As a seasoned crypto investor with a few market cycles under my belt, I’ve seen Bitcoin plummet before. The recent 10.5% drop to around $57,000 left me concerned but not entirely surprised. Market dumps due to events like Mt. Gox’s reimbursement and government liquidations are nothing new to the crypto world.

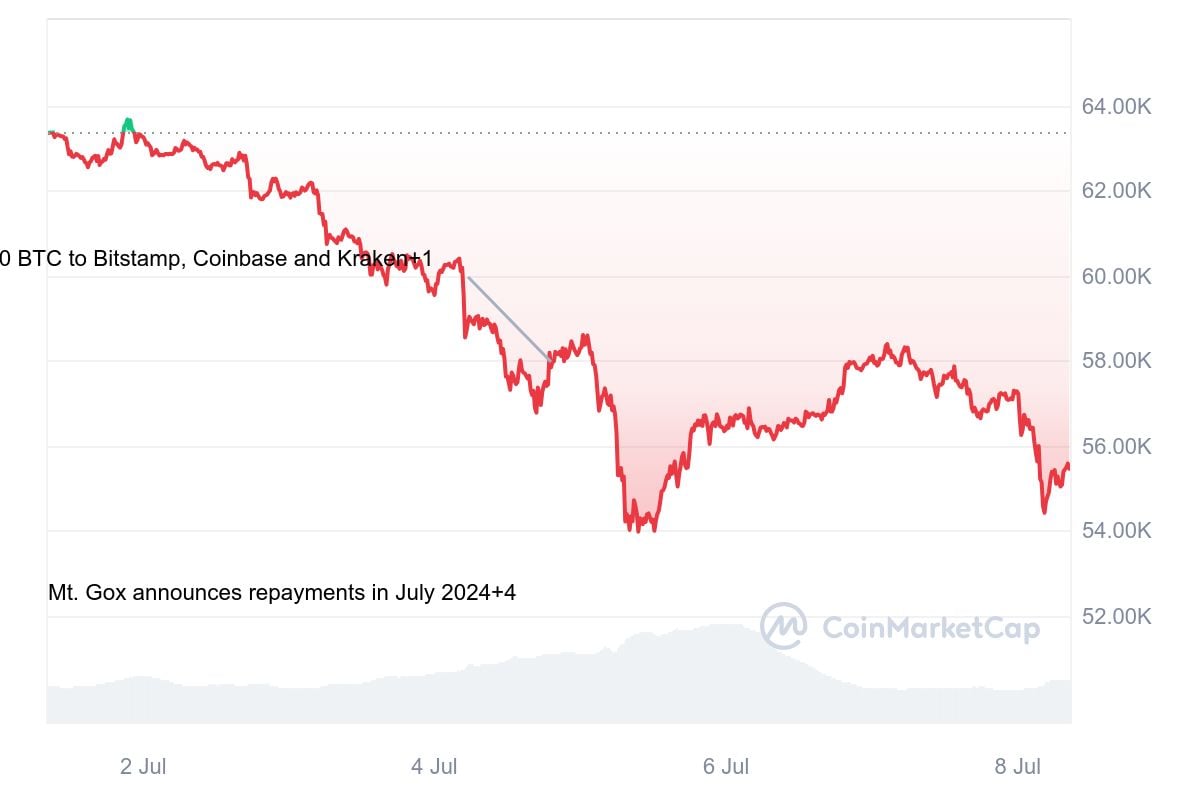

Over the last week, Bitcoin experienced a significant decline of approximately 10.5%, dropping down to roughly $57,000. The cryptocurrency reached its lowest point at $53,550 due to two primary reasons: firstly, concerns over Mt. Gox’s ongoing distribution of around 140,000 Bitcoins to its clients; and secondly, the German government’s sale of Bitcoin holdings.

As a researcher studying the cryptocurrency market, I’ve observed a significant shift in market sentiment based on recent data from CoinGecko. In just 24 hours, the combined market capitalization of all cryptocurrencies dropped by a staggering $170 billion. This substantial decline signifies a transition to extreme fear within the market.

Although the markets were open over the weekend, Bitcoin‘s optimistic investors were able to regain some lost territory. The latest closing price for a single coin was recorded at $58,250, which is very close to their target of $58,450.

The emotional response to this situation has been affected by reports of the German government selling off some of the seized Bitcoins in their possession. The German authorities have given indications that they might be intending to sell a portion of their Bitcoin hoard. According to Arkham, an observant source, Germany currently owns over 40,000 Bitcoins, which are valued at approximately $2 billion.

The RSI (Relative Strength Index) level for Bitcoin on a daily basis is close to the oversold mark of 30. This indicates that a turnaround or deceleration in the ongoing bearish trend could be imminent, implying a potential recovery.

Bullish signs

A significant factor to consider is the anticipated reduction in U.S. federal funds rate. With a persistent deceleration in employment expansion, the Federal Reserve is contemplating making these cuts to invigorate the sluggish labor market. Historically, lower interest rates have favored riskier assets like Bitcoin due to their diminished appeal compared to safer investments.

A significant sign is the return of investments into Bitcoin ETFs based in the United States following two straight days of withdrawals. These Bitcoin ETFs experienced their biggest inflows in a single month, amounting to $143.1 million.

Crypto expert Willy Woo notes a challenge in using on-chain data to forecast Bitcoin prices due to an oversupply of futures contracts in the market.

It’s a common misconception for many to focus on the wrong aspects of the current Bitcoin market situation. Let me clarify:

— Willy Woo (@woonomic) July 6, 2024

The hashrate fell by 7.7%, touching a four-month low of 576 EH/s. This marks a significant decrease from its all-time high on April 27. This decline implies that certain miners are reducing their mining activities, potentially due to the financial strain experienced within the Bitcoin mining sector following the halving event.

As a seasoned crypto investor, I’ve observed that when the Bitcoin market displays signs of miner sell-offs and operational reductions, it often signals that we’re approaching the market bottom. This pattern has played out in past cycles, with market recoveries following shortly thereafter.

Price analysis

As a seasoned Bitcoin investor, I’ve observed historical market trends revealing that each Bitcoin halving – an event where the reward for mining new blocks is cut in half – has been followed by a price growth phase lasting between 12 and 18 months, culminating in a market peak.

As a crypto investor, I’ve been keeping a close eye on the market since the last halving occurred back in April 19th of this year. However, it’s important to note that significant historical time frames, such as the 200-day moving average or the bull and bear markets, have yet to play out.

The pattern observed suggests the possibility of additional drops for Bitcoin, while Brandt’s chart graphically illustrates this downward trend, serving as a warning to investors.

As a market analyst, I’d interpret the current Bitcoin scenario as follows: At present, Bitcoin is experiencing a dip in demand without any substantial backing below. The most formidable resistance lies around $47,000. For a renewed bull run to materialize, it is crucial that Bitcoin manages to end and maintain its position above the crucial level of $61,000.

— Ali (@ali_charts) July 5, 2024

Based on Ali Martinez’s analysis, Bitcoin must rise to $61,000 in order to reignite the uptrend, as there are currently no significant support points present.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD COP PREDICTION

- USD PHP PREDICTION

- USD CLP PREDICTION

- EUR RUB PREDICTION

2024-07-08 11:35