Despite Sam Bankman-Fried’s pleas, the FTX controversy has come to an end with the ex-CEO being sentenced to 25 years in prison. The significant repercussions of this groundbreaking case are expected to last.

In November, the ex-CEO of a collapsed cryptocurrency exchange was found guilty of committing fraud on seven counts and conspiring to launder money. He received a sentence of over twenty years’ imprisonment in late March.

At the court hearing, three ex-colleagues of Bankman-Fried provided testimony, accusing him of instructing them to employ FTX resources for diverse reasons. These included settling Alameda’s financial obligations, contributing to political campaigns, and purchasing lavish properties in the Bahamas. They admitted to committing fraud and are now facing judgement.

Bankman-Fried admitted to errors in risk management, but firmly rejected any allegations of theft against him.

Crypto dream turned into nightmare

In late 2022, FTX, which had a valuation of $32 billion, faced bankruptcy after being hit hard by the broader cryptocurrency market crash. The reasons for its failure included the misappropriation of customer funds for risky investments in Alameda Research, a hedge fund with close ties to FTX. Additionally, it was revealed that the company’s founder, Sam Bankman-Fried, had also used customer money for his own high-risk projects, as determined by the court.

The legal troubles for crypto figurehead Bankman-Fried aren’t unique. Lately, Terraform Labs and its ex-CEO Do Kwon have been under scrutiny in a New York City fraud case. Since early last year, Kwon has been in Montenegrian custody.

The risk associated with that collateral was linked, not only to other similar assets but also to the platform itself. Suddenly, within just a few days, there was an unprecedented market crash affecting more than half of the correlated assets, with no buyers left in the market to provide liquidity. Simultaneously, there was a massive withdrawal of funds from the bank.

— SBF (@SBF_FTX) November 16, 2022

Changpeng Zhao, the ex-CEO of Binance, is set to be sentenced in April’s end for not implementing anti-money laundering measures within his organization. He consented to paying a penalty of $50 million and relinquishing his CEO position.

The aftermath of FTX’s downfall went beyond just financial damages, also harming the reputations of well-known individuals connected to the company. This event set off a domino effect of crypto collapses throughout the industry, leaving it still struggling to bounce back. Moreover, the occurrence brought about increased regulatory oversight and dampened public opinion towards cryptocurrencies at a pivotal moment when they were starting to gain broader acceptance in society.

No one cares until crash arrives

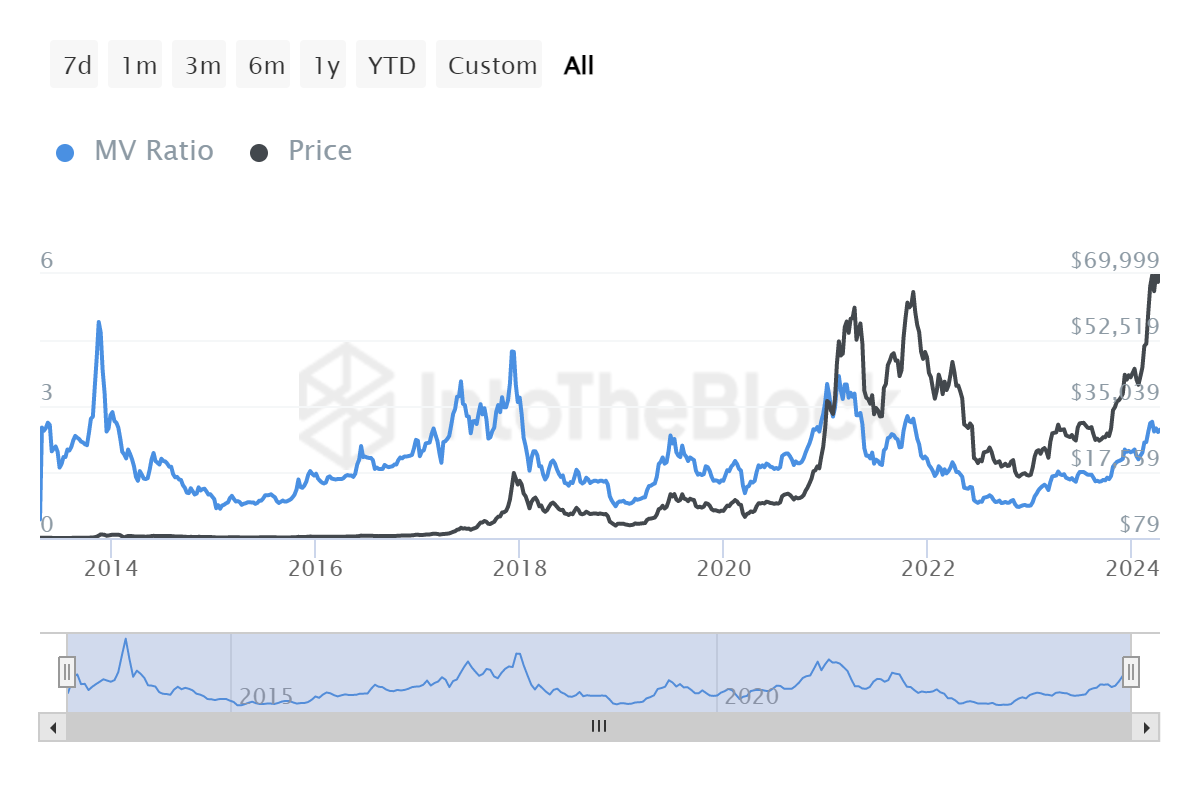

In periods of substantial market growth, investors tend to disregard risks. The rise of Bankman-Fried became noteworthy following the influx of crypto markets post-2020, drawing in fresh investors from conventional finance. Michael Saylor’s $250 million investment in Bitcoin represented a pivotal moment in this emerging phase.

The tribute to Sequoia FTX’s demise highlights the oversight that venture capitalists may occasionally commit in carrying out thorough checks before jumping into the lucrative world of cryptocurrencies.

Alameda Research relied heavily on FTT tokens for funding, believing the value of these tokens and FTX users’ commitment would stay consistent. Customers and investors weren’t overly concerned about verifying Alameda’s leadership or checking if they could withdraw funds from FTX at that moment.

Regulators to choose paradigm

In simpler terms, one possible solution to address the issue at hand is through regulation. As SEC Chair Gary Gensler stressed after the FTX incident, “Regulation is crucial for crypto platforms. The suspected fraud by Mr. Bankman-Fried serves as a reminder that these platforms need to follow our laws. Adherence to regulations ensures investor protection and implements proven safeguards like segregating customer funds and maintaining business separation.”

While converting the cryptocurrency sector into conventional finance might reduce fraud to some extent, it may not completely eliminate it. A more effective approach could be strengthening regulatory guidelines and encouraging self-regulation among crypto industry players.

During market peaks, it’s essential to carefully consider these questions to avoid missing out on important opportunities or potential risks that could impact our future financial well-being.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

- SEILOR PREDICTION. SEILOR cryptocurrency

- USD CLP PREDICTION

- Best JRPGs That Focus On Monster Hunting

- COW PREDICTION. COW cryptocurrency

2024-04-14 04:12