It was a day much like any other, except for the fact that the market decided to throw a rather large tantrum. The liquidation wave, you see, was driven by a bunch of traders who thought it was a good idea to bet against the tide. And when the tide decided to come in, well, let’s just say it wasn’t pretty for those late to the party. 🌊💥

Why the Short Squeeze Happened

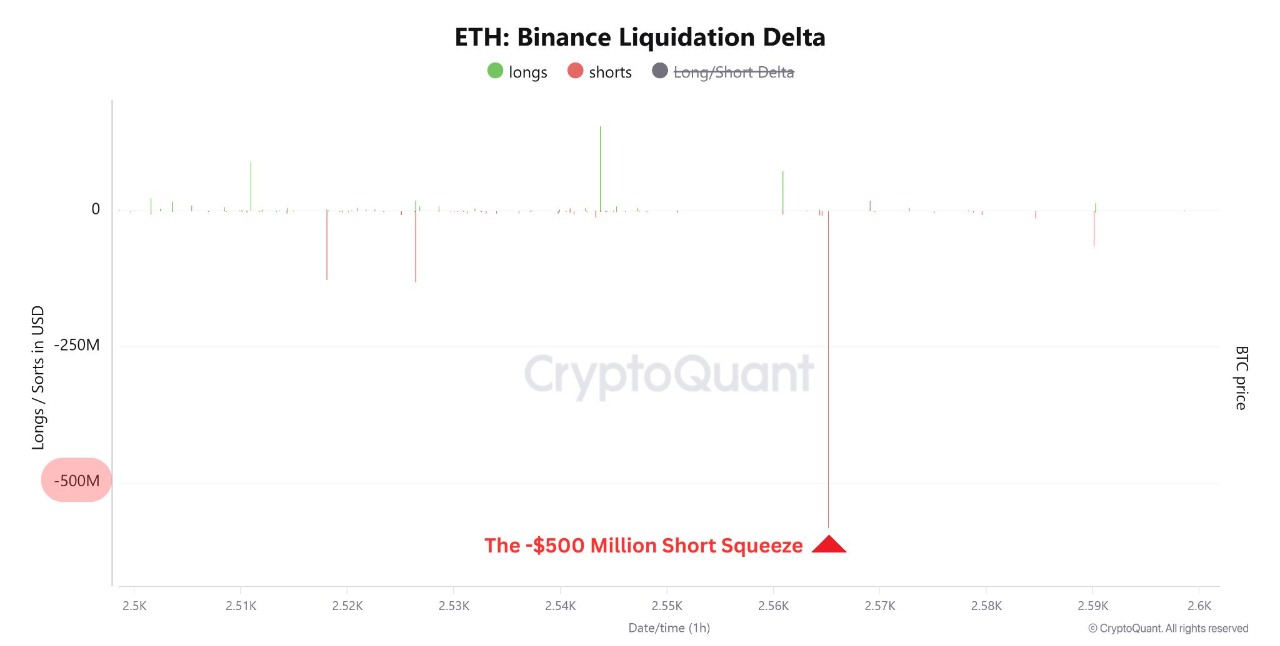

According to the report, the liquidation cascade was primarily triggered by overcrowded leveraged short positions. As Ethereum began its valiant recovery from recent lows, traders who entered short positions too late found themselves in a rather uncomfortable position. 🤦♂️

Their forced closures activated market buy orders to cover those positions, creating upward pressure and accelerating the rally. This dynamic rapidly flipped funding rates into positive territory, signaling a shift toward bullish momentum in the derivatives market. It’s like when you try to hold back a rubber band, and it snaps back with a vengeance. 🏹

