What’s happening?

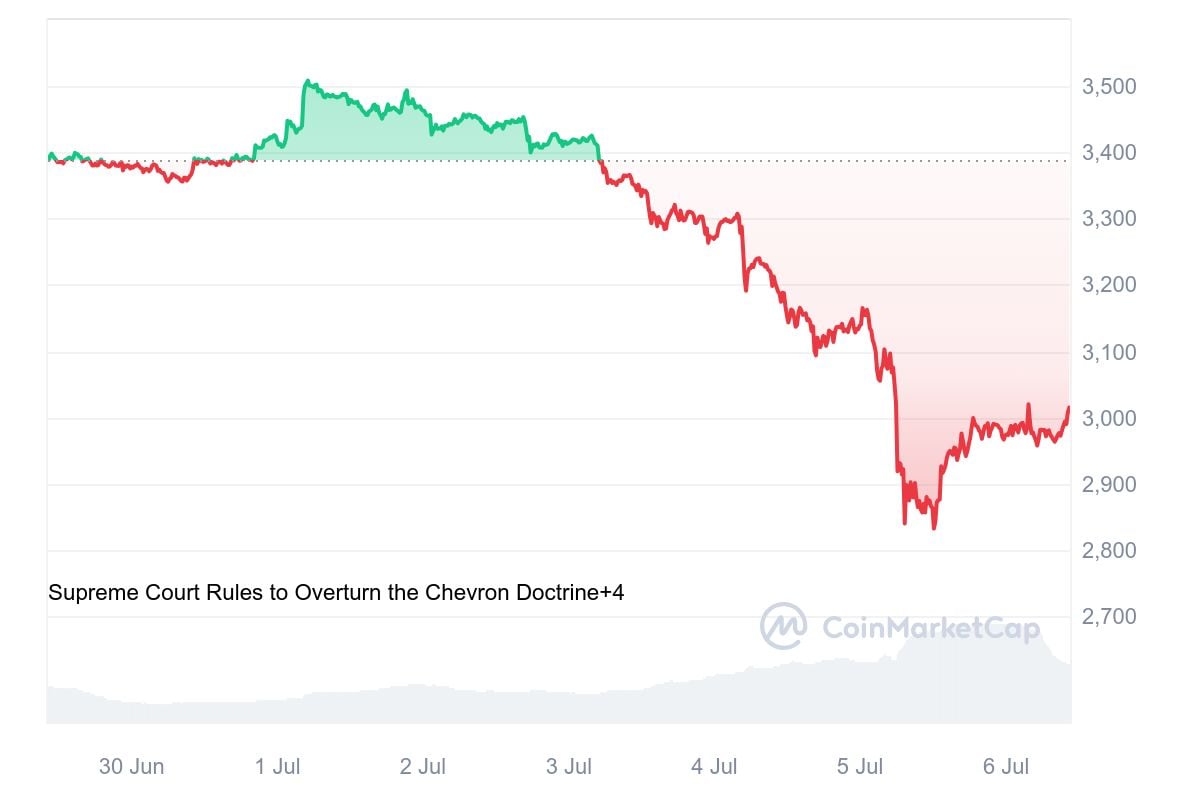

As a seasoned crypto investor with a few years of experience under my belt, I’ve seen my fair share of market volatility and price swings. The recent sell-off crisis in Ethereum has been disheartening, to say the least. With the price dropping below $2,900 and a massive capital outflow of over $119 million, it’s a tough time for ETH holders.

Over the last week, Ethereum has experienced a significant downturn, causing its value to fall beneath the $2,900 mark.

Over the past few weeks, there has been a significant drain in investment from Ethereum, as indicated by a recent report from CoinShares. This outflow represents the largest since August 2022, with a total value of approximately $119 million withdrawn from the cryptocurrency.

As a crypto investor, I’ve noticed that Ethereum’s price drop last week from a high of $3887 to a low of $3232 represented a significant loss of 16.9%. However, despite the current stagnation in ETH‘s price, I see positive signs in the surge of staking activity among existing users. This indicates their confidence and belief in Ethereum’s long-term potential.

In the wake of ETF launch

Based on Bloomberg’s report, several contenders are required to submit revised S-1 form versions before July 8. Consequently, the final approval of these forms might be completed by July 12. Subsequently, the stock market debut could occur around the second half of that week.

Confident asset managers anticipate securing the green light from the SEC for the launch of the initial US Exchange-Traded Funds (ETFs) investing directly in Ether by mid-July. Previously, there were market rumors suggesting that this approval could occur during the July 4 holiday week.

As a researcher, I’ve come across the news that the Securities and Exchange Commission (SEC) has given Ether exchange-traded fund (ETF) applicants until July 8 to submit revised documentation. It’s important to note that there could be another round of filings following this deadline.

Some experts, such as Eric Balchunas, point out to an unnecessary pause on the SEC part.

As a crypto investor, I’ve noticed the peculiar delay in the SEC’s approval process despite relatively mild comments. It’s perplexing because these could have started trading by now. There might be one problematic issuer causing the holdup or perhaps it’s just summertime lethargy and people on vacation. Regardless, all signs point towards an eventual launch.

— Eric Balchunas (@EricBalchunas) July 3, 2024

As an analyst, I would rephrase it as follows: I’ve reviewed the feedback from the SEC regarding issuers’ applications. The questions posed are relatively minor and are currently being addressed. In May, the SEC granted proposals from exchanges to list these products, but a final approval is still required before they can be launched.

The head of asset management at Galaxy Digital is optimistic that regulatory approval for a spot Ether Exchange-Traded Fund (ETF) will occur within “weeks” instead of a few days, but he predicts this will happen no later than July.

Who’s joining In?

Bitwise Asset Management has submitted an updated S-1 form for its proposed Ethereum exchange-traded fund (ETF), signaling that the product is close to being launched before the July 8 due date. Several other companies, including BlackRock, Fidelity, 21Shares, and Invesco, have likewise submitted filings, all of which are pending regulatory approval.

Several fund providers have not revealed the charges for their specific investment vehicles as of now. This information needs to be disclosed first for transactions to commence.

Will the price follow?

For more than a year now, Ether’s performance has lagged behind Bitcoin’s impressive growth. This surge in Bitcoin’s value can be attributed to approximately $14 billion worth of inflows into its spot Exchange-Traded Funds (ETFs) during the year 2024.

As a crypto investor, I’m excited about the upcoming launch of Ethereum ETFs on July 8, which could potentially act as a “golden egg” for Ether’s price movement. However, it’s important to keep an eye on Bitcoin as well. According to a report by K33 analysts, Bitcoin may encounter sell pressure with the return of approximately $8.5 billion worth of coins to creditors of the defunct exchange Mt. Gox, starting this week.

The moving average of Ether’s price over the past 100 days (100 EMA) often indicates the overall direction and a drop below it could lead to significant selling pressure. After recovering the important $3,000 mark, Ether must retake the $3,360 support zone before July 8 in order to continue its short-term upward trend. If this level isn’t reclaimed, the current rally may come to a halt.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- USD COP PREDICTION

- Remnant 2: Prototype Parts Quest Walkthrough (How to Repair Robot)

- EWT PREDICTION. EWT cryptocurrency

2024-07-06 11:07