As a long-term crypto investor with some experience in the market, I find Willy Woo’s analysis on Bitcoin hash ribbons and miner capitulation intriguing. The ongoing miner capitulation, as indicated by the hash ribbons, is a significant development that could potentially impact the price of Bitcoin.

Aanalyst shared that Bitcoin typically bounces back following downturns similar to its current bearish trend.

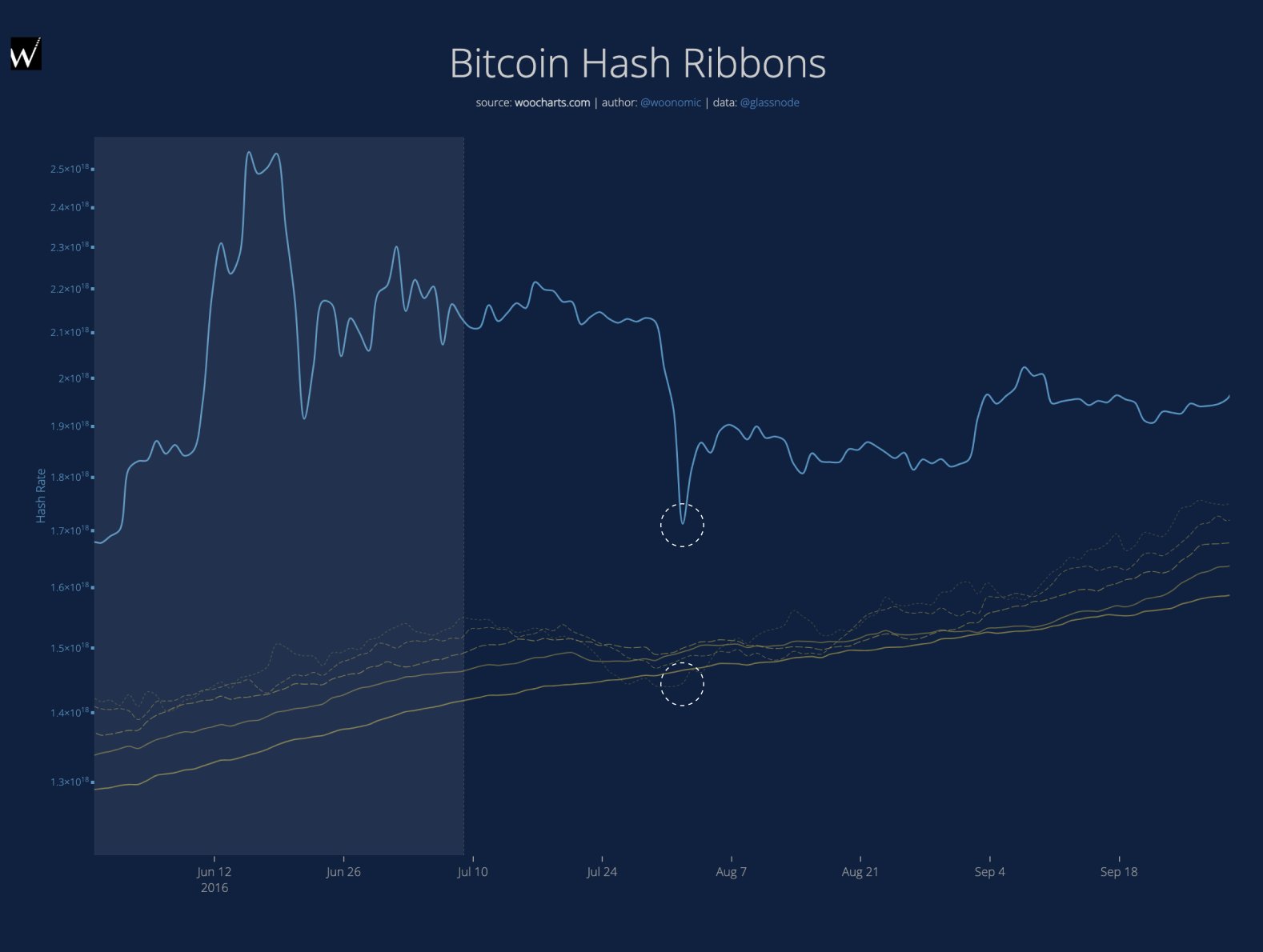

Bitcoin Hash Ribbons Show Miner Capitulation Is Ongoing

As a researcher studying the Bitcoin market, I’d like to draw your attention to a recent post by analyst Willy Woo on X. In this article, Woo explores the significance of Bitcoin’s hashrate in relation to its price recovery. The term “hashrate” represents the collective computing power that miners have dedicated to the network at present.

As an analyst, I would interpret an upward trend in this metric as a reflection of the current state amongst chain validators. When this indicator increases, it implies that miners find the chain alluring to validate transactions at present.

An opposite trend in the metric may signify that certain miners have chosen to withdraw from the Bitcoin network, possibly due to current mining activities being unprofitable for them.

To determine if there’s any lasting pattern in the occurrence of these behaviors, consider examining the “hash ribbon” indicator. This tool contrasts a short-term moving average (MA) of the hashrate with a longer-term one.

As a researcher studying market trends, when the number of miners dropping below a certain threshold compared to the total, I observe a mass surrender or give-up within their group. Conversely, a crossover where the previous figure exceeds the current one signals an end to the capitulation among this specific cohort.

What is the connection between Bitcoin’s hash ribbons and its pricing, you ask? According to Woo’s observation, Bitcoin exhibits price recuperation following the demise of “weak miners” and the subsequent recovery of the hash rate. This occurs during the market phase when capitulation has been completed.

The following chart, provided by the analyst, illustrates the current status of miner participation in the hash ribbons.

According to the graph, the Bitcoin hash ribbons indicate that miners are experiencing capitulation. This downturn for miners can be attributed to the Halving event that occurred in April.

As a network analyst, I can explain that halvings represent recurring occurrences taking place every four years. During these events, the rewards given to miners for adding new blocks to the Bitcoin blockchain are reduced by half permanently. These incentives serve as compensation for their computational efforts in maintaining the network’s security and validating transactions.

As an analyst, I’d put it this way: The significant portion of income for this group comes from these rewards. Consequently, slashing them in half would undeniably impact their financial situation. Given this reality, it’s no wonder the mining hashrate has been on a downward trajectory lately.

The latest miner capitulation is noteworthy because the hash ribbons have been signaling this trend for an impressive 61 consecutive days. As Woo points out, “this is a remarkable occurrence given the prolonged period of miner capitulation following the halving event.”

For comparison, here is a close-up view of how the stressful mining period in 2016 looked like:

As a researcher studying historical trends in the mining industry, I’ve discovered that it took miners approximately 24 days to recover from a downturn in the past. This is significantly less time than the current cycle’s capitulation event has lasted so far. In fact, during the 2020 event, the hash ribbons exhibited a reverse cross in just eight days.

It’s yet uncertain when the hash ribbons will intersect once more and if the miner recovery will result in an uptick in Bitcoin’s price.

BTC Price

At the time of writing, Bitcoin is trading at around $63,900, down more than 4% over the past week.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

- USD ZAR PREDICTION

- USD COP PREDICTION

- USD CLP PREDICTION

- USD PHP PREDICTION

- G PREDICTION. G cryptocurrency

2024-06-22 07:12