As a seasoned researcher with years of experience in analyzing cryptocurrency market trends, I find the recent data on Bitcoin‘s selling participants particularly intriguing. The surge in Dormant Circulation among 90+ day and 365+ day investors suggests that the long-term holders (LTHs), a group I’ve always admired for their patience and resilience, have been active in profit-taking.

According to the information from blockchain data, it appears that this section of the Bitcoin market has been actively selling at the recent peak prices.

90-Day+ Bitcoin Investors Have Been Showing Activity Recently

According to a video by YouTuber denome in a recent post, it’s just one sector of the Bitcoin market that’s currently involved in profit-taking. The data provided by the user comes from the on-chain analytics company Santiment. To be precise, the graph displayed is related to the Dormant Circulation indicator.

The System for Monitoring Idle Transactions records the overall count of cryptocurrency units that haven’t been actively used on the blockchain for a specified duration or longer.

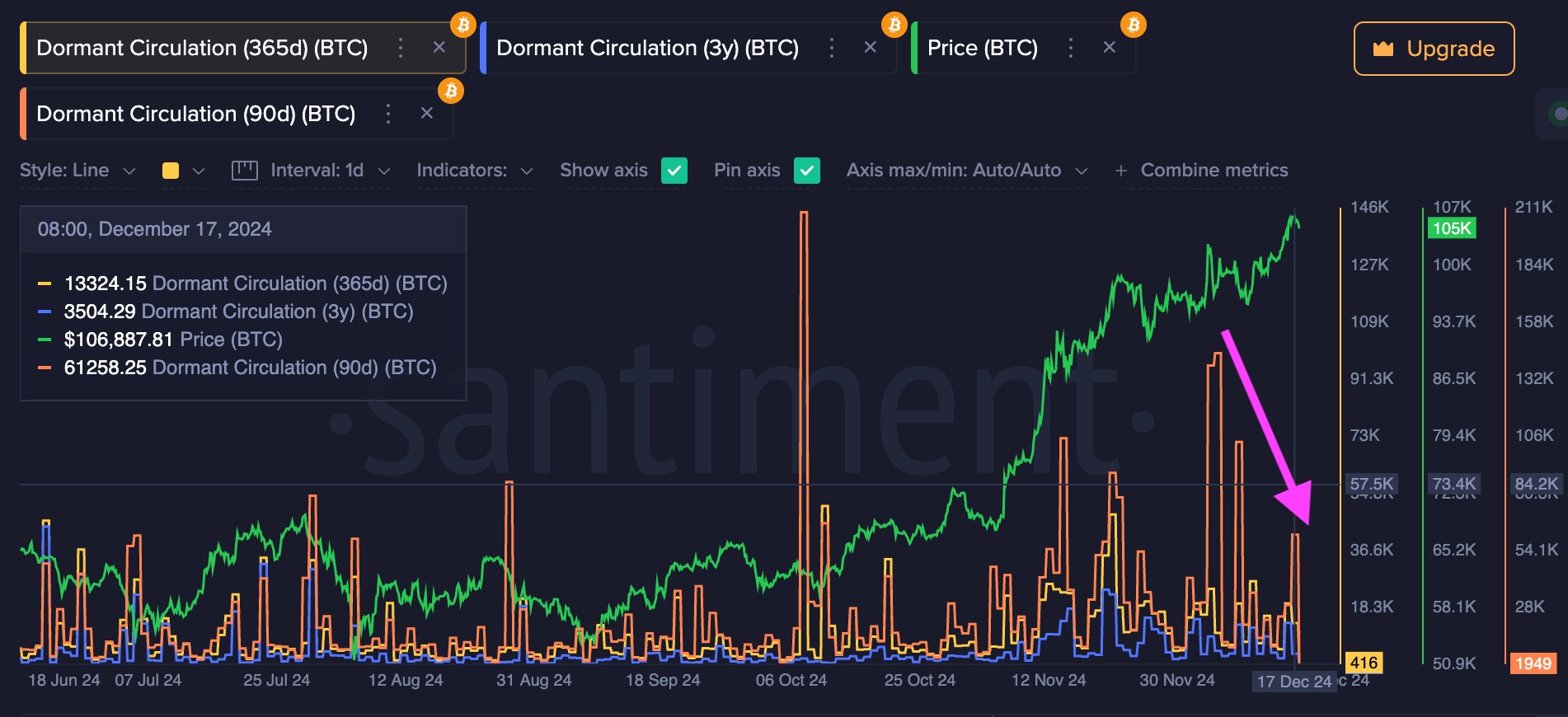

Here’s a graph depicting the progression of this metric’s values across various periods during the recent months:

In the provided graph, you’ll find three variations of Dormant Circulation: 90 days, 1 year (365 days), and 3 years. Keep in mind that these figures represent the initial durations being monitored; for example, the 90-day duration tracks transactions involving coins that had been held for over 90 days before being moved.

According to the graph, the Dormant Circulation significantly increased for coins with a holding period of 90 days or more and 1 year or more during the past month when the cryptocurrency experienced its rally.

At some stage, the spikes of the two data sets weren’t significantly different, suggesting that a large number of transactions being tallied by the 90+ days version were actually from coins that had been in circulation for more than a year (365 days). This implies that the long-term holders (LTHs) of Bitcoin, a group often referred to as the veterans, appeared to be actively selling their Bitcoins.

This month, the 90-day Inactivity in circulation has persisted at significant rates, given that the asset’s bullish trend is still going strong, pushing its value beyond the $100,000 mark.

In contrast to last month, the 365-day version of the indicator hasn’t shown any significant surges, suggesting that coins held for approximately 90 days to a year are being offloaded. This range includes both older short-term holders (STHs) and younger long-term holders (LTHs), each making up half of this time frame.

Given that the larger Long-Term Holder (LTH) group has not been involved in selling, it’s reasonable to assume that most transactions might actually involve coins owned by Short-Term Holders (STHs).

From the observed pattern over the past month, it appears that some Bitcoin holders may have acted too quickly in cashing out their profits. However, many within the community remain optimistic about Bitcoin’s ability to surpass its recent peaks, leading them to delay any plans to sell at this time.

As a crypto investor, I’ve come to recognize that Speculative Temporary Holders (STHs) often exhibit a volatile nature, readily cashing out their investments. Given this behavior, it’s not unexpected that they continue to realize their profits amid the surging hype surrounding prices above $100,000.

BTC Price

At the time of writing, Bitcoin is trading around $104,200, up more than 6% over the past week.

Read More

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Eiichiro Oda: One Piece Creator Ranks 7th Among Best-Selling Authors Ever

- How to Reach 80,000M in Dead Rails

- T PREDICTION. T cryptocurrency

- Top 5 Swords in Kingdom Come Deliverance 2

- EUR HUF PREDICTION

- Nolan’s The Odyssey: A Game-Changer in Fantasy Cinema!

2024-12-19 12:42