately $7 billion in earnings from its investment portfolio alone. Additionally, Berkshire’s stock has experienced a growth of around 11% so far in 2024, outperforming the S&P 500’s total return of 8%.

Nubank

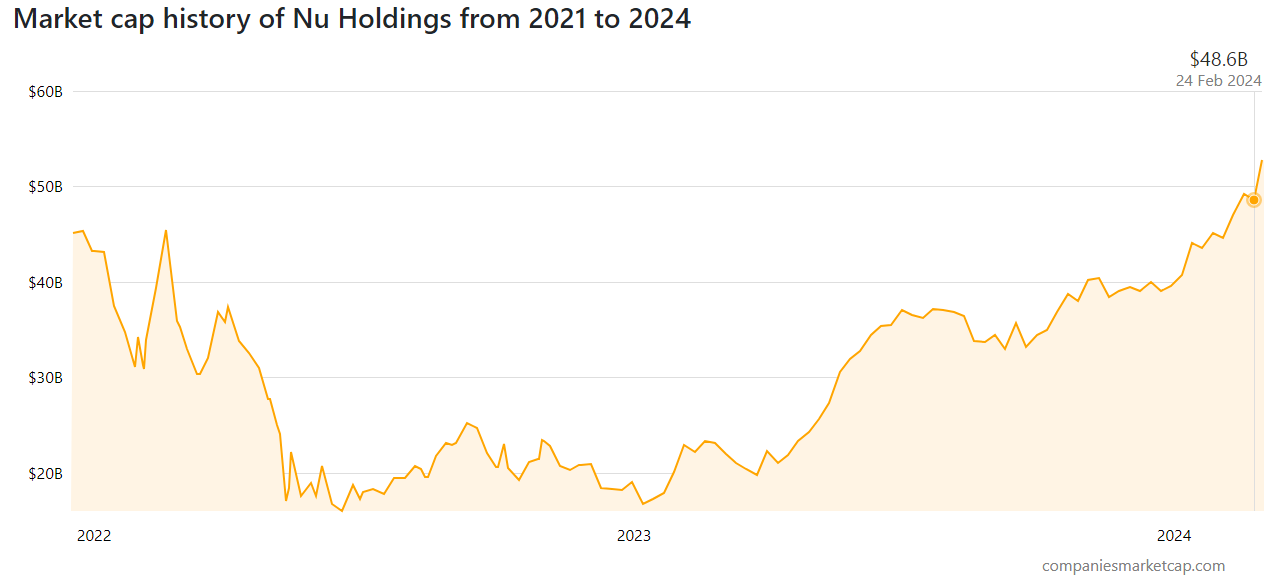

Brazilian fintech company Nu Holdings has introduced groundbreaking offerings such as Nucripto, enabling customers to deal in cryptocurrencies including Bitcoin and Ethereum. In June 2021, Berkshire Hathaway, led by Warren Buffett, invested $500 million in Nubank. Subsequently, during the IPO, they injected an additional $250 million, bringing their total investment in 2021 to a billion dollars.

In the year 2023, the value of Nu Holdings in Berkshire Hathaway’s portfolio experienced a significant surge, rising by more than 100%. This impressive growth surpassed the performance of other investments such as Amazon, Apple, Coca-Cola, and Bank of America. Consequently, Nu Holdings became the most profitable investment for Berkshire Hathaway during that period. Buffett’s decision to retain his stake in this company, despite his historically cautious stance on cryptocurrencies, indicates a positive view towards Nu Holdings’ future prospects.

Nubank provides digital financial solutions, allowing users access to a Bitcoin ETF via its investment wing, NuInvest. The company intends to profit from this emerging sector by delivering groundbreaking financial services and tackling customer frustration over exorbitant charges and subpar experiences.

Despite not fitting with Warren Buffett’s traditional investment approach, the impressive returns from cryptocurrencies, like Bitcoin’s 150% growth in 2023, could potentially impact Berkshire Hathaway’s investment strategies moving forward. The acquisition of Nubank by Berkshire indicates a deliberate expansion into the digital finance domain, hinting at a growing interest in crypto-related ventures despite Buffett’s personal misgivings.

Cashing in

In the first quarter of 2024, Berkshire Hathaway amassed a historic cash hoard totaling $189 billion, with the company further reducing its stock portfolio, notably offloading a substantial chunk of its Apple shares.

I discovered recently that the company sold approximately $19.8 billion in stocks during the first quarter of this year, while purchasing a mere $2.7 billion worth. Consequently, my stock portfolio, which was valued at $354 billion at the end of last year, is now worth $336 billion following this significant transaction.

Bitcoin ETF effect

As a crypto investor, I’ve noticed the significant strides made this year with the launch of spot Bitcoin ETFs. This development has sparked increased interest among investment firms towards digital assets and crypto businesses. BlackRock CEO Larry Fink, who was previously skeptical, now holds a strong conviction in Bitcoin as a distinct asset class. In his view, just like gold, Bitcoin plays a crucial role in safeguarding wealth.

Just like Fidelity, recognized for its initiatives in creating a comprehensive crypto platform that includes trading, ETFs, and custodial services, provides tools to assist individuals in confidently “trading cryptocurrencies,” reflecting the expanding acceptance and curiosity of conventional financial organizations towards digital currencies.

The SEC has a significant decision to make regarding the first Ether-holding ETFs in May. If approved, Wall Street’s entry into digital assets featuring Ethereum, the cryptocurrency with a market worth of $393 billion as its second-largest, will gain momentum.

Major financial firms such as Fidelity, BlackRock, and Invesco have submitted proposals to create Exchange-Traded Funds (ETFs) based on Ether. According to a Bernstein Research report released in February, it is highly likely that regulatory approval for these ETFs will be granted within the next year.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- TAO PREDICTION. TAO cryptocurrency

2024-05-20 01:16