From the shadows of a bustling marketplace, where whispers of prosperity mingle with the scent of kimchi, emerges the data from Kaiko Research. It unveils an incredulous tale: South Korea’s won, that oft-overlooked currency, dances its way into the annals of crypto history, staking claim as the second most influential fiat in digital trading, following only the mighty U.S. dollar.

In the Arena of Crypto, the Won Struts While the Dollar Strolls

South Korea, that energetic engine of financial innovation, remains a veritable cauldron of digital asset endeavor. Kaiko’s monumental figures reveal that the won has not merely entered the fray; it is elbowing its way forward, trailing only behind the dollar in terms of fiat-crypto trading volume. What an unparalleled spectacle—like a sumo wrestler trying to sneak past a guarded donut shop!

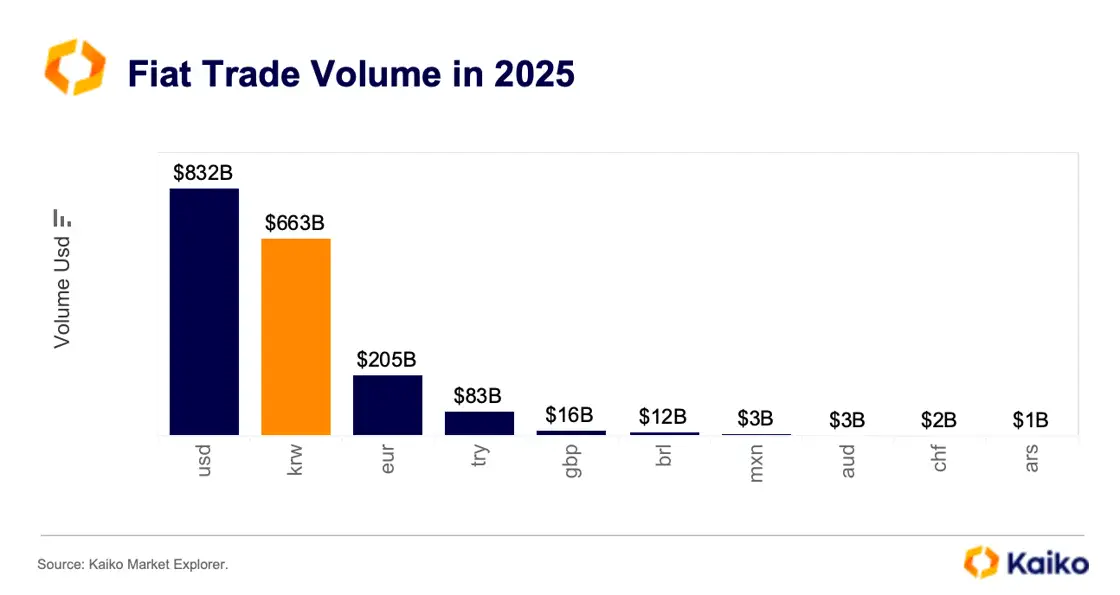

All the while, the U.S. dollar’s trades have totalled an astonishing $832 billion. The won, not one to shy away from a challenge, follows closely, boasting a whopping $663 billion since the dawn of 2025—just a mere $169 billion behind. Alas, the won has gallantly outpaced Europe‘s euro, Turkey’s lira, and the ever-reserved U.K. pound sterling. Take that, you financial pretenders!

Yet, as Kaiko Research sagely notes, persistent barriers—like fragmented markets, dismal stablecoin adoption rates, and that tormenting ‘kimchi premium’—continue to impose their burdens on institutional growth and innovative spirit within Korea’s crypto domain. How delightfully ironic, that innovation thrives while tethered by tradition!

At the time of this observation, bitcoin stood tall at around $1,150 higher than global averages, nestled at the luxurious price of $105,116 per coin. Meanwhile, Cryptoquant data indicates that this kimchi premium, with its charmingly inflated nature, has remained high since May 22, persisting 2.46% above the global weighting of its comrades.

The last time bitcoin deigned to dip below the global average was a distant May 21. Ever since, the premium has established itself in an enviable position, throwing occasional tantrums while wielding its power. Kaiko’s insightful report reveals a staggering notion—South Korea stands as the “second largest crypto market in the world,” with nearly one in three South Koreans clutching some form of digital currency, doubling the adoption rate of their American counterparts! Such a delicious twist of fate, wouldn’t you agree?

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

2025-06-18 17:57