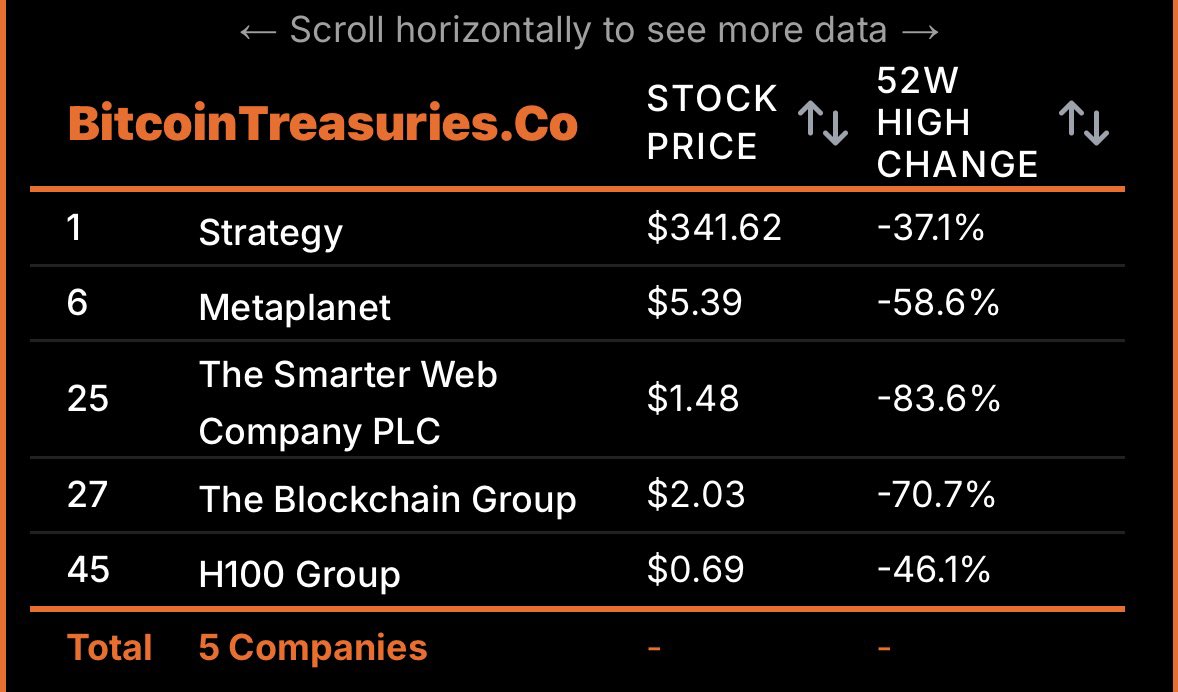

Over the past 10 weeks, Bitcoin Treasury Companies (BTCTCs) stocks have plummeted by 50-80%, sending investors into a tailspin of panic and confusion.

