What is happening?

As a seasoned analyst with over two decades of experience in the financial sector, I’ve seen my fair share of market turbulence and regulatory investigations. The ongoing scrutiny of Tether by the U.S. federal government is certainly not unprecedented, but it’s undeniably significant given the stablecoin’s massive influence on the crypto market.

Reports indicate that Tether, the company behind the stablecoin USDT, is being probed by U.S. authorities over possible breaches of anti-money laundering regulations and sanctions rules, as suggested by The Wall Street Journal.

According to reports, federal investigators, headed by the U.S. Attorney’s Office in Manhattan, are looking into allegations that certain parties may have utilized Tether for illegal transactions, but at this point, there are no publicly announced charges.

After reviewing this report, the value of Bitcoin decreased from $68,600 to $66,589, while Tether momentarily dropped to 99.81 cents, and the overall cryptocurrency market responded to the news by experiencing fluctuations.

According to Paolo Ardoino, the CEO of Tether, he has refuted any claims that an investigation into the company is currently taking place. He emphasized on X that at this point, there’s no substantiating evidence indicating that Tether is being examined.

At Tether, we frequently interact with law enforcement personnel to ensure that unscrupulous countries, terrorists, and criminals do not abuse USDt. Rest assured, if an investigation involving us were to occur, we would be made aware. Therefore, we can verify that the accusations in… are unfounded.

— Paolo Ardoino 🤖🍐 (@paoloardoino) October 25, 2024

Why Tether matters

Tether, the organization behind the stablecoin known as USD Tether, presents a digital version of the U.S. dollar, and its total value in circulation is around 120 billion dollars at present.

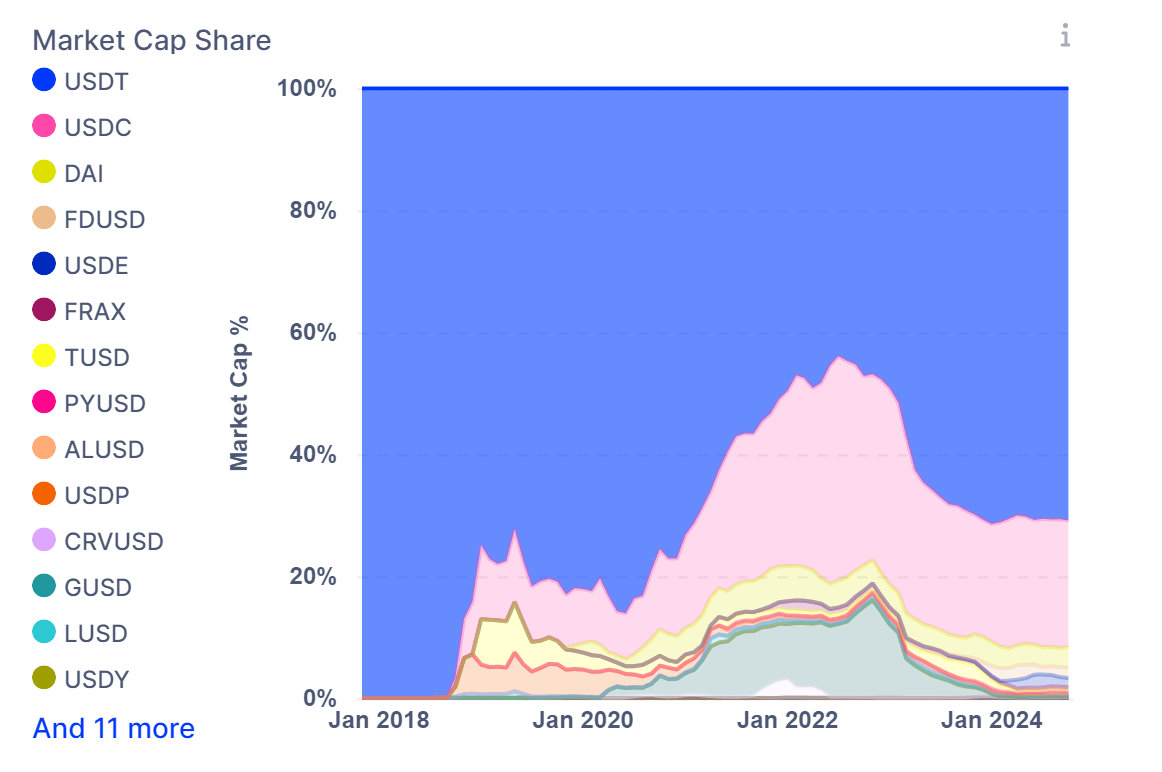

USDT, often serving as a substitute for the U.S. dollar within the realm of cryptocurrencies, ranks third in terms of value among all digital currencies. It is also the most commonly traded due to its use in crypto markets where conventional money is hard to reach.

Since stablecoins are the main access points connecting traditional (fiat) currencies and digital assets, a growing supply of stablecoins might indicate upcoming market surges, suggesting that investors have more purchasing power.

Significantly, in August, Tether produced approximately $1.3 billion in USDT just following Bitcoin’s drop to a five-month low of about $49,500. This action underscores the increased interest in USDT when cryptocurrency markets experience a downturn.

USDT, a popular digital currency, has seen widespread usage, boasting around 330 million digital wallets. Yet, this figure doesn’t include countless others who utilize USDT through centralized systems. The user base has been growing rapidly, with each successive quarter surpassing the one before it in terms of growth rate.

Reports indicate that Tether, a company known for issuing stablecoins, might be planning to loan some of its substantial earnings to commodity trading businesses. If this happens, it could signify a significant change in the usual financial landscape where these firms typically rely on banks for credit, as suggested by Bloomberg.

What’s next for Tether?

Reports indicate that the U.S. Treasury Department might impose penalties on Tether, as it’s believed to be utilized by sanctioned parties. This information comes from the Wall Street Journal, which also mentioned that Tether has faced scrutiny over suspected banking fraud accusations from its stakeholders for a prolonged period.

In reaction, Tether dismissed the article as “unsubstantiated reporting,” claiming it makes “baseless accusations” without concrete evidence.

The company made clear that no official sources have validated these rumors, and they are unaware of any ongoing investigations regarding their operations. Moreover, Tether underlined their commitment to working closely with law enforcement agencies to deter any misuse of their USDT token and other digital currencies.

Additionally, it’s been reported that along with the Manhattan investigation, the United States Treasury Department has contemplated imposing sanctions on Tether. This is because Tether is extensively utilized by entities and individuals subject to U.S. sanctions, as suggested by the Wall Street Journal.

Earlier, attention was primarily on if Tether had enough reserves to uphold the $1 worth of its token. However, in 2021, top Tether executives were warned by federal prosecutors in Washington about possible charges linked to suspicions of misleading banks during fund transfers.

The investigation later shifted to the U.S. Attorney’s Office in Manhattan, yet two years have passed without any charges or enforcement actions.

As of now, the U.S. Attorney’s Office has not issued an official statement on the matter.

Despite the news, Tether’s USDT has shown resilience, dipping only briefly to about 99.69 cents.

Read More

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- PlayStation and Capcom Checked Another Big Item Off Players’ Wish Lists

- EUR CAD PREDICTION

- XDC PREDICTION. XDC cryptocurrency

- Black Ops 6 Zombies Actors Quit Over Lack Of AI Protection, It’s Claimed

- APU PREDICTION. APU cryptocurrency

- POL PREDICTION. POL cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- JST PREDICTION. JST cryptocurrency

2024-10-26 15:22