Ah, the grand spectacle of U.S. spot bitcoin ETFs, gathering a princely sum of $3.06 billion in just one week – as if the digital coffers could ever be full! Meanwhile, BlackRock’s IBIT, like a patient noble awaiting his coronation, is but 11,314 BTC shy of the legendary 600,000 mark. Shall he claim the throne?

Three Bitcoin ETFs Reign Over Nearly 1 Million BTC – The Empire Strikes Digital

According to the archives at sosovalue.com, since the dawn of 2024, these ETFs have attracted a lavish $38.43 billion – with last week alone adding a sumptuous $3.06 billion. On a particularly dizzy Friday, BlackRock’s IBIT coquetted with $240 million more, swelling its digital treasure. As the sun set on April 27, 2025, BlackRock’s own ledger revealed IBIT clutching 588,686.91 BTC, worth a cool $55.3 billion in today’s cryptic currency.

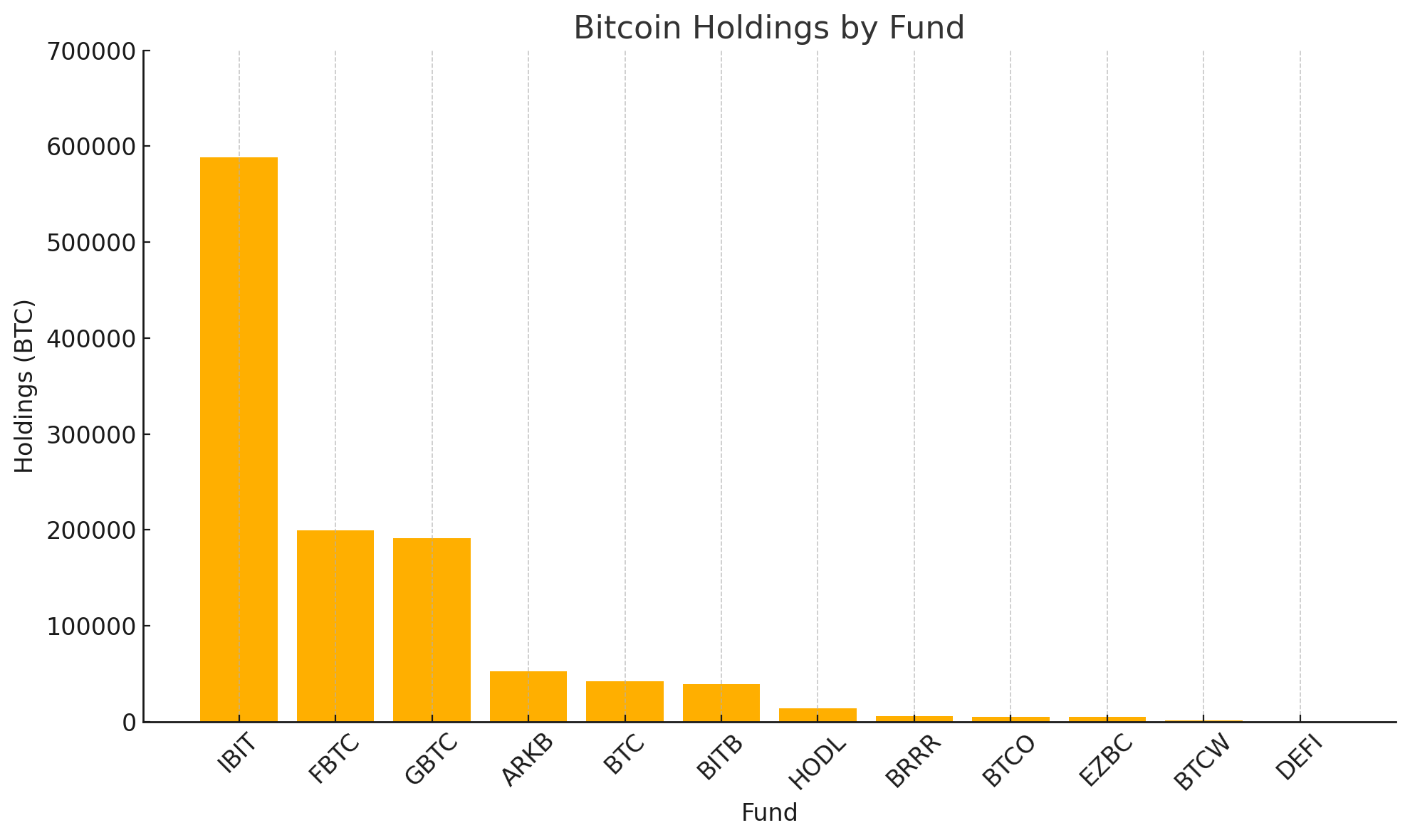

In a world swirling with roughly 19.85 million BTC, IBIT lordly controls 2.97% of the floating coins. Fidelity’s FBTC, ever the diligent steward, guards 199,684.83 BTC, a princely $18.76 billion. Meanwhile, Grayscale’s GBTC clutches 191,190.971 BTC, valued at about $17.9 billion – enough to make one wish for a horse and carriage. Together, these three lords watch over 979,562.711 BTC, a staggering $92 billion fortune, ruling nearly 5% of all circulating Bitcoin. A kingdom fit for kings and savvy traders alike.

But lo! The drama continues beyond these titans. Three other ETFs boast more than 35,000 BTC each, including Ark Invest’s ARKB with a comfortable 52,604 BTC – enough to impress even the most stoic Russian noble. Grayscale’s Bitcoin Mini Trust wields 42,079.29 BTC, while Bitwise’s BITB hangs on to 39,020.06 BTC. Together, they control about $12.5 billion, a respectable 0.67% slice of our hefty 19.85 million BTC pie. And just to add a little flair, six additional funds (HODL, BRRR, BTCO, EZBC, BTCW, DEFI) collectively clutch some 32,646 BTC, crossing the $3 billion mark – modest peasants in this grand court but respectable nonetheless.

In the grand tally, the U.S. spot bitcoin ETFs hold a magnificent total of 1,145,912.217 BTC, a princely sum worth $107.70 billion as of late April 2025. This hoard accounts for a majestic 5.77% of all Bitcoins in circulation, a force to be reckoned with. Factor in international ETFs and the holdings of dust-coated public and private megacorps, and one can only imagine the mountain of satoshis buried deep beneath the surface of the market.

Such is the age of digital fortune, where fortunes are amassed not in gold or grain, but in cryptographic enigmas, all under the watchful eye of funds that might as well be the new aristocracy – one meme coin away from a revolution, or a very sassy emoji rally. 💰👑

Read More

- AI16Z PREDICTION. AI16Z cryptocurrency

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Tainted Grail: How To Find Robbie’s Grave

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- LUNC PREDICTION. LUNC cryptocurrency

2025-04-27 20:28