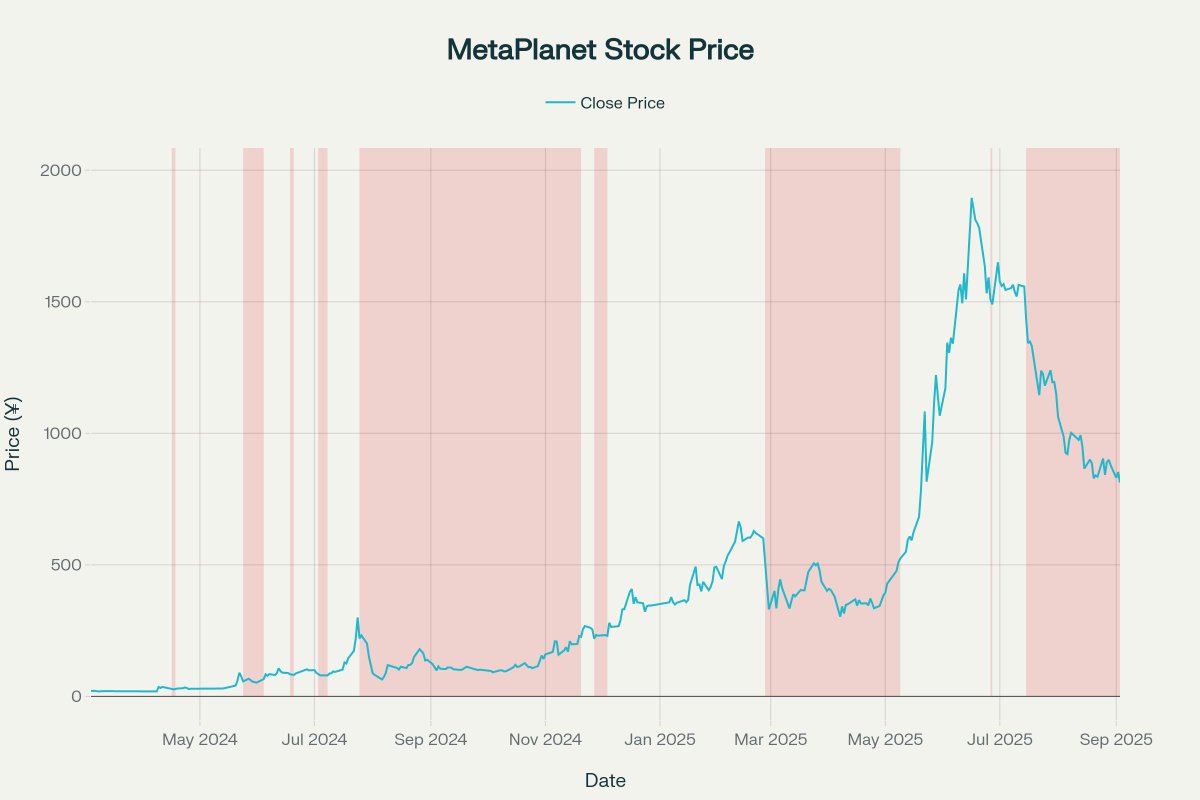

The tale of Metaplanet (MTPLF) serves as a perfect example of the chaos that reigns supreme in this volatile market. In just 18 months, it has survived no fewer than 12 “mini-bear markets.” Now, one might wonder: are BTCTC stocks simply a mirror of Bitcoin’s wild mood swings, or do they have their own set of internal demons to deal with? 🧐

When BTCTCs’ Stocks Are Riskier Than Bitcoin Itself

In the past 10 weeks, Bitcoin Treasury Companies (BTCTCs) stocks have taken a nosedive, recording 50-80% declines. This has sent shockwaves through the investment community, with Metaplanet ($MTPLF) being a prime example of the chaos.

Within 18 months, Metaplanet has endured 12 mini-bear markets-ranging from single-day drops to prolonged downtrends. On average, each decline was about -32.4% and lasted 20 days. The worst phase saw the stock plummet by 78.6% over 119 days (July 25 – November 21, 2024). Talk about a rollercoaster ride! 🎢

The burning question is whether these downturns are solely influenced by Bitcoin’s (BTC) volatility.

According to analyst Mark Moss, the data paints a curious picture. Only 41.7% (5 out of 12) of Metaplanet’s corrections coincided with Bitcoin’s down cycles. The other half? Well, that’s where things get interesting. These declines were often triggered by internal corporate factors, such as option issuance, capital raising, or the shrinking “Bitcoin premium”-the gap between the stock price and the actual value of BTC holdings. 🤑

Still, Mark observed a partial link.

Specifically, Metaplanet’s deepest declines (like -78.6% or -54.4%) tended to overlap with significant Bitcoin drawdowns. This suggests that once BTC enters a high-volatility phase, BTCTC stocks often remain weak for longer, suffering a double whammy from both market and internal dynamics. It’s like being caught in a storm while your boat has a leaky hull. 😅

Of course, Bitcoin remains the dominant influence. However, corporate variables act as the real “leverage,” amplifying BTCTCs’ volatility far beyond that of BTC itself. If Bitcoin can be understood through a 4-year cycle, BTCTCs behave like “4 cycles in a single year.”

“So, in summary, the partial synchronization suggests that BTC vol does influence Metaplanet…” noted Mark Moss, scratching his head and wondering if he should have stuck to investing in socks. 🧦

For investors, holding BTCTCs is not merely a bet on Bitcoin’s price, but also a gamble on corporate capital management, financial structure, and business strategy. In short, it’s like trying to catch a falling knife while juggling chainsaws. Good luck with that! 🔪🔥

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- How to Unlock & Upgrade Hobbies in Heartopia

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- EUR USD PREDICTION

- Sony Shuts Down PlayStation Stars Loyalty Program

- God Of War: Sons Of Sparta – Interactive Map

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

2025-09-04 08:52