Rising ETH Deposits to Derivative Exchanges

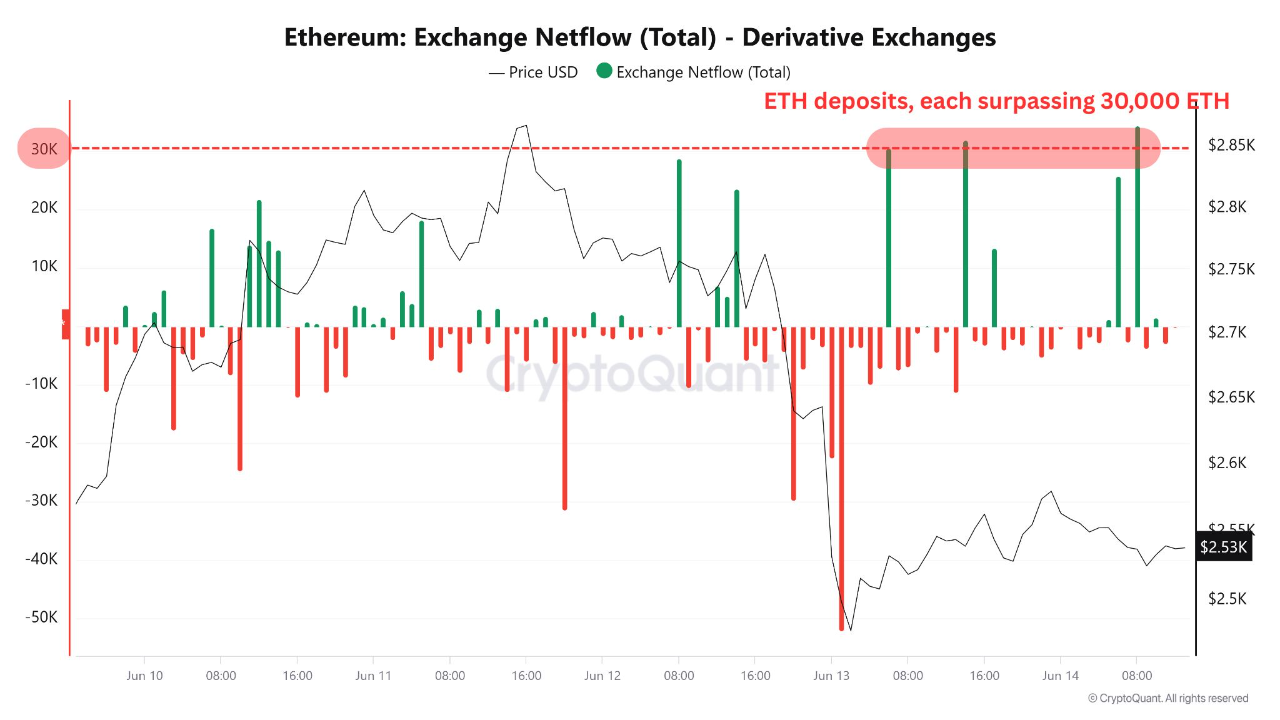

In parallel with the short squeeze, CryptoQuant noted a substantial increase in Ethereum transfers to derivative exchanges. Starting June 13, multiple transactions surpassed 30,000 ETH each—indicating a strategic influx of capital into futures and margin platforms. It’s as if the market decided to throw a big, fancy party, and everyone was invited. 🎉

These inflows may serve several purposes:

- Hedging Activity: Traders could be depositing ETH to hedge existing spot exposure through derivative instruments. It’s like buying an umbrella when the sky looks a bit too blue. ☂️

- Short Position Setup: The ETH could also be used to establish new short positions if traders expect a pullback following the squeeze. It’s the market’s version of “I told you so.” 🙄

What Comes Next?

The interplay between liquidations, funding rates, and exchange flows will be crucial in shaping Ethereum’s next move. While a short-term correction may occur to reset overheated funding rates, the increasing ETH balances on exchanges suggest a new phase of market volatility could emerge. It’s like a rollercoaster, but with more numbers and less screaming. 🎢

Whether this fuels further upside or sets up bearish positioning depends on how derivatives traders respond in the coming sessions. Traders are advised to keep a close watch on funding rate shifts and ETH netflows, as these signals will likely determine the strength and direction of Ethereum’s price trajectory in the near term. It’s a bit like trying to predict the weather, but with more spreadsheets and less raincoats. 📊🌈

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Who Is the Information Broker in The Sims 4?

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Top 8 UFC 5 Perks Every Fighter Should Use

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

2025-06-14 22:50