Sharplink Gaming, like a cunning chess player spotting a pawn grossly undervalued on the board, has unleashed its share buyback program, hailing these “below-the-net-asset-value” gambits as nothing less than “immediately accretive.” Armed with a colossal ether hoard and zero crippling debt, the company pirouettes gracefully on the tightrope of capital returns.

Sharplink’s Dance of Dollars and Decimals: Repurchases Backed by Ether, Not Empty Promises

Sharplink Gaming, Inc. (Nasdaq: SBET) announced on a sun-drenched September 9 that it has embarked upon a journey of stock repurchases, a noble crusade to “drive long-term stockholder value.” Think of it as ethereum’s Robin Hood, plucking shares from the marketplace while they gallop sadly below net asset value, clutching their invisible price tags.

Sharplink claims their common stock is “significantly undervalued,” a phrase investors love almost as much as the cool relief of a pooled ether bath. They’ve already snatched approximately 939,000 shares at a casual $15.98 a pop – pocket change if you’re swimming in ethers – and promise to keep buying, fueled by cold, hard cash, the magical yields of staking, or whatever financial wizardry conjures itself overnight.

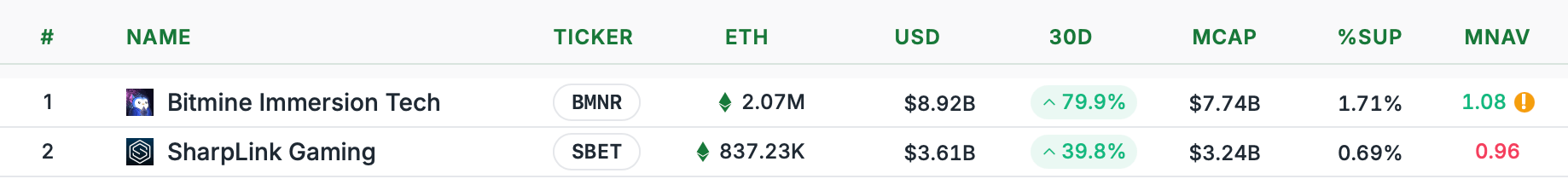

Market sophisticates warily peer at the depressed mNAV, debating whether it’s a glittering “bargain” or a siren-song leading straight to the dreaded value trap-a peril deserving of mythological status in ETH-linked equities folklore. Sharplink’s mandarins boast a balance sheet glittering with approximately $3.6 billion in ether, utterly unburdened by the chains of debt. That vast ether cache is almost entirely staked-a word which, in this context, means continues to conjure fresh revenue streams, like magic beans for sustaining operations and rewarding patient investors alike.

Notably, the company has politely declined to tap into its at-the-market facility while shares languish beneath NAV, knowing full well such moves would dilute their coveted ether per share (the horror!). But, like a poker player wary of revealing their hand too soon, they reserve the option to flex this mechanism-if only market whims become sufficiently courtly.

“Maximizing stockholder value remains our top priority,” assures co-CEO Joseph Chalom, a man whose steely gaze pierces through the ether haze, extolling a “position of strength” fortified by ether reserves and the gentle drip of staking income. He extols discipline in capital allocation, especially share repurchases, while salivating over Ethereum’s long-term prospects as though it were a fine aged cheese.

If this repurchase ritual endures, even as shares twirl beneath their NAV spotlight, the ether-backed ledger and staking manna might just swell the per-share ether buffet, delighting the lucky holders who remain. Of course, if the ether moon slips or the discount stubbornly refuses to narrow, our managers might find their attentions loyally diverted elsewhere, testing the ironclad vow to continue this buyback ballet.

Meanwhile, the pantheon of U.S. and global crypto treasury outfits pirouettes nervously, some waltzing through clouds of depressed or erratic mNAVs even as token prices rise-no easy feat! These pratfalls owe their origins to equity dilution, absent redemption exits, and business strategies tropically mystifying. Archived stats reveal ETHZ, BTCS, and ETHM sharing in the mNAV misery this week, proving that market sorrows are indeed universal.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Top 8 UFC 5 Perks Every Fighter Should Use

- Who Is the Information Broker in The Sims 4?

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

2025-09-10 21